Highlights:

- Solana price rebounds to $193, as the crypto market extends recovery.

- Solana’s upcoming APAC event could fuel optimism in the market.

- The technical outlook shows potential for further upside as the trading volume spikes.

The Solana price is continuing the recovering trend, trading at $193, after rebounding from the trendline support. The recovery is attributable to rising trade volumes and expectations in anticipation of the current Accelerate Asia Pacific Accreditation Cooperation (APAC) event on Friday.

智能硬件已经成为人们生活中的一部分,DePIN 让用户无感知的参与到区块链的世界里。

亚太市场拥有促进DePIN发展的土壤,Solana聚集了一批优质的DePIN项目,加入Accelerate APAC进一步了解Solana 生态。 pic.twitter.com/683heuB2vG

— Solana (@solana) October 20, 2025

The increased use of decentralized technologies can be seen as Solana cooperates actively with the local communities and developers. The push has come at an opportune time because the region of Asia-Pacific presents immense potential in terms of the continued growth of blockchain-based infrastructure and applications. Having the series of events behind its belt, Solana will empower its status as a crucial player in the blockchain industry. This could appeal to the projects and developers willing to venture into the opportunities of DePIN.

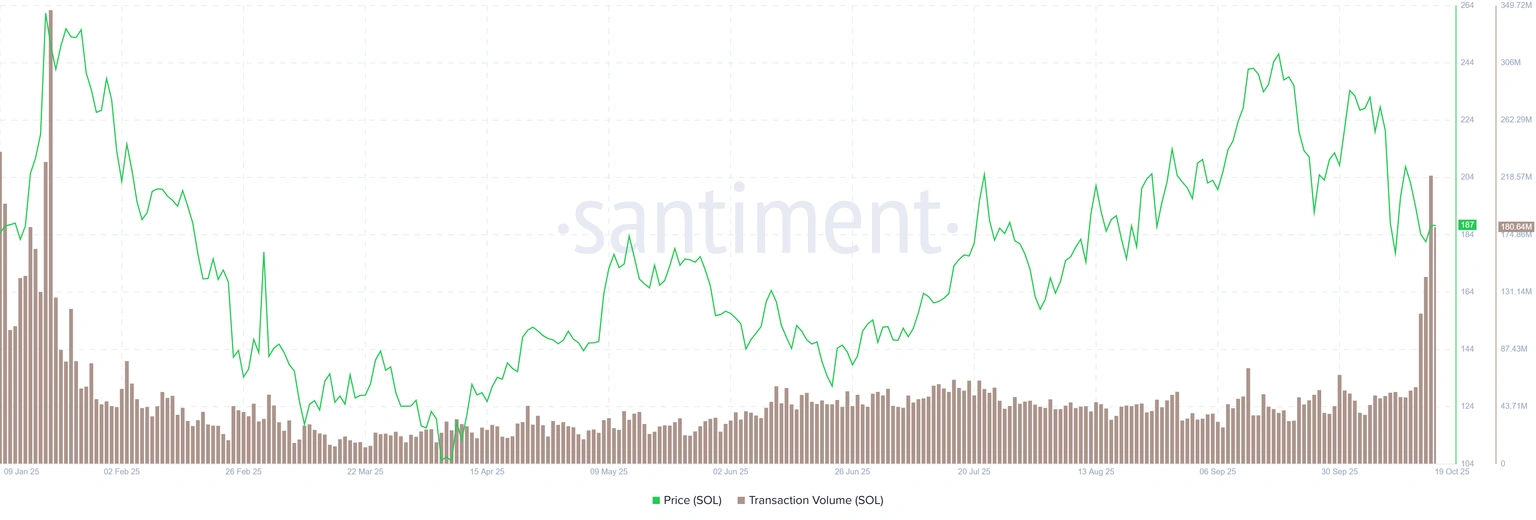

SOL Trading Volume Surges, Suggesting Potential Upside

The performance of Solana in the markets has been characterized by its growing ecosystem and involvement in the community. According to Santiment data, over the last few weeks, Solana has regained momentum, and its price has had a significant surge in mid-October, which is a clear sign of the rise in market activity.

This surge is indicated in the transaction volume, with the number of transactions surging, especially as the price was rising. The volume of transactions exceeded the 200 million SOL threshold in October 2025, which proves a clear increase in market interest and activity. The sentiment in the market is picking up, and traders are riding on the wave. This has resulted in more trading volumes and price action.

Looking at the daily chart, Solana price has recently rebounded from the lower trendline of the falling wedge, currently trading at $193. Moreover, the bulls seem to be building momentum, as the immediate support lies around the 200-day SMA at $175.

Solana Price Long-Term Outlook Remains Strong

Now, the price is targeting the resistance around $215, aligning with the 50-day SMA. If the bulls overcome this key resistance, the Solana price could bounce and continue rising. The next big target is between $238 and $250, marking 29% gains. This is where a lot of buy orders (liquidity) might be waiting, which might push the price higher.

On the downside, support is found around $175. If that breaks, the next strong support is near $155, where buyers stepped in before. The RSI (Relative Strength Index) is at 44.46. This means Solana isn’t oversold yet but has room to rise after crossing above the RSI-based MA. That said, the longer-term structure remains bullish unless SOL breaks down below the immediate support at $175. A daily close above the $215 level would confirm renewed buying strength and set the stage for a move toward the $250 resistance zone.

While Solana is currently under short-term pressure, the broader price structure favors continuation to the upside, especially if it manages to reclaim $215. If support around $175 holds, SOL could soon aim for the higher zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.