Highlights:

- Ethereum leads ETF gains with its third straight cash inflows worth $443.9 million.

- Bitcoin ETFs ended their losing streak with a $219 inflow on August 25.

- All active Bitcoin ETFs recorded gains, led by the Fidelity Bitcoin ETF.

On August 25, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded cash inflows to begin the week on a positive note. According to the renowned on-chain ETF tracker, SosoValue, Ethereum ETFs led the profit surge with $443.9 million cash inflows, marking their third straight profitable outing. Meanwhile, Bitcoin ETFs added $219 million to mark their first inflows since August 14.

On August 25, Ethereum spot ETFs recorded $444 million in total net inflows, marking three consecutive days of inflows. Bitcoin spot ETFs saw $219 million in total net inflows, with none of the twelve ETFs reporting outflows.

https://t.co/Tvs2oCSxTg— Wu Blockchain (@WuBlockchain) August 26, 2025

