Highlights:

- Bitcoin and Ethereum ETFs struggle as investors continue to withdraw cash from the funds.

- Bitcoin ETFs lost $258.46 million, marking their third net outflow this week.

- Ethereum ETFs also lost $251.2 million, extending their net outflows to the fourth straight day.

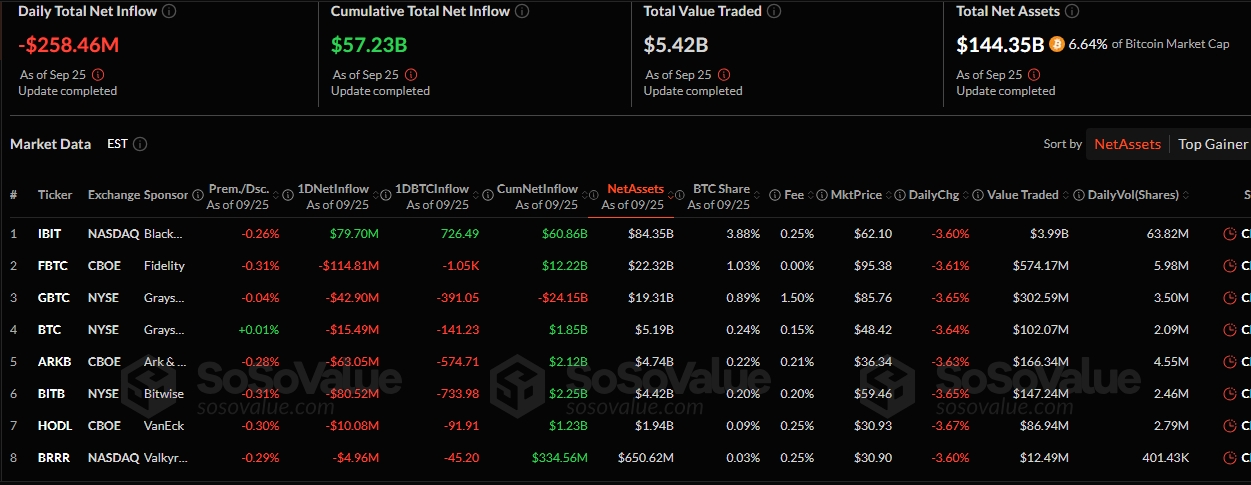

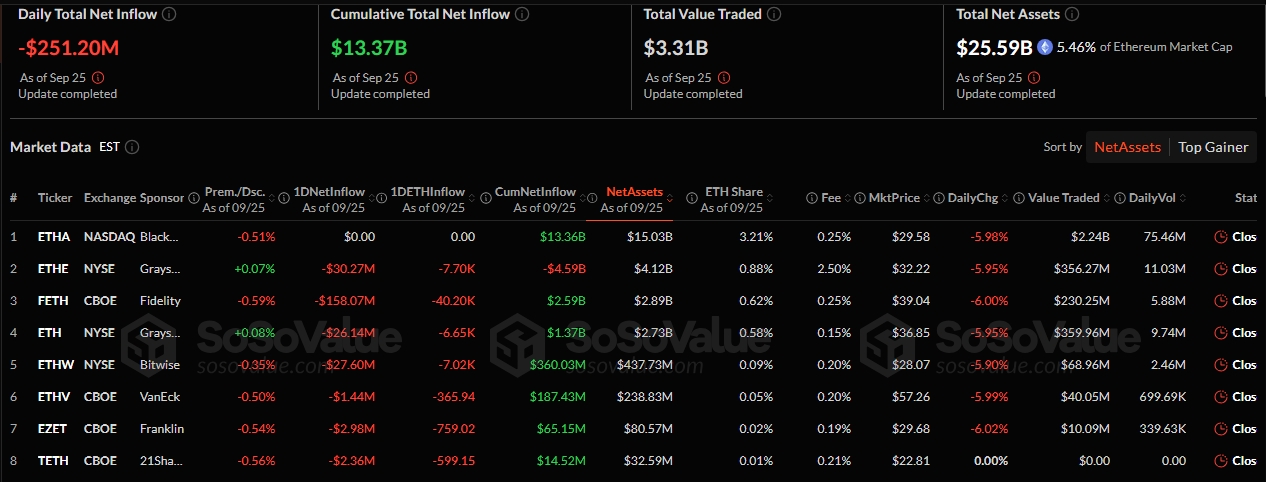

On September 25, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded $509.66 million in combined net outflows, as investor withdrawals trend persists. SosoValue, a renowned on-chain ETF tracker, reported that Bitcoin ETFs lost $258.46 million, marking their third net outflow this week.

Similarly, Ethereum funds forfeited $251.2 million, extending their net outflows to the fourth consecutive day. The persistent outflows elicited market decline concerns as BTC and ETH prices dropped below key levels. Notably, BTC now trades below $110,000, while Ethereum is trading below $4,000.

On September 25 (ET), U.S. spot Bitcoin ETFs recorded a total net outflow of $258 million, with BlackRock’s IBIT being the only fund to see net inflows. Spot Ethereum ETFs posted a total net outflow of $251 million, marking the fourth consecutive day of outflows.… pic.twitter.com/nmszjJ2I6W

— Wu Blockchain (@WuBlockchain) September 26, 2025

BlackRock Remained Positive Amid Heavy Outflows from Other BTC ETFs

Yesterday, nine Bitcoin ETFs were active, as Invesco Bitcoin ETF (BTCO) and WisdomTree Bitcoin ETF (BTCW) recorded neither inflows nor outflows. Among the active funds, only BlackRock Bitcoin ETF (IBIT) attracted inflows worth $79.7 million. Fidelity Bitcoin ETF (FBTC), Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), and Grayscale Bitcoin ETF (GBTC) led the outflows. They lost $114.81 million, $80.52 million, $63.05 million, and $42.9 million, respectively.

Other ETFs that recorded outflows included Grayscale Mini Bitcoin ETF (BTC), VanEck Bitcoin ETF (HODL), Franklin Bitcoin ETF (EZBC), and Valkyrie Bitcoin ETF (BRRR). These funds lost $15.49 million, $10.08 million, $6.35 million, and $4.96 million, respectively.

Overall, Bitcoin ETFs’ total value traded rose from $2.58 billion to $5.42 billion. However, the cumulative net inflow and net assets valuation dropped to $57.23 billion and $144.35 billion, respectively. The new net assets valuation represents 6.64% of Bitcoin’s market cap.

At the time of writing, Bitcoin is trading at $109,527 following a 2.2% decline in the past 24 hours. It fluctuated between $108,787 and $112,1127 with a trading volume of $72.66 billion. Bitcoin’s 7-day-to-date and month-to-date variables also reflected decrements of about 6.2% and 1.4%, respectively. Despite the price declines, Strategy’s executive chairman is optimistic that BTC will record significant price spikes by the end of this year. He based his assertion on the rising demand for BTC, which has almost exceeded miners’ supply.

Ethereum ETFs Record Only Outflows

On September 25, eight Ethereum ETFs were active, leaving BlackRock Ethereum ETF (ETHA) as the only fund with neither inflows nor outflows. All active ETFs registered outflows, led by the Fidelity Ethereum ETF (FETH) with $158.07 million. Other Ethereum funds that recorded over $10 million in inflows were Grayscale Ethereum ETF (ETHE), Bitwise Ethereum ETF (ETHW), and Grayscale Mini Ethereum ETF (ETH). These ETFs lost $30.27 million, $27.60 million, and $26.14 million, respectively.

Similarly, Franklin Ethereum ETF (EZET), 21Shares Ethereum ETF (TETH), Invesco Ethereum ETF (QETH), and VanEck Ethereum ETF recorded $9.12 million in combined net outflows. Like Bitcoin, Ethereum ETFs’ cumulative net inflows and net asset valuation also dropped by considerable margins. The former dropped from $57.49 billion to $57.23 billion, while the latter fell from $149.74 billion to $144.35 billion. In contrast, the total value traded dropped $5.42 billion to $2.58 billion.

ETH’s Price Slips Amid Bitcoin and Ethereum ETFs’ Struggle

Ethereum is priced at $3,938, following a 2.1% decline in the last 24 hours. It fluctuated between $3,833.75 and $4,051.26 with a trading volume of $58.196 billion. Meanwhile, sentiment on ETH has remained bearish, with a Fear & Greed Index pointing towards fear at 28. Volatility was medium at 3.43%, while supply inflation was low with a 12.66% dominance.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.