Highlights:

- Nate Geraci has confirmed that Grayscale could launch the first spot Chainlink ETF this week.

- The ETF will list on the NYSE and will become the third Grayscale fund to be approved within two weeks.

- The ETF will launch with a staking feature that allows investors to earn rewards without directly holding LINK.

Leading cryptocurrency asset management firm Grayscale has received the United States Securities and Exchange Commission approval to launch the first spot Chainlink (LINK) exchange-traded fund (ETF). This will become Grayscale’s third approved fund in just two weeks, highlighting growing interest in ETF products.

Set to launch this week…

First spot link ETF.

Grayscale will be able to uplist/convert Chainlink private trust to ETF. pic.twitter.com/i7z0WAKKvC

— Nate Geraci (@NateGeraci) December 1, 2025

With the approval, Grayscale’s existing Chainlink Trust will transform into a fully tradable ETF. Notably, Grayscale filed the S-1 to convert the trust in late September. ETF analyst Nate Geraci confirmed the approval on X, noting that the fund will trade on the New York Stock Exchange (NYSE) Arca under ticker GLNK, expanding investors’ exposure to LINK through a simple, regulated market product.

Grayscale’s Chainlink ETF will join the recently approved Grayscale XRP (GXRP) and Dogecoin (GDOG) ETFs. Unlike GXRP and GDOG, GLNK will launch with a staking feature. Some analysts believe that staking remains an aspect that needs clarification from the SEC.

Meanwhile, Bitwise also has a Chainlink ETF product, “CLNK,” which does not include options for staking. In November, CLNK was listed on the Depository Trust and Clearing Corporation (DTCC), a US organization that handles trade settlements and custody services.

Grayscale is set to launch the first US spot Chainlink (LINK) ETF by converting its private LINK trust into a publicly traded fund, expected to debut on December 2. This marks a major step for regulated, spot exposure to Chainlink, a key decentralized oracle network. The move… pic.twitter.com/hbIMU4rKcn

