Highlights:

- The Monero price has also rebounded from the $257 lows over the weekend to $310

- On-chain metrics show a positive funding rate as the weekly trading volumes hit a yearly high.

- The positive technical outlook signals a further upside towards $361.

The Monero price is continuing its recovery and is trading at $310 at the time of writing on Monday. Its daily trading volume has increased 5% indicating growing investor confidence in the market. Meanwhile, the bullish derivatives, weekly trading volumes are at an all-year high as the funding rates are positive. Technically, the daily chart indicates more gains ahead as the bulls target levels beyond the 350 mark.

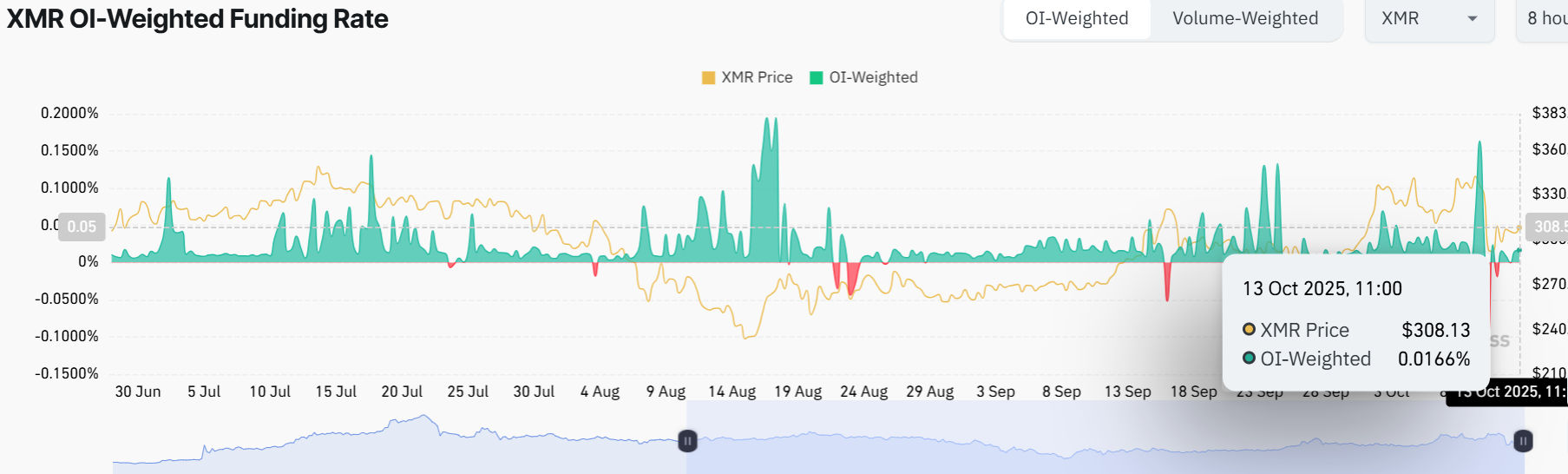

A quick look at the Monera price data from CoinGlass shows that the funding rate of XMR indicates a positive outlook. XMR has a volatile OI-weighted funding rate with the most recent funding rate of 0.0166. These ups and downs are a result of the trading conditions in the entire market. The difference between the trend of the price and the rate of funding denotes that the market may be apprehensive, but there is optimism that the token will continue the recovery.

