Highlights:

- The Sei price is portraying bullish signals, as it trades at $0.28, a 0.38% surge.

- BlackRock and Brevan Howard launch tokenized funds on Sei.

- Sei price eyes $0.36 mark if the bulls gain momentum past $0.30 resistance.

The Sei price is portraying bullish signals, despite the crypto market swimming in a ‘blood bath.’ SEI is up 0.38% to 0.28 mark, as the bulls aim to break out of a falling wedge pattern. Recently, Sei Network has created a new wave of change for institutional finance. This comes as BlackRock and Brevan Howard tokenized funds go live on Sei through KAIO infrastructure. The latest partnership with Kaio will bring tokenized Real-World Assets to the Sei ecosystem while increasing liquidity and market efficiency.

KAIO is excited to announce our multiphase partnership with @SeiNetwork to bring tokenized RWAs on Sei.

This is what we mean by Transforming Institutional Funds Onchain. https://t.co/DwKHSdVfnK

— KAIO (@KAIO_xyz) October 8, 2025

Kaio’s partnership with Sei has officially come into play with the announcement of tokenized Real-World Assets. In this case, semi-facilitated assets that belong to financial sectors but haven’t yet transitioned to blockchain will become fully decentralized assets. By bridging traditional systems with blockchain in a partnership with Kaio, access is provided with ideal efficiency and transparency.

Sei’s Derivative Market Activity

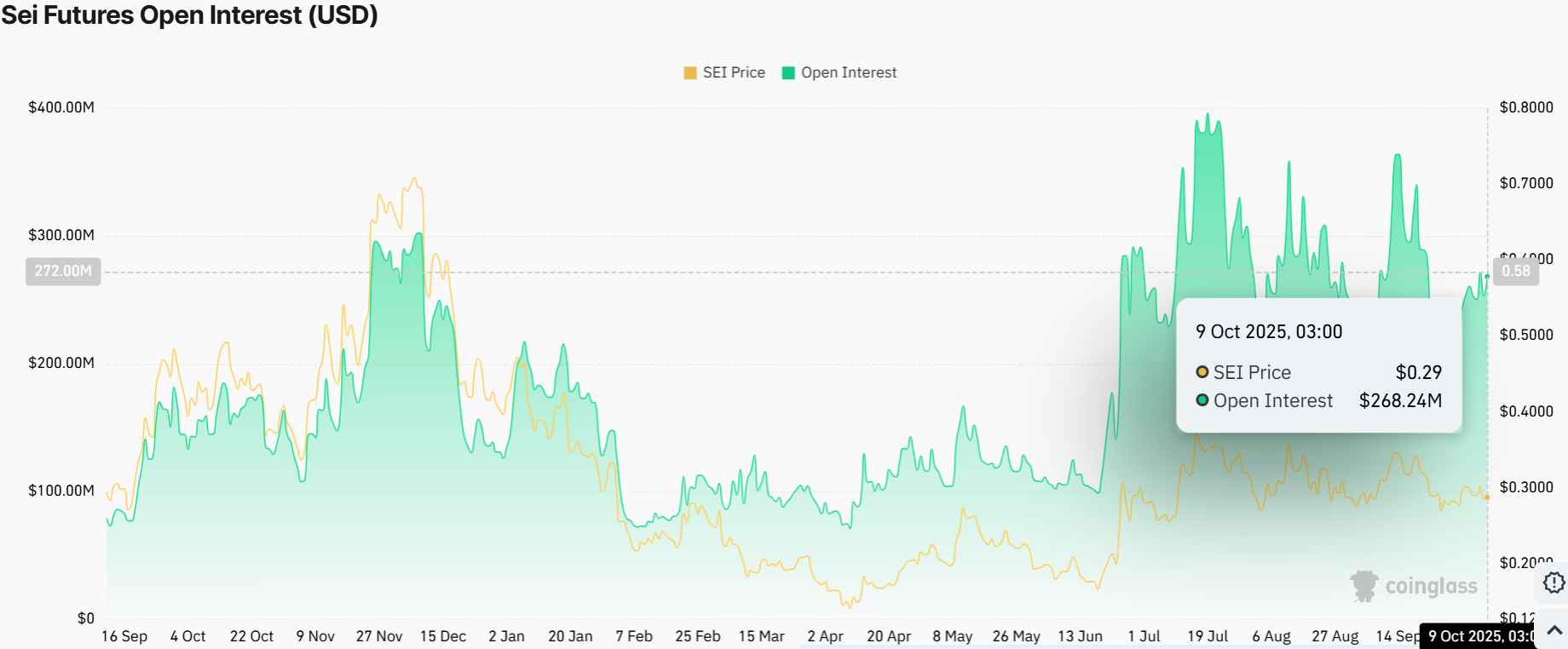

Sei Network has seen significant price interest as a result of these partnerships. Currently, the open interest has risen from $258 million on Oct 8 to $268 million. This marks the growing presence of Sei within the crypto world, as investors show confidence.