— Fama Crypto (@Famacrypt) December 1, 2025

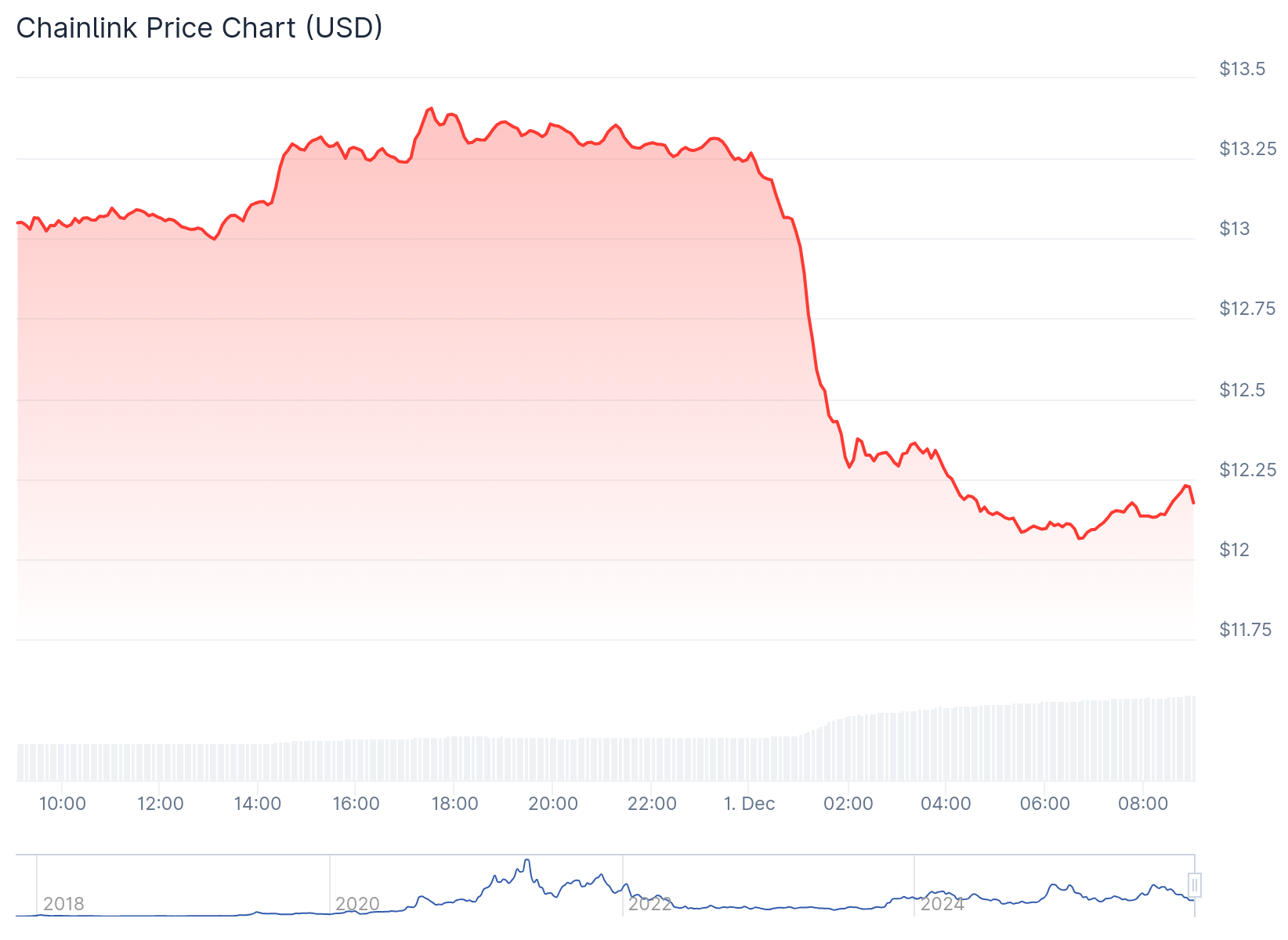

LINK Continues to Dip Amid Anticipated ETF Launch

At the time of writing, the cryptocurrency market is down 4.9% in the past 24 hours with a market capitalisation of approximately $3.019 trillion. Similarly, LINK dropped 6.6%, trading at roughly $12.13 with a market cap of $8.49 billion and a trading volume of $592.56 million. Other extended period data reflected declines. For context, LINK dropped 4.3%, 29.2% and 35.2% 7-day-to-date, month-to-date, and year-to-date, respectively.

Coincodex’s risk assessment showed that 96% of the top 100 crypto assets have outperformed Chainlink. The asset is trading below its 200-day Simple Moving Average (SMA) with only 13 profitable days in the past month. LINK has high supply inflation and volatility at 11.17% and 9.89%, respectively. Its “Fear & Greed Index” reflects fear at 28, while sentiment stays bearish.

Grayscale Moves to Launch More ETF Products

On November 26, Crypto2Community reported that Grayscale filed an S-3 registration statement with the US SEC. The application aims to convert the company’s existing Grayscale Zcash Trust into a spot Zcash ETF, marking a significant step in bringing a privacy-focused asset into regulated markets. According to the filing, the ETF will hold Zcash and track its price using the CoinDesk Zcash Price Index. Grayscale also filed the required 19b-4 form to allow the ETF’s listing on NYSE Arca.

Grayscale stated:

“The Trust’s investment objective is for the value of the Shares to reflect the value of ZEC held by the Trust, as determined by reference to the Index Price (as defined herein), less the Trust’s expenses and other liabilities.”

In October, Grayscale updated its Ethereum and Solana exchange-traded products (ETPs) to enable staking. This update affected the Grayscale Ethereum ETF (ETHE), the Grayscale Ethereum Mini ETF (ETH), and the Grayscale Solana Trust (GSOL). With staking options, investors earn rewards from blockchain networks without directly holding cryptocurrencies. This will be the first time a US-listed spot crypto ETP will enable staking options.

Grayscale’s Chief Executive Officer (CEO), Peter Mintzberg, stated:

“Staking in our spot Ethereum and Solana funds is exactly the kind of first mover innovation Grayscale was built to deliver.”

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.