Highlights:

- The ZCash price has slipped 12% to $230, as further decline is more likely.

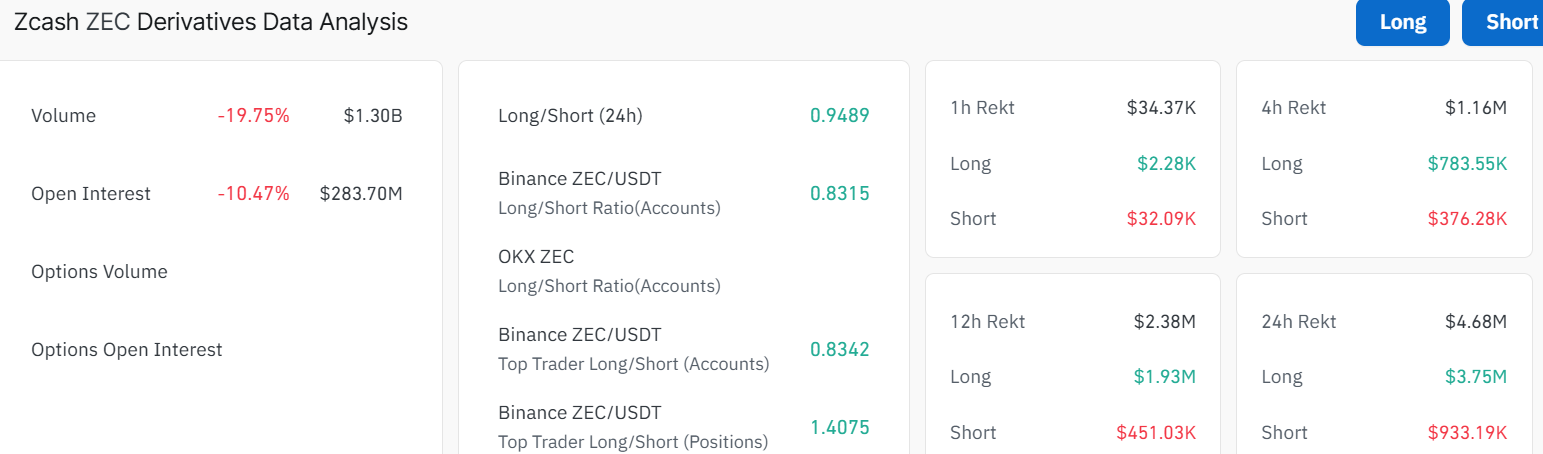

- CoinGlass data shows declining open interest and volume, indicating decreasing optimism among traders.

- The technical outlook signals further decline towards $211 support zone.

The ZCash price is swimming in the red today, down 12% to $230, as the crypto market turns bearish. The daily trading volume is notably down 18%, indicating a drop in market activity. Zcash has also gained traction as a favorite asset on exchanges where one can use privacy coins as collateral.

The growing adoption of $ZEC as collateral on exchanges and platforms, including Quanto, is also an additional indicator of its relevance to the decentralized finance (DeFi) ecosystem. According to the recent announcement, one can use ZEC as collateral on their platform, and this increases its application in trading and collateralized lending. The action is especially favorable to users who prefer privacy when engaging in high-stakes trades.

Use your $ZEC as collateral now on @quanto.

Zolana. pic.twitter.com/bBkrAA7KNL

— Quanto (@quanto) October 14, 2025

ZCash Derivatives Market Outlook

Meanwhile, Zcash, a privacy-oriented cryptocurrency, is showing weakness in the cryptocurrency derivatives market. Recent statistics show that the overall value of Zcash derivatives is a huge 1.30 billion, but has recorded a 19.75% decline. The open interest has notably slipped 10.47% to $283.70 million.

Supporting this risk-off vibe, long liquidations over the past day total $3.57 million compared to $933.19K in shorts. This suggests that bullish-aligned traders have been wiped out to a greater extent. As bulls get liquidated by force, the sell side takes over in the ZEC derivatives.

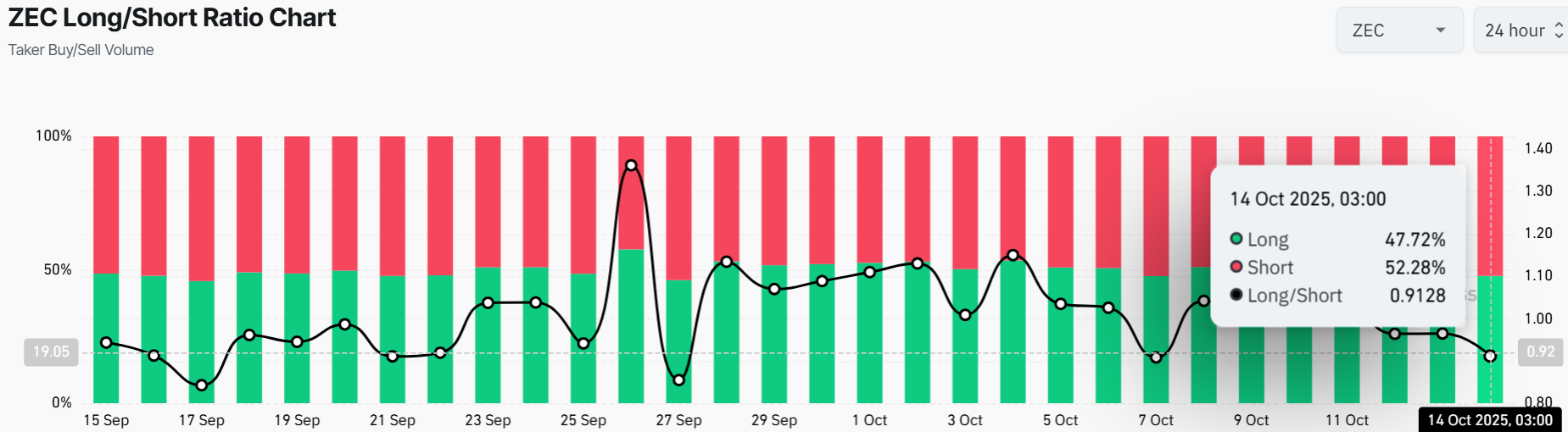

On the other hand, the long-to-short ratio shows that the bears are having the upper hand. The shorts have garnered 52.28% compared to the longs, who have 47.72%. The long-to-short ratio currently sits at 0.9128, indicating some bearish sentiment creeping into the market.

ZCash Price Signals a Pullback

The chart shows that the ZCash price recently broke out in a parabolic curve, hitting an ATH of $298. However, the recent bearish sentiment in the market has seen the ZEC token pull back. The price is currently at $230, marking a 22% drop.

The 50 Simple Moving Average (SMA) on the 1-day chart at $88 and the 200 SMA (blue line) at $52 are holding as support, giving the bulls the upper hand.

The Relative Strength Index (RSI) at 67.22 is showing a healthy pullback, allowing the bulls to sweep through liquidity. Looking ahead, the ZCash price is showing a pullback after hitting the overbought territories. Meanwhile, if ZEC holds above the $211 support level, there could be a push toward the $298 ATH again. However, a drop below $211 might signal a retreat towards $176 safety net.

The ZCash price still has room to move. The 322% monthly surge shows retail FOMO, but the chart warns of a possible correction. In the short term, traders could aim for $298 ATH, but in the long term, $300-$400 could be in play if the bulls regain strength. For now, cautious investors may wait for a dip towards the $211-$176 support region.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.