Highlights:

- Solana price has rebounded from the $152 lows, currently trading at $163 mark.

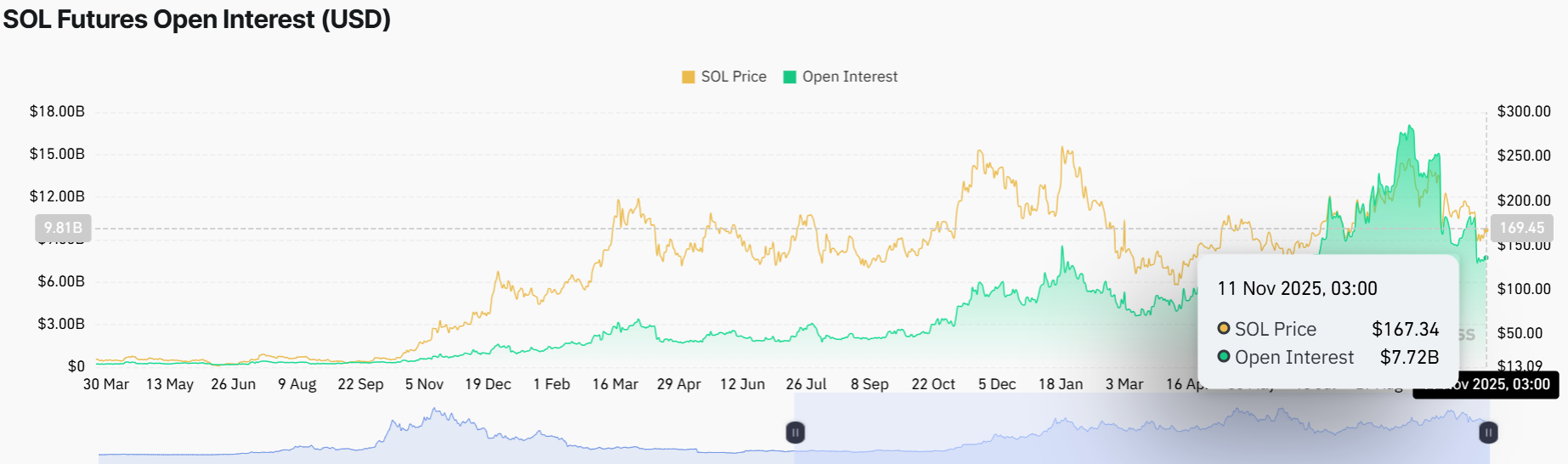

- Solana open interest shows indecision as traders remain on the sidelines.

- The technical outlook shows a potential breakout above the falling wedge pattern.

The Solana price has rebounded from the $152 lows, currently exchanging hands at $163 mark. Its daily trading volume is holding strong, spiking 3% indicating renewed investor confidence. The Solana derivatives market has yet to rebound after being liquidated on October 10. About $19 billion of the crypto assets were sold in a single day. The futures Open Interest (OI) stands at an average of $7.72 billion on Tuesday, compared with $10 billion on November 1 and $14.83 billion on October 1, according to CoinGlass data.

The repressed OI, which signals the value of excellent futures contracts, also suggests that retail investors have remained on the sidelines until risk-on is restored. The steady recovery in OI is an indicator that traders should follow to gauge the short-term bullish outlook. Otherwise, the chances of Solana’s recovery may be limited.

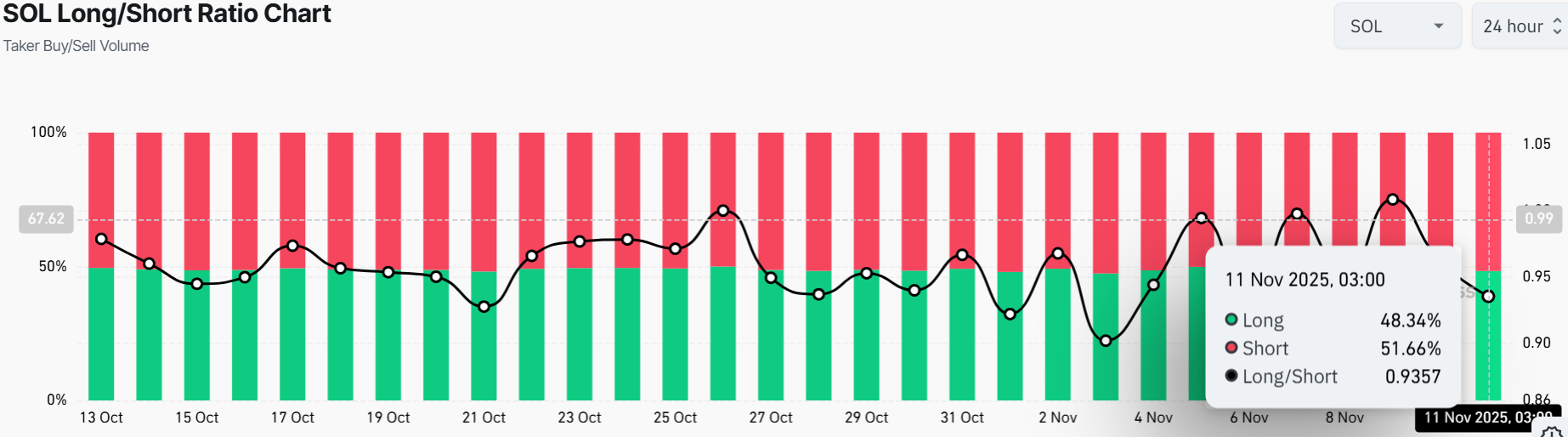

On the other hand, the long/short ratio in the derivatives market is 0.9357, suggesting a slight prevalence of short positions (51.66%) over long positions (48.34%). This indicates that traders are now more willing to bet against Solana’s price movement. The chart also exhibits a cyclical trend, with the long and short positions swinging within a narrow range over the last few weeks. This shows that the market is unsure of Solana’s direction.

Solana Price Eyes a Breakout Above the Falling Wedge Pattern

The SOL/USD 1-day chart shows the price trading at $163.25, with the 50 SMA at $194.81 and the 200 SMA at $180.43. These moving averages are acting as immediate resistance zones, cushioning the bulls against further upside.

Now, the Solana price has rebounded and is attempting to break out of the falling wedge pattern. If the bulls reclaim the $170 mark, it could act as support. If it holds, Solana could bounce and continue rising. The next big target is between $200 and $250. This is where a lot of buy orders (liquidity) might be waiting, potentially pushing the price higher.

Zooming in on the indicators, the RSI at 39.90 has rebounded from oversold territory. If the buyers initiate a buy-back strategy, a climb above 50 would validate the bullish grip. On the downside, support is found around $146-$152. If that breaks, the next strong support is near $126, where buyers stepped in before.

A daily close above the $170 level would confirm renewed buying strength and set the stage for a move toward the $200-$220 resistance zone. Failure to hold the support, however, may delay the uptrend. While Solana’s price is currently under short-term pressure, the broader price structure favors continuation to the upside. The falling wedge pattern reinforces this, especially if it manages to reclaim $170 mark. If support around $170 holds, SOL could soon aim for the higher zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.