Highlights:

- Canary Capital filed with the SEC to launch the MOG ETF tracking MOG Coin directly.

- The fund holds real MOG tokens, which gives investors direct access to the price.

- MOG price jumped after the filing, attracting more investors and trading activity.

Canary Capital Group LLC filed with the U.S. SEC on November 12 to launch the Canary MOG ETF. The fund will follow the price of MOG Coin directly. This is one of the first attempts to link a U.S. ETF to a memecoin. The fund will hold real MOG tokens, which gives investors direct access to the coin’s price. It works like other spot crypto ETFs. Regular investors can buy and trade MOG through normal brokerage accounts.

MOG ETF Filing Draws Market and Investor Attention

According to a preliminary prospectus, the ETF will issue shares of beneficial interest that trade on a regulated U.S. exchange. The filing gained attention after ETF analyst James Seyffart shared it on X, showing rising institutional interest in community-driven cryptocurrencies.

NEW: @CanaryFunds files for a MOG ETF. pic.twitter.com/IUBkL4mF3E

— James Seyffart (@JSeyff) November 12, 2025

The trustee for the ETF will be CSC Delaware Trust Company, and U.S. Bancorp Fund Services will act as the transfer agent. Once approved, a custodian will manage the MOG tokens for investors. The fund’s pricing will follow an index based on major MOG trading platforms, similar to spot-based Bitcoin and Ethereum ETFs. “Because of its association with the ‘Mog’ meme culture and its community-driven branding, some consider MOG both a cultural statement and a digital collector’s item,” Canary said in its filing.

Canary said the people and community behind MOG have not shared any real use for the coin on the blockchain. The coin is known only for its brand and cultural popularity. It also said there is no guarantee these uses or benefits will happen. MOG’s popularity and community support may not grow or last over time.

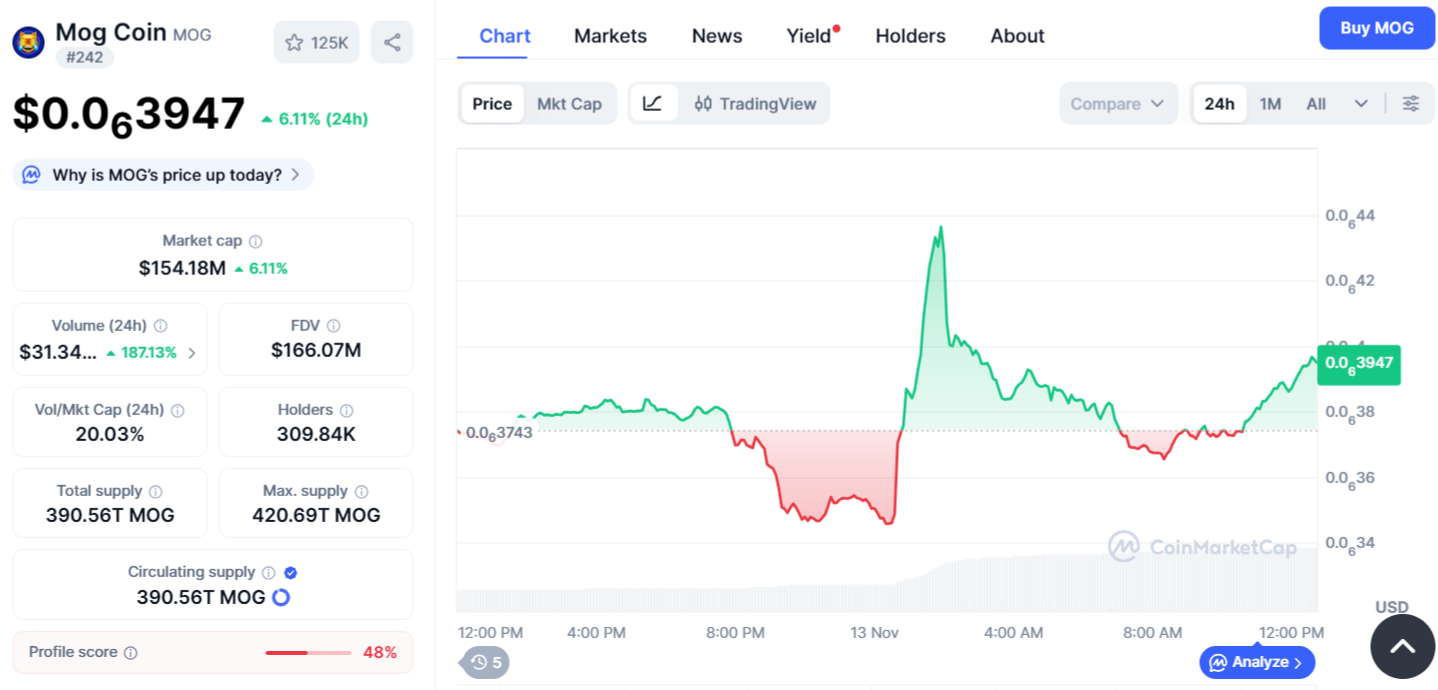

Since MOG runs on the Ethereum network, the ETF might allocate up to 5% of its assets in Ether to cover transaction fees. The ETF news boosted MOG’s market activity. According to CoinMarketCap, MOG was trading at $0.0000003947, reflecting a 6.11% increase in the past 24 hours.

The MOG ETF filing arrives as the U.S. crypto ETF market gains momentum after recent regulatory developments. Canary’s XRP ETF is set to start trading on Nasdaq on November 13, becoming the first U.S. spot XRP ETF under the Securities Act of 1933. The fund provides direct exposure to XRP without using futures contracts and charges a management fee of 0.50%.

🚨NEW: As of 5:30 PM ET, @CanaryFunds’ $XRP ETF is officially effective after @Nasdaq certified the listing, clearing $XRPC for launch tomorrow at market open. pic.twitter.com/h3hxVMDhWP

— Eleanor Terrett (@EleanorTerrett) November 12, 2025

SEC Set to Resume Work on Crypto ETFs After Government Shutdown

As the U.S. government shutdown ends on Wednesday, the SEC is expected to resume work on digital asset ETFs. ETF expert Nate Geraci said several XRP-linked ETFs are ready to start trading. In September, the SEC cleared the way for many new spot crypto ETFs, including funds for Solana and Dogecoin. Canary Capital has filed for multiple crypto ETFs, including Litecoin and HBAR, which launched last month.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.