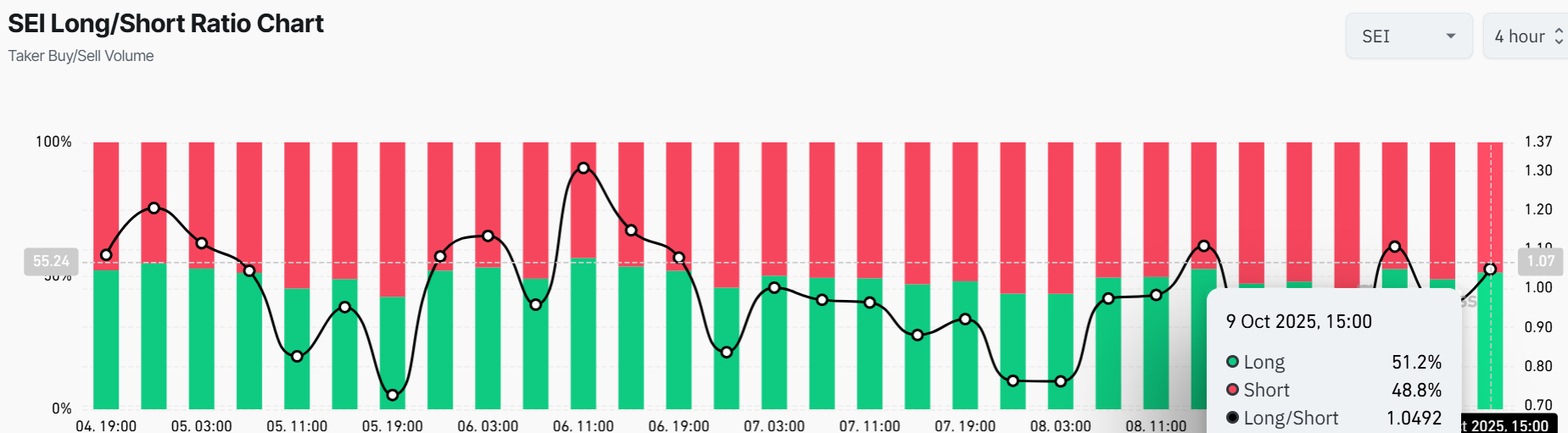

Notably, SEI’s long-to-short ratio interest has been positive in the past 4 hours. The long interest comes in at 1.04, which means more traders are looking to go long on the Sei price than short. Market sentiment indicates that the price is 0.29, which indicates a price resurgence. The bullish grip is evident in the market as bulls target higher levels in the Sei price.

Sei Price Targets $0.36 In the Short Term

The SEI/USD chart shows the 50-day Simple Moving Average (SMA) sits at $0.30, acting as a cushion against further upside for the bulls. Meanwhile, the 200-day SMA at $0.25 is trending upward, suggesting a longer-term bullish vibe, if it continues to hold as support. The Sei price is currently trading well within a falling wedge channel, as the bulls target to overcome the immediate resistance at $0.30.

The Relative Strength Index (RSI) at 43.96 indicates neutral territory. There’s no overextension yet, so there is room for more gains if the hype train starts rolling. The Moving Average Convergence Divergence (MACD) is showing a bullish crossover, with the MACD line edging above the signal line (orange), backed by rising histogram bars. This is a green light for traders.

Looking ahead, the $0.30 resistance (50-day SMA) is the next big test for the Sei bulls. If SEI price smashes through, it could surge toward the $0.34-$0.40 psychological level. However, a drop below the $0.25 support could spell trouble, potentially sliding back to $0.22 if the bears take over. In the short term, SEI bulls need to overcome the $0.30 mark to ignite a potential rally to $0.36. In the long term, it’s a wait-and-see game.

Watch $0.267 on $SEI. Hold it, and $0.36 is next! pic.twitter.com/ahJakklx8H

— Ali (@ali_charts) October 8, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.