Highlights:

- The crypto market crashed 10% after Trump announced 100% tariffs on Chinese imports.

- Over 1.6 million positions liquidated, erasing $19.31 billion across major crypto exchanges.

- Binance users faced delays as trading volume surged during the market crash.

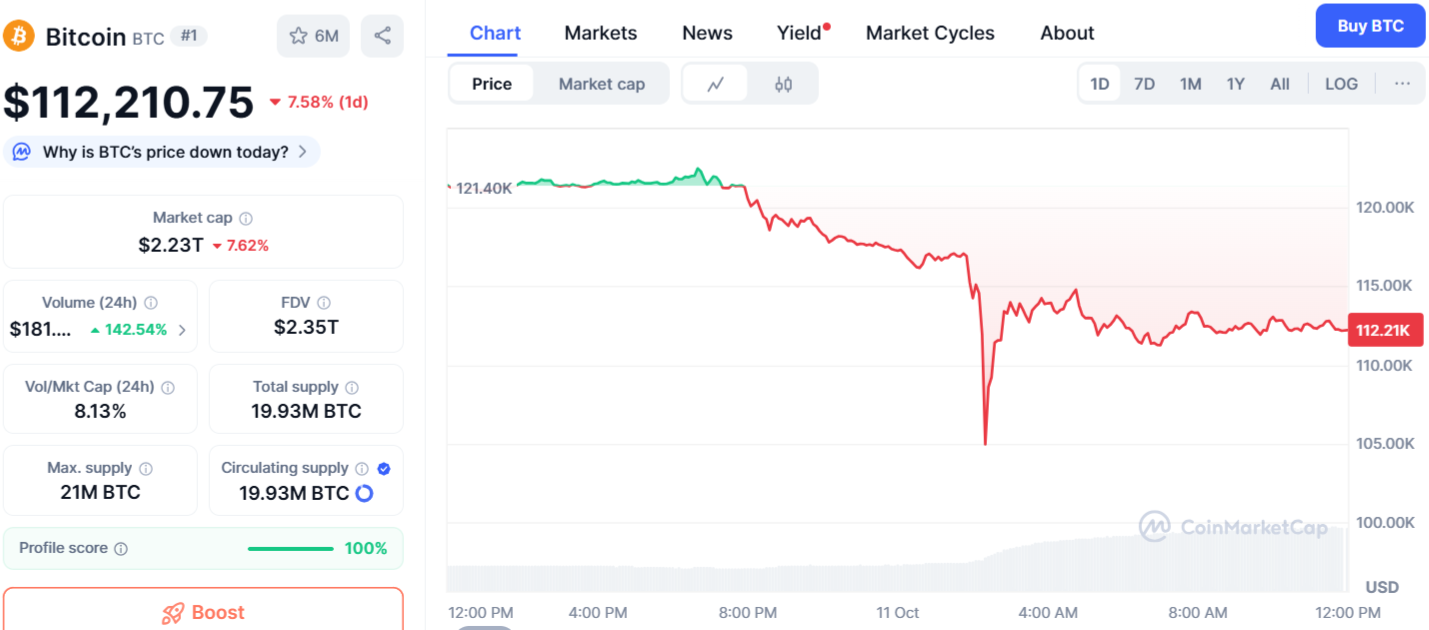

Crypto markets plunged again on Friday after President Donald Trump confirmed a 100% tariff on Chinese imports. Bitcoin dropped almost 8%, slipping below $113,000, while other major cryptocurrencies fell even more. Ethereum, the second-largest blockchain token, lost nearly 12%. Meanwhile, BNB, XRP, and Solana dropped by at least 13.5%, 14.1%, and 16.23%, respectively, according to CoinMarketCap data.

The move comes as a response to China tightening control over its rare earth exports, and the new tariffs are expected to start on November 1, or possibly earlier. He wrote that China’s action was hard to believe and added, “the rest is History.” On Thursday, China’s Ministry of Commerce said foreign companies must get a license to export products containing more than 0.1% rare earth from China.

However, the president later mentioned he is still open to meeting Xi. He added that the tariff increase might be canceled if China changes its stance before November 1.

— Rapid Response 47 (@RapidResponse47) October 10, 2025

After the announcement, the Official Trump token fell about 24% to $5.74. This is its lowest price since January. Overall, crypto’s total market value dropped more than 9.78% and is now around $3.8 trillion.