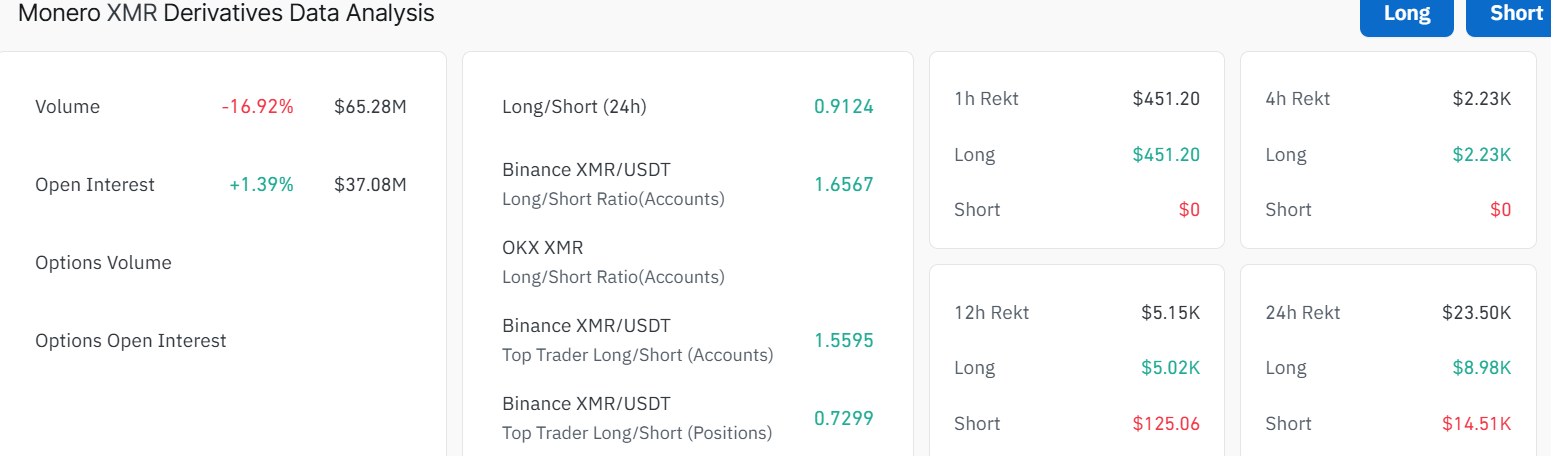

In addition, trading and open interest volumes are important indicators of the asset’s liquidity and investor interest. As the derivatives data shows, the total volume of Monero price has droopped 16.92% to 65.28M.

Meanwhile, the open interest is increasing, which means that investors have confidence in owning Monero. The market is responding with signals such as an increased number of open positions, which indicates long-term interest in both short-term and long-term positions.

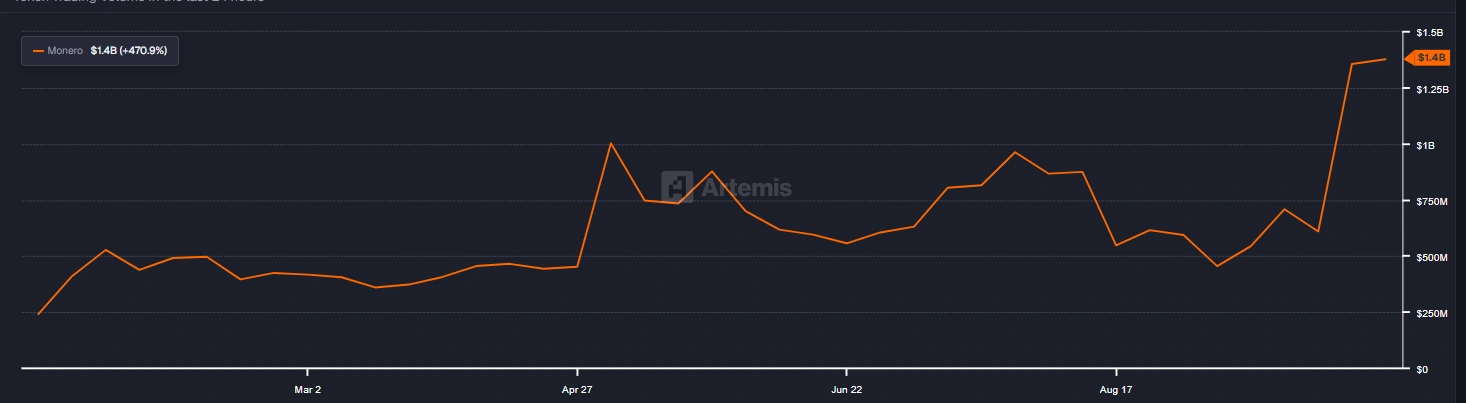

According to Artemis terminal data, the XMR ecosystem’s weekly trading volume (the sum of weekly trading volume created by every exchange application active on the chain) hit an annual high of $1.4 billion last week. This volume increase has been climbing since the beginning of September. Such a volume increase represents a growing demand by traders on the XMR chain and indicates a bullish sentiment.

Monero Price Outlook: Bulls Aim at the $361 Resistance Soon

The XMR/USDT daily chart paints a bullish picture, with Monero price bouncing from a $257 daily low over the weekend. The 50-day Simple Moving Average (SMA) and the 200-day SMA, both at $291 and $292, show the long-term uptrend is still intact.

Digging into the indicators, the Relative Strength Index (RSI) at 51.94 is hovering near neutral territory, but heading upwards. This suggests there’s room for the Monero price to run before overbought conditions are reached.

Looking ahead, if Monero price holds above the support zones at $291 and $292, there could be a test of the next resistance near $361 in the coming days. However, a pullback to the 200-day SMA ($292) could be a prime entry point for investors. However, a drop below this level might signal a retreat to $257 lows.

For now, the chart’s green light suggests riding this wave, as the bulls target a rebound above the rising channel. With the positive on-chain metrics, the Monero price is targeting the next resistance at $361. A break above this zone will see the bulls target $400 and above before the end of November.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.