Highlights:

- Solana price maintains a bullish structure, soaring 3% to $225.

- Forward Industries has previously closed a huge $1.65B private placement that is designed to propel the Solana ecosystem.

- More upside is expected in the Solana price as bulls target $250 in the short term, with the open interest exploding.

The bullish structure remains intact in the Solana price, which has soared 3% to $225. The trading volume is also showing momentum, as it has risen 2% to $8.84 billion, indicating growing investor optimism. Meanwhile, in what is believed to be a record, Forward Industries has previously closed a huge $1.65B private placement that is designed to propel the Solana ecosystem. Having the most successful companies in the industry, such as Galaxy Digital, Jump Trading, and Multicoin Capital, this action is a sign of the increasing confidence in the future of Solana.

🚨BREAKING: Forward Industries (NASDAQ: FORD) has closed a $1.65B private placement in cash and stables, led by @galaxyhq, @jump_, and @multicoincap. Proceeds will fund a Solana treasury strategy centered on $SOL accumulation. pic.twitter.com/mK3dCgD8YB

— SolanaFloor (@SolanaFloor) September 11, 2025

The proceeds of this placement will be invested to facilitate a Solana treasury strategy. This will be focused on the acquisition of a substantial number of $SOL tokens. The support of the project by key participants in the crypto industry reflects an organized effort to enhance the standing of Solana in the competitive blockchain ecosystem. With the ongoing growth in investor interest in $SOL, the Solana Foundation might be setting itself up to enter a massive growth stage.