Massive Liquidations Across Crypto Markets

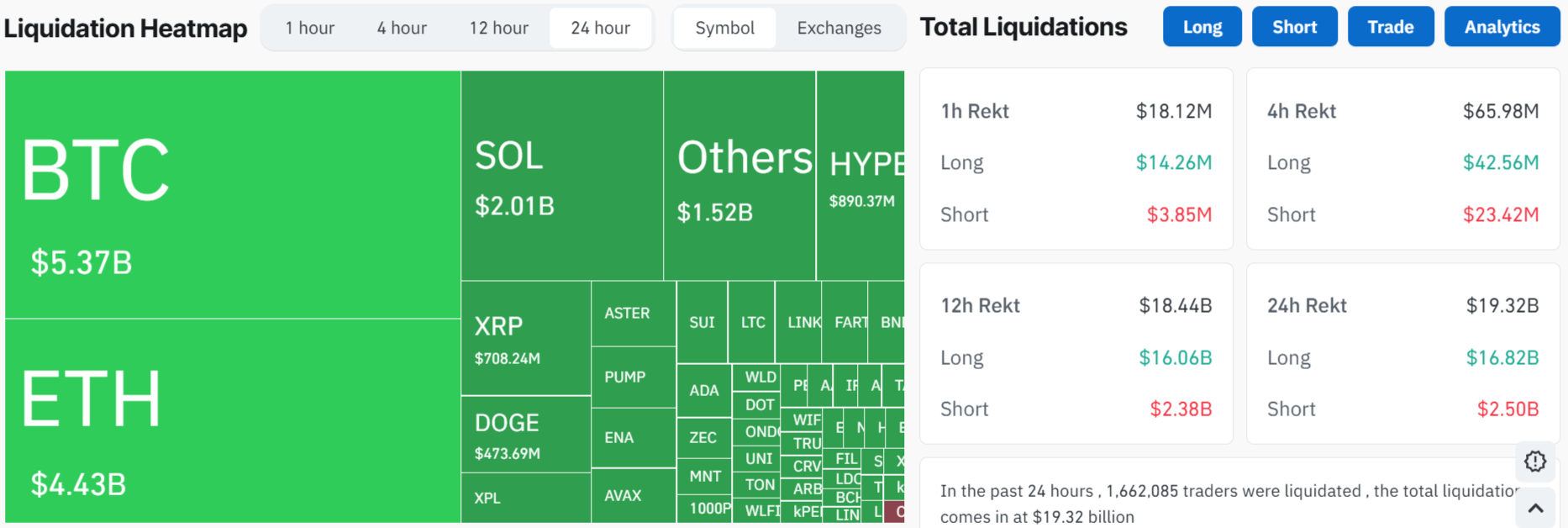

The impact on traders has been severe. According to CoinGlass, more than 1.6 million crypto positions were liquidated in 24 hours, erasing $19.31 billion. Of this, $16.82 billion were long positions and $2.50 billion were shorts. Bitcoin and Ethereum saw the biggest losses, with $5.37 billion and $4.43 billion erased, respectively.

HTX exchange recorded the largest single liquidation, wiping out $10.30 billion in value. Some traders believe Friday’s drawdown could be “the largest liquidation event,” at least in dollar terms, in crypto history. It is hard to understand liquidation events because many crypto sources do not keep a full history.

Bitcoin’s last big long liquidation was on September 24. About $285 million in BTC longs were closed that day. It was the largest daily loss since February. One trader said Friday’s drop could be the biggest liquidation ever in crypto, in dollar terms.

Exchange Outages Amid Heavy Trading

Some users said they faced problems while trading on a few exchanges. Binance mentioned that heavy market activity caused high system load, leading to small delays or display issues for some users. The exchange said it is watching the situation closely and working to fix it. It also ensured that all funds are safe.

🚨 Due to heavy market activity, our systems are under high load. Some users may experience intermittent delays or display issues.

We’re actively monitoring the situation and working to resolve it. Funds are SAFU.

Thank you for your patience!

— Binance (@binance) October 10, 2025

Canceling the tariffs might help crypto prices rise again, but liquidations cannot be changed. Many traders faced losses during Friday’s market drop, though one big trader seemed to benefit. A whale on Hyperliquid reportedly shorted large amounts of Bitcoin and Ethereum, making around $190 million in profit. A trader named @mlmabc on X said the whale may have done even more on other exchanges and likely had a big impact on the market.

In case you didn’t know – the BTC whale closed 90% of his BTC short and fully closed his ETH short, making around $190–$200M profit in just one day on Hyperliquid.

The crazy part is that he shorted another 9 figs worth of BTC and ETH minutes before the cascade happened. And this… pic.twitter.com/QhmUpesG0j

— MLM (@mlmabc) October 10, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.