Highlights:

- Between October 7 and October 12, OranjeBTC acquired 16 BTC, valued at approximately $1.94 trillion.

- The Brazilian company now holds 3,691 BTC worth $389.07 million at an average selling price of $105,412 per token.

- Within the same period, OranjeBTC sold 296,600 shares, bringing its total outstanding shares to 155,522,600.

Brazil-based Bitcoin-focused company OranjeBTC has expanded its Bitcoin holdings with a fresh investment worth $1.94 million. On October 13, the Bitcoin investment firm tweeted about the purchase, as the crypto market recovers from the October 11 crash.

Between October 7 and October 12, 2025, the company acquired 16 BTC at an average cost of $121,058 per token, contributing to a 1.5% return on its Bitcoin holdings for 2025. Meanwhile, since October 6, the portfolio’s return has been 0.25%. Currently, OranjeBTC holds 3,691 BTC, valued at about $389.07 million at an average selling price of $105,412 per token.

OranjeBTC has acquired 16 BTC for ~$1.94 million at ~$121,058 per Bitcoin and has achieved a BTC Yield of 1.5% YTD 2025. As of 10/13/2025, we hold 3,691 BTC acquired for ~$389.07 million at ~$105,412 per Bitcoin. Ticker: OBTC3 pic.twitter.com/UqbEVvZQ02

— OranjeBTC (@ORANJEBTC) October 13, 2025

Today’s purchase comes a few days after the company had increased its BTC holdings to about 3,675 tokens. On October 7, OranjeBTC added 25 BTC for $2.81 million ahead of its listing on Brazil’s B3 stock exchange. On September 24, the company reported one of its largest BTC acquisitions worth $385 million for 3,650 BTC.

Guilherme Affonso Ferreira Filho, founder of Bioma Educação and an OranjeBTC shareholder, said the company is focused on establishing one of the largest Bitcoin holding treasuries in Latin America. He also mentioned that OranjeBTC will prioritize investors’ education.

Guilherme stated:

“We will bring to Latin America the first listed company 100% focused on Bitcoin, to accumulate the largest possible balance sheet of Bitcoins, and with special attention to investor education.”

Shares Sales Accompany Bitcoin Purchase

During its most recent BTC purchase, OranjeBTC also sold 296,600 common shares, bringing the company’s total outstanding shares to 155,522,600, excluding treasury shares. If all debentures issued by the company were converted, it would issue an additional 6,966,760 shares, bringing the total to 162,489,360.

Overall, the company raised R$7,463,582 ($1.36 million) from the share sales at a weighted average price of R$25.16 ($4.59) per share. While OranjeBTC sold significant portions of its shares, none were repurchased during the same period.

OranjeBTC Ascends in Bitcoin Treasury Rankings

On the BitcoinTreasuriesNet platform, OranjeBTC ranks as the 26th largest Bitcoin treasury firm. It is the most valuable Brazilian Bitcoin treasury firm, outpacing Méliuz, which is currently ranked 60th on the global scale. Méliuz currently owns 605 BTC worth around $70 million.

JUST IN: Brazilian public company @ORANJEBTC OranjeBTC (OBTC3) buys 16 additional #Bitcoin and now holds a total of 3,691 BTC.

🔸Bitcoin 100 Ranking: 26🔸 pic.twitter.com/t9JagSeMAM

— BitcoinTreasuries.NET (@BTCtreasuries) October 13, 2025

Meanwhile, Michael Saylor’s Strategy remains the largest corporate holder of Bitcoin with 640,250 BTC valued at about $47.38 billion. Earlier today, the company announced a new purchase of 220 BTC for $27.2 million at an average rate of $123,561 per token.

MARA Holdings, the second-largest Bitcoin treasury firm, also recently added 400 BTC to its treasury. On October 13, Crypto2Community reported that the mining company spent roughly $46.29 million in its most recent acquisition, increasing its BTC holdings to 53,250 tokens. Notably, Smarter Web firm, a UK-based tech firm, ascended in the Bitcoin treasury rankings after adding 100 BTC worth £9.07 million to its robust holdings. Currently, the UK-based company ranks 30th and holds 2,650 BTC valued at about £219.57 million.

Crypto Market Rebounds

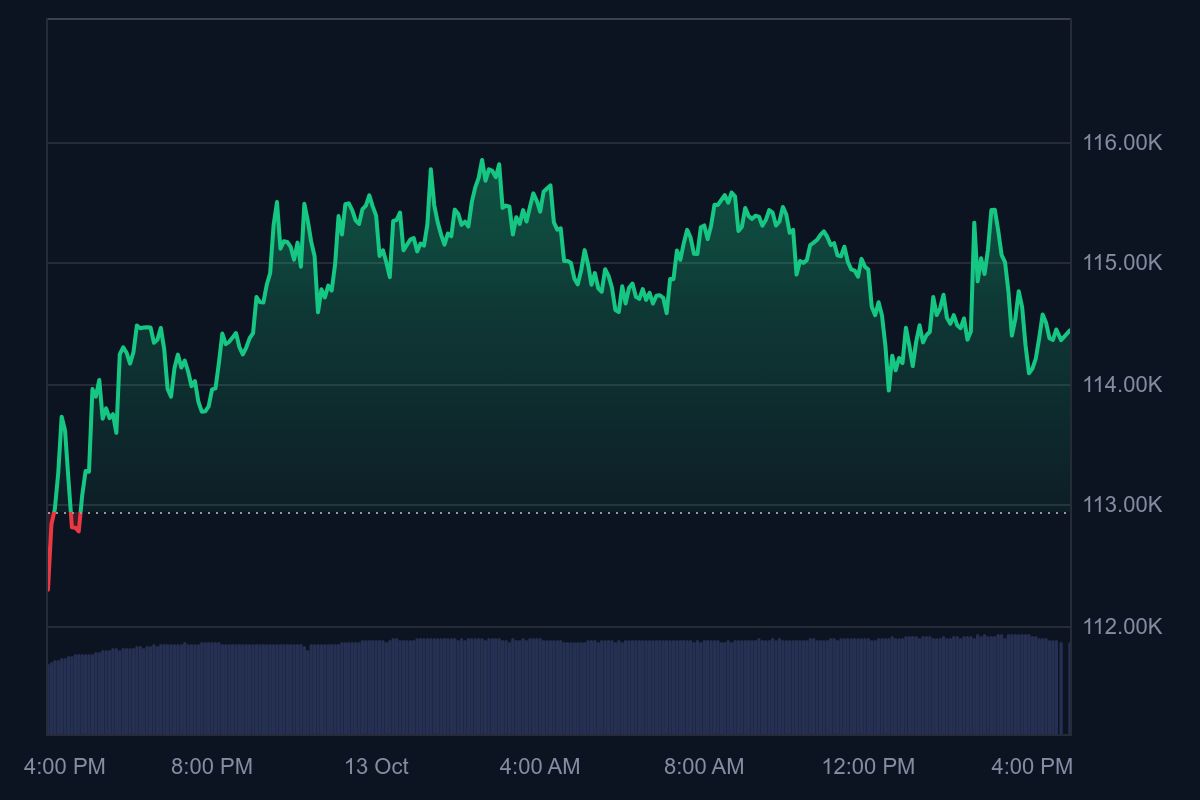

At the time of writing, the crypto market is up 2.4% with a market cap of $3.97 trillion. Similarly, Bitcoin is changing hands at $114,243 following a 1.3% upswing in the past 24 hours. In the past week, BTC dropped 8.4% with price extremes fluctuating between $109,883 and $126,080.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.