Highlights:

- Sui’s bullish momentum stays intact, as it rises 1% to $3.63.

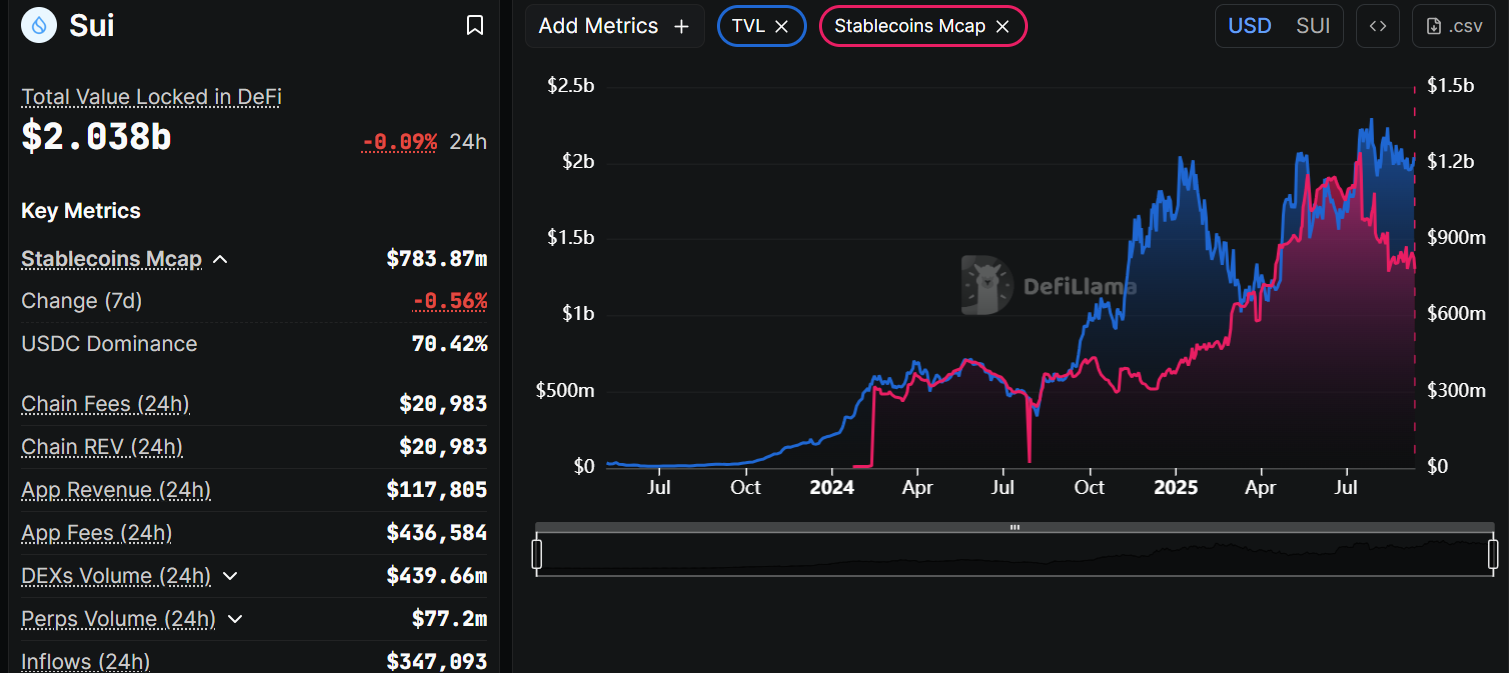

- SUI’s TVL crosses the $2B mark, heightened investor interest.

- The rising open interest in the market could spark a rally to $4 in the SUI price.

Sui price is building upside momentum, as it is up 1% to $3.63. Recently, the Sui Network has been on a rising trajectory and showcasing the increasing tide in decentralised finance (DeFi) and its integration into Bitcoin (BTC). As highlighted by Sui’s recent tweet, they are making new BTC milestones weekly and staking their claim in the decentralised finance space.

The introduction of BTCfi into their ecosystem is an important one, as it enables the seamless integration of Bitcoin and Sui’s layer 1 blockchain. By backing BTC-based assets and protocols, Sui is positioning itself as a top contender in decentralised financial products with improved scalability, reduced costs, and high throughput.

Hitting new BTC milestones every week.

Sui is for BTCfi! pic.twitter.com/6VO0MUeZfK

— Sui (@SuiNetwork) September 11, 2025

Moreover, the DeFi space has seen significant growth and the newest achievements from Sui Network. With a total value locked (TVL) of $2.038 billion, Sui is showing no signs of slowing down and is emerging as a powerhouse in the blockchain ecosystem. Additionally, there has been a significant growth in stablecoins, reaching $783.87 million, which has improved Sui’s dominance. This is especially the USDC stablecoin that holds 70.42% of the market share.

A higher TVL also brings lower supply, and from there, the potential selling pressure circulates. A decline in supply of SUI tokens on the open market and increased demand is a recipe for a sustained price rally.

Sui Derivatives Market and Technical Outlook

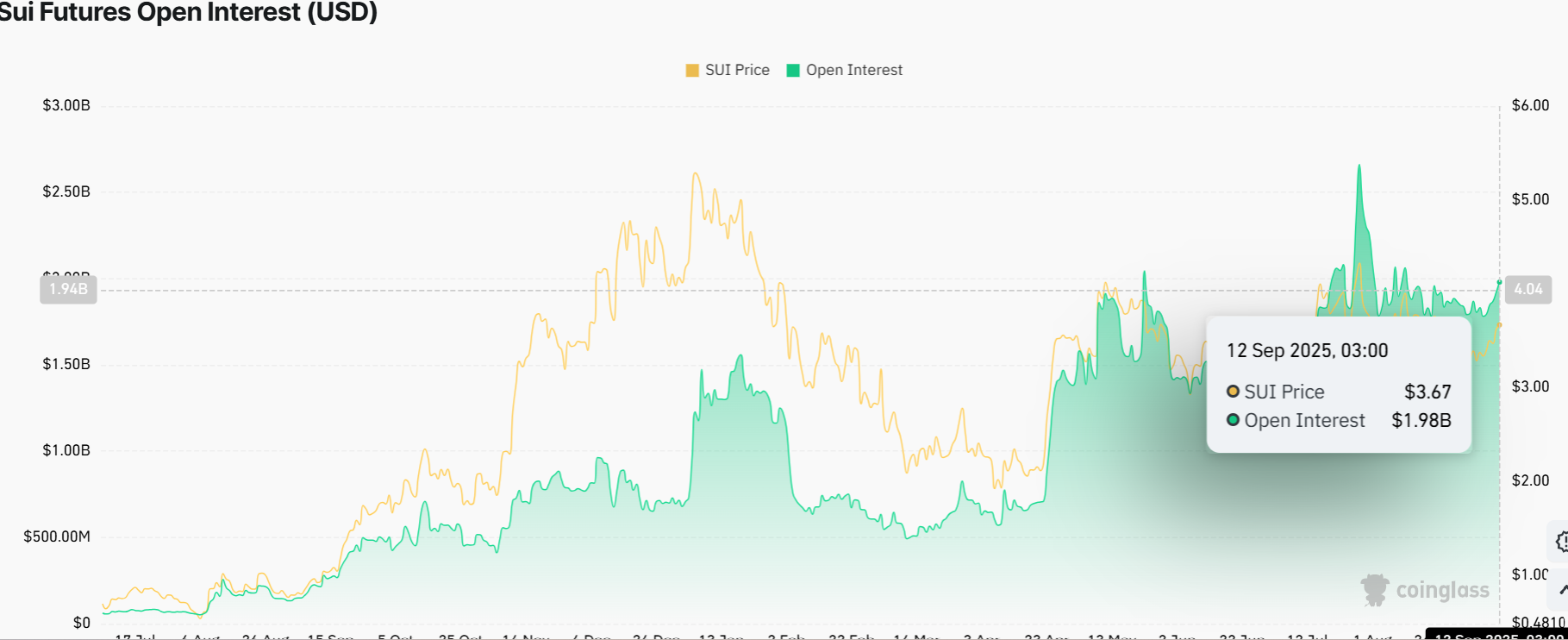

Interest from retailers in SUI continues to be fairly high. According to data from CoinGlass, Sui futures Open Interest (OI) averaged $1.98 billion on Friday. This represents an increase from Sui OI that averaged $1.78 billion on August 22. OI refers to the notional value of futures contracts that are outstanding.

The rising OI trend suggests that investors believe that Sui can spark a 22% jump to around $4.43, breaking and sustaining above a descending trendline resistance. A quick look at the SUI/USD 1-day chart shows that the bulls are having the upper hand. This is reinforced as the SUI price is currently trading well above important moving averages, including the 50-day SMA at $3.60 and the 200-day SMA at $3.14, which are all slightly bullish.

Is SUI Price Poised for a Breakout?

Looking at the technical indicators, such as the Relative Strength Index (RSI) at 55.79, suggests more buying opportunities. This is evident as there is still more room for the upside before the Sui price is considered overbought.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bullish crossover. The histogram bars are consolidating around the same height, indicating the trend is still in its early stages and is likely to rally soon. If Sui price stays above the key moving averages, the altcoin will be in good shape to reach $4.43. But if it falls below that, it could drop towards $3.60 safety net. However, if the trading volume flips positive, the price could rise to reach $5 by October.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.