Highlights:

- Hyperliquid price faces strong bearish pressure, down 5% to $38 mark.

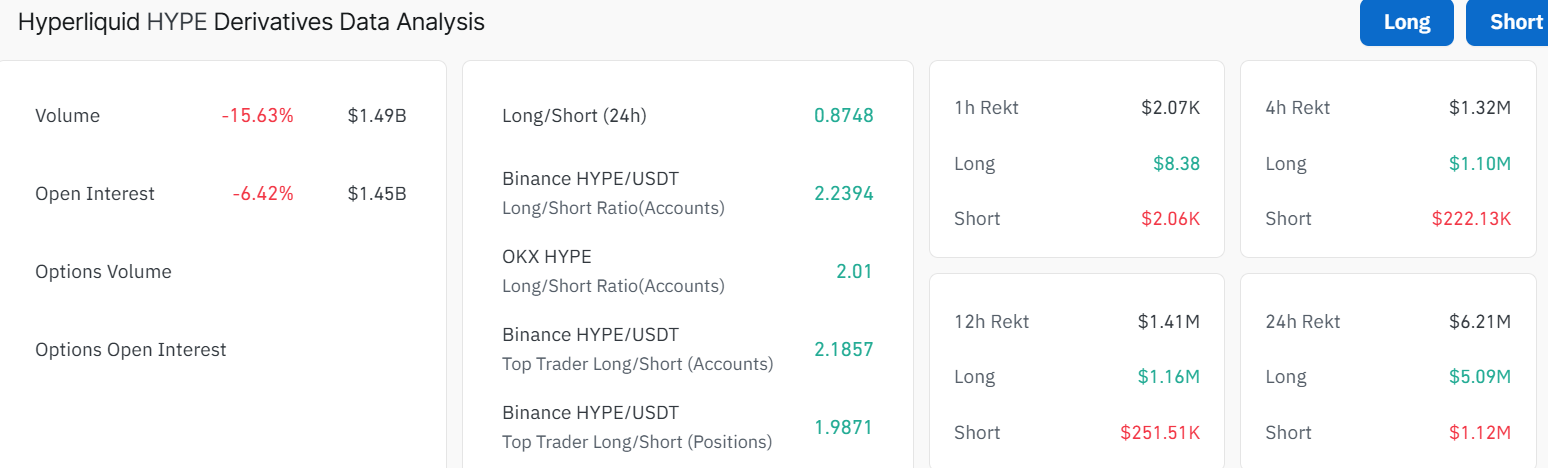

- Coinglass derivatives data shows a drop in open interest and volume, indicating a drop in traders’ interest.

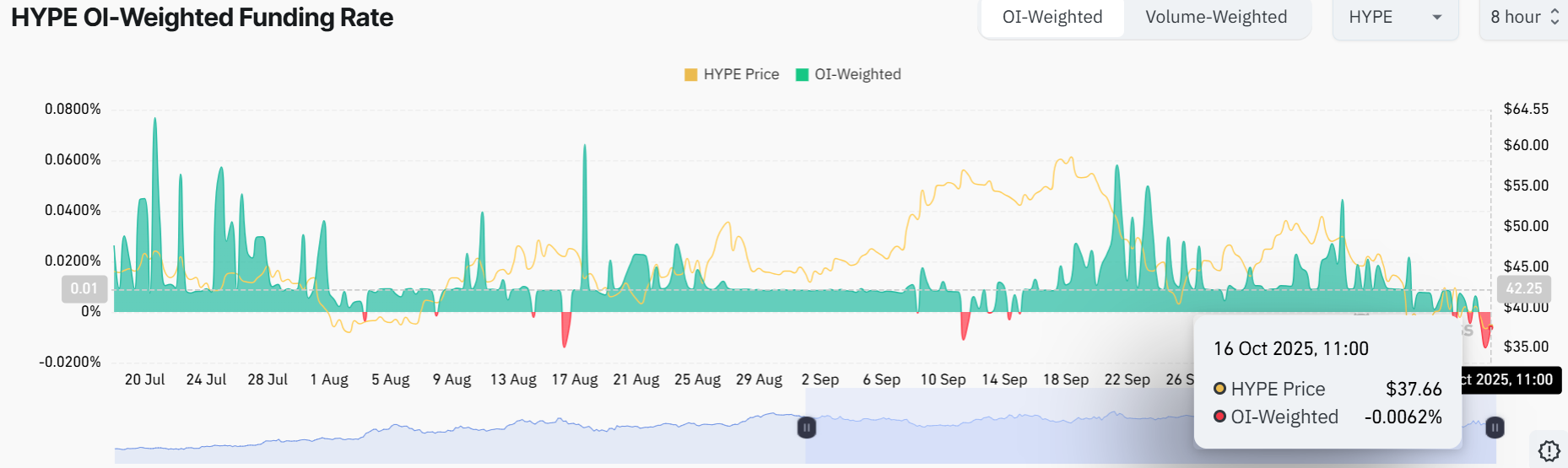

- The OI-weighted funding rate has turned negative, cautioning traders of a further drop in the HYPE price.

The Hyperliquid price is facing strong bearish pressure, down 5% to $38. The daily trading volume is notably down 15%, indicating a drop in market activity. The HYPE price remains at the selling pressure with a bearish mood being gathered across the derivatives market. The falling open interest and negative funding rates suggest weakening trader confidence in HYPE.

According to the recent statistics on CoinGlass, they reveal that HYPE’s trading volume has gone down by 15.63% to $1.49 billion. Another important market sentiment indicator, the open interest, has also decreased by 6.42% to $1.45 billion. This outlook reveals that the trader’s optimism is decreasing, which may cause further decline in the Hyperliquid price.

HYPE’s long-to-short ratio has dipped below 1 to 0.8748, indicating intense bearish sentiment. On the other hand, the data of derivatives of Hyperliquid favors the bearish perspective. The OI-Weighted Funding Rate data of Coinglass indicates that more traders believe that the Hyperliquid price will decrease even more, as opposed to traders who believe that the price is going to rise.

The indicator has reversed to a negative mark but stands at -0.0062% on Thursday and was approaching the figures in the huge price fall that occurred last week(-0.0083%). The negative ratio indicates that shorts are paying longs, thus bearing a bearish mood on HYPE.

Hyperliquid Price Prediction: To Hold or To Fold?

The Hyperliquid chart paints a bearish picture. HYPE is trading within the falling channel pattern, reinforcing the bearish grip in the market. The bulls are attempting to gain control after last week’s market crash that sent Hyperliquid’s price to a low of $31. The recent rebound may need more bullish momentum to break above the resistance zones. The 50-day Simple Moving Average (SMA) at $40 and the 200-day SMA at $47 are notably cushioning the bulls against further upside.

The Relative Strength Index (RSI) at 46.32 is showing an upward movement upwards the 50-mean level. Moreover, HYPE still has room to run before it is considered overbought.

Looking ahead, the Hyperliquid price is facing some resistance around the $40 and $47 zones. These barriers have suppressed the price against further upside. If Hyperliqud price breaks and holds above $40-$47 level, the asset might target the next resistance at $51, a 30% leap from current levels.

On the flip side, if the HYPE token continues the downside movement and the resistance levels prove too strong, a push towards $36-$31 may be likely. In the short term, the Hyperliquid price has the potential to reach $51 and beyond if the bulls gain momentum. In the long term, breaking $47 could signal a parabolic move.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.