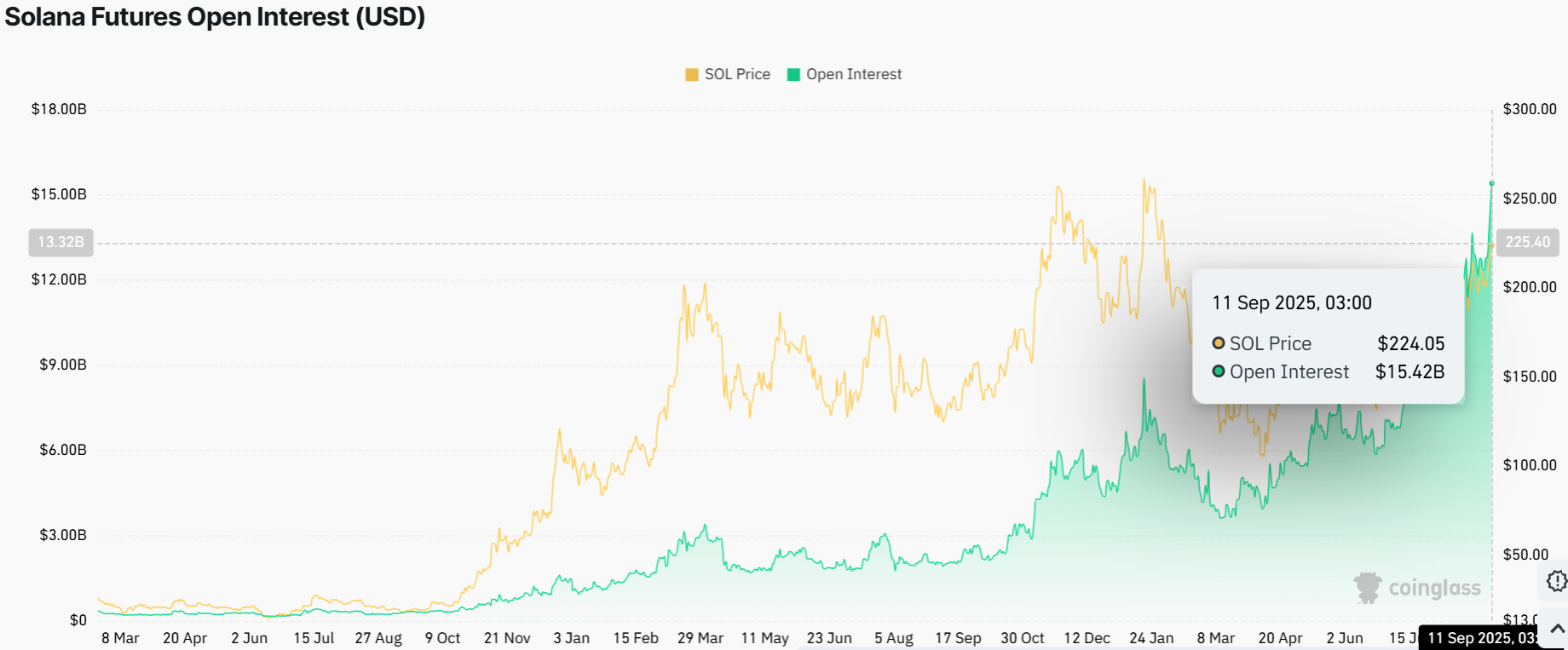

SOL Open Interest Explodes

Considering the current market performance of the token, the Solana price is demonstrating a good bullish movement. The Solana Futures Open Interest has had a significant increase, reaching $15.42B. This indicates that the market activity and the investment commitment of investors in the project are rapidly growing. This open interest surge highlights the fact that there is an increasing opinion that $SOL may keep its bullish course as it has strong market fundamentals and strategic accumulation.

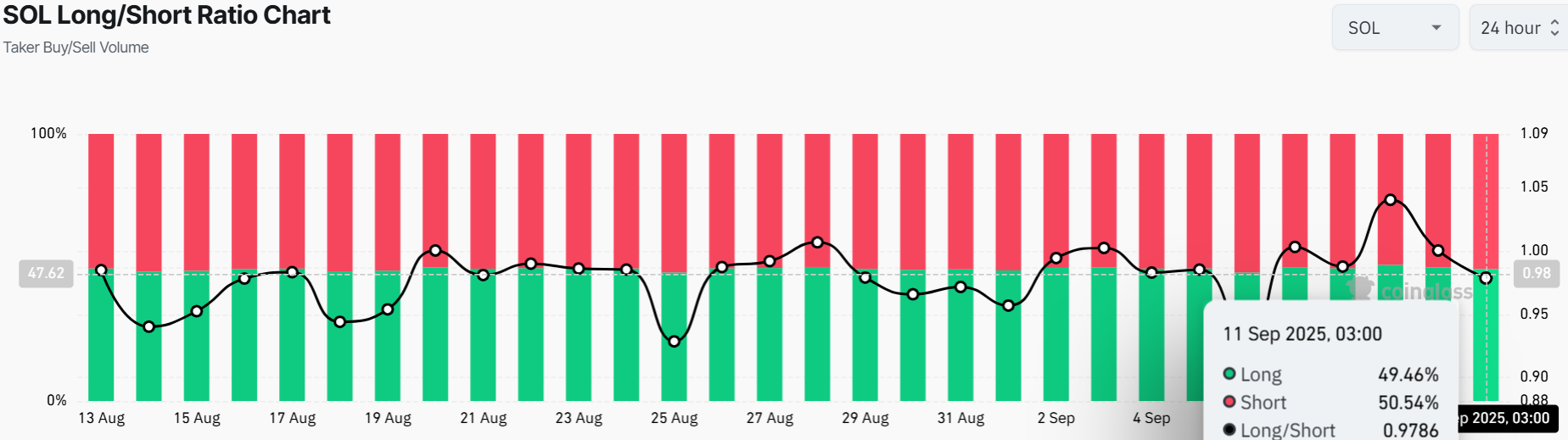

Notably, the Long/Short Ratio of $SOL depicts a bullish picture with 49.46% and 50.54% long and short, respectively. This indicates that traders show a cautious optimism, as there is an almost equal balance between bulls and bears.

Moreover, both the spot and derivatives markets have been increasingly interested in the Solana market, where SOL is trading above its main support and approaching its historic highs. This movement is backed by the ongoing strategic inflows of investment, like that made by Forward Industries. This serves to cement Solana as one of the most popular blockchain ecosystems.

Solana Price Poised for Further Upside

The SOL/USD 1-day chart is showing a strong bullish outlook, with the altcoin intact within the rising channel. The bulls are showing no signs of stopping soon, as they have established immediate support at $190 and $158. If these zones keep holding strong, SOL is poised for a rally towards $250.

Other technical indicators, such as the RSI, show intense bullish momentum. Currently, it’s at 64.45, giving buyers more room before hitting overbought conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line (blue) slicing above the signal line, showing momentum is still on SOL’s side.

Overall, SOL’s 9% weekly pump reflects intense community hype and FOMO, pushing its Solana price even higher. In the short term, the Solana price may go to $250 if support holds. Long-term, if the altcoin season cripples back in Q4, SOL might see $300 and beyond. However, traders will want to watch for overextension risks. Meanwhile, a break below $190 area could spell trouble in the Solana market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.