Highlights:

- VanEck’s Form 8-A filing makes its Solana ETF a step closer to launch.

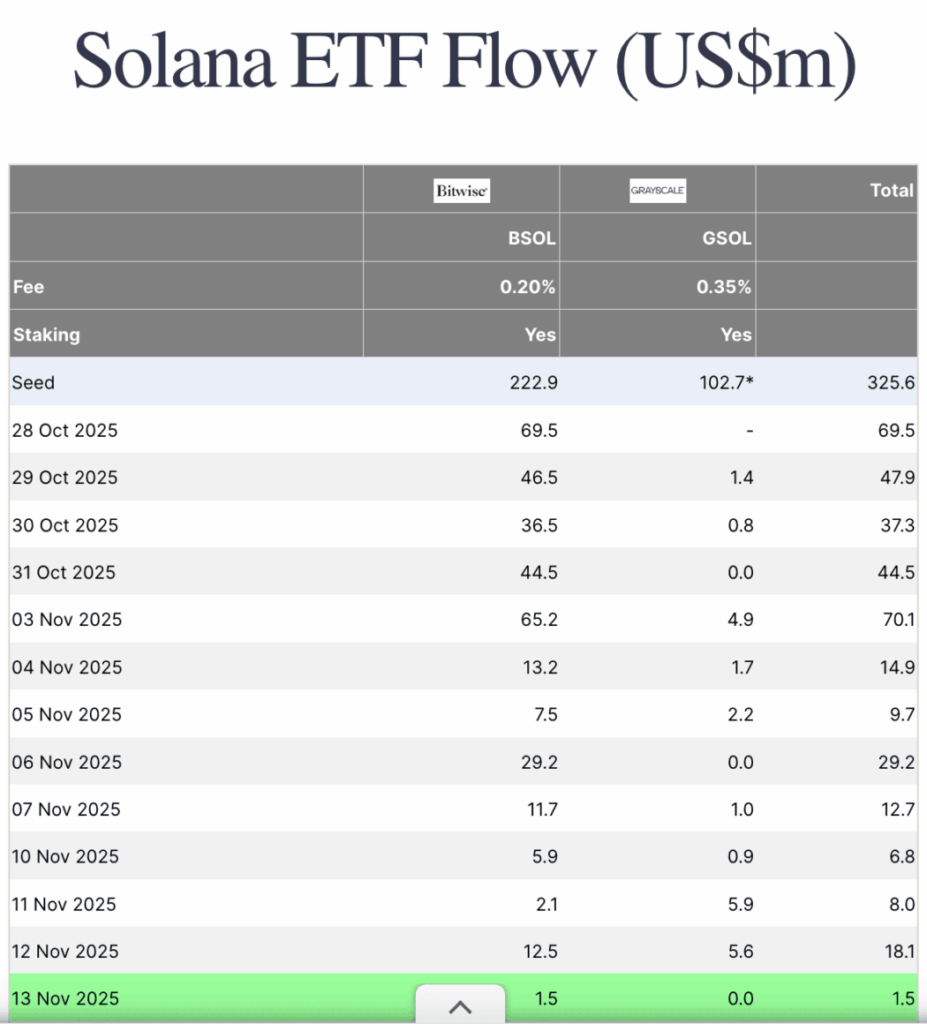

- Since October 28, Solana ETFs have received net inflows of $370 million.

- VanEck’s Solana ETF includes an investor-yield staking policy.

Leading investment firm VanEck has submitted a crucial Form 8-A to the U.S. Securities and Exchange Commission (SEC) for its Solana ETF. The filing represents the last step prior to the ETF’s possible launch. This move indicates that VanEck is prepared to offer the much-awaited Solana-based exchange-traded fund (ETF) to U.S. investors.

VanEck’s Solana ETF Set to Launch Soon

The submission of Form 8-A is the usual step taken in the ETF launching process, and it indicates the near availability of the product. Additionally, the filing comes after VanEck’s last update to its S-1 registration, which not just proposed a management fee of 0.30% but also outlined the staking strategy in detail.

🚨BREAKING: @vaneck_us has filed a Form 8-A with the SEC for its @Solana spot ETF, a step that typically comes right before launch. These filings are usually followed by trading beginning the next day. pic.twitter.com/uhMEU183gO

— SolanaFloor (@SolanaFloor) November 13, 2025

The staking strategy, which is a collaboration with SOL Strategies, is set to provide investors with yields. VanEck is positioning the Solana ETF as an attractive option for both institutional and retail investors.

Solana has emerged as a standout asset among cryptocurrency ETFs so far. The launch of the first Solana ETF on October 28 was a turning point in the market as substantial inflows followed. Spot Solana ETFs are still of interest to the market and have had continuous inflows for the last 13 days, according to Sosovalue data. On Thursday, the inflow amounted to $1.5 million, which shows that the investors’ demand is very strong.

The total net inflows of the two active Solana ETFs, which are Bitwise’s BSOL and Grayscale’s GSOL, have reached an impressive $370 million. Moreover, the first week of trading saw almost $200 million, demonstrating Solana’s attractiveness.

Institutional Interest in Solana ETFs

The demand for Solana-based investment products has been fueled by institutional interest. Analysts consider that such demand will continue due to the emergence of more Solana-related ETFs. Furthermore, this would be a big opportunity to gain entry into the developing cryptocurrency investment industry with VanEck.

The inflows witnessed in Solana ETFs demonstrate a larger trend in the crypto ETF market. Other ETFs, including Bitcoin and Ethereum funds, have recently received outflows, but the Solana ETFs have continued to break ground. Solana is attracting attention among investors due to its ability to provide returns despite the volatile market environment.

ETF Expansion Accelerates Across the Market

Vaneck’s Solana ETF has coincided with the growth of the overall crypto ETF in the market. Other major players in the industry, such as Canary Capital, filed to launch the Mog Coin ETF. These funds give investors a chance to take part in the crypto market through regulated channels.

NEW: @CanaryFunds files for a MOG ETF. pic.twitter.com/IUBkL4mF3E

— James Seyffart (@JSeyff) November 12, 2025

The U.S. crypto ETF market has more than a dozen active funds as of November 2025. With the upcoming launch of VanEck’s Solana ETF, the company is set to play a vital role in the development of crypto ETFs.

Meanwhile, Solana’s native token has seen subdued market activity recently, declining by 8% and 30% on the weekly and monthly charts, respectively. As of this writing, the altcoin is trading around $140 with a market cap of $77 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.