Highlights:

- BTC is trending towards the $123,495 resistance

- A rally through this resistance could see Bitcoin hit $130k short-term

- Growing excitement around a US Bitcoin Strategic Reserve Act could be the trigger

Bitcoin (BTC) is in the green today, continuing the marginal buildup in momentum through the week. In the past week, BTC has gained 3.75%. Today, Bitcoin is up by 1.03% to trade at $116,829.69. However, trading volumes are unchanged in the day. In the last 24 hours, Bitcoin trading volumes have decreased by a negligible 0.17%, to $46.39 billion. This indicates that holders are not selling their Bitcoin and are confident that the price will likely increase. It also means that those not holding Bitcoin are not making moves yet.

They could be unsure of Bitcoin’s next move, an indicator that the average investor is still sitting on the sidelines. Both of these are bullish for Bitcoin. That’s because holders not selling means they believe Bitcoin’s fundamentals are strong. At the same time, if the price starts going up, there could be FOMO into Bitcoin that could send Bitcoin to new highs in the short term. A couple of factors support the underlying bullish expectations, both from holders and the retail money on the sidelines.

BTC Strategic Reserve Act Round Table Excites Market

One of them is that there could soon be a Bitcoin Strategic Reserve Act in the US. Yesterday, September 16, there was a round table in Washington, DC, to deliberate on the Bitcoin Strategic Reserve Act. The proposal is to have the US accumulate 1 million Bitcoin in its reserves over 5 years. The deliberations on this act are a buildup to the move earlier in the year.

President Trump stated through an executive order that all seized cryptocurrencies would not be sold and would instead be put in a strategic cryptocurrency reserve. The news around the US Bitcoin Strategic Reserve Act could send BTC higher in the short to medium term for a couple of factors.

good morning crypto brothers☀️

The US is preparing a strategic BTC reserve.

Today, US lawmakers will meet with Michael Saylor (Strategy), Tom Lee (BitMine/Fundstrat), Fred Thiel (MARA), and other industry leaders to discuss advancing the BITCOIN Act.The bill proposed by… pic.twitter.com/xnPIVtFDMy

— INSHADOW (@inshadow0x) September 16, 2025

First, it elevates BTC as a reserve, and other countries could see similar reserves forming. There could be a sudden surge in demand that could trigger a Bitcoin rally to prices as high as $1 million in the future.

UK FCA Set to Regulate Cryptocurrency Providers

Other countries are already making moves that mirror the positive approach that Bitcoin has taken to the cryptocurrency market. In the UK, the Financial Conduct Authority (FCA) has announced plans to bring cryptocurrency asset providers under its framework in 2026. This will come with multiple changes to how such providers operate, the key being a stricter approach to operational risks.

[Cryptocurrency, Decentralized Finance]

🇬🇧 FCA | FCA Proposes Minimum Standards for Crypto Firms Compliance

• FCA invites feedback on proposed minimum standards for crypto firms' compliance. • Regulatory scrutiny to impact operational requirements and compliance costs for…

— RegFlow Hub (@RegFlowHub) September 17, 2025

The move is a big deal as it could inspire more conservative investors to become more confident about investing in Bitcoin and other cryptocurrencies. The result is a potential buying pressure on Bitcoin, which could further fuel upside price momentum going into the future. All this is coming at a time when the US is set to cut interest rates, a factor that could send Bitcoin and other risk-on assets rocketing in the foreseeable future.

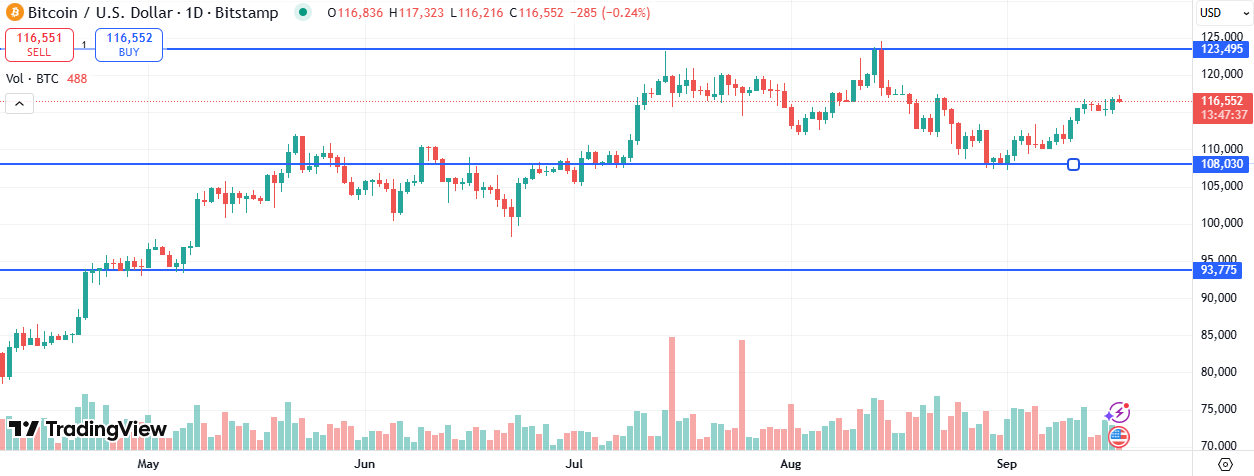

Technical Analysis – BTC Trending Towards Resistance

After bouncing off the $108,030 support on September 1, Bitcoin has been going up, albeit with low volumes. If bulls sustain the momentum they have built up so far, the key level to watch would be the multi-week $123,495 resistance. A rally through this resistance could see Bitcoin rally to $130k in the short term.

On the other hand, if bulls retake control and push BTC lower, the odds would be high that it could retest the $108,030 support. However, with all the talk of a possible Bitcoin Strategic Reserve Act, the odds are higher for a rally towards the $123,495 resistance.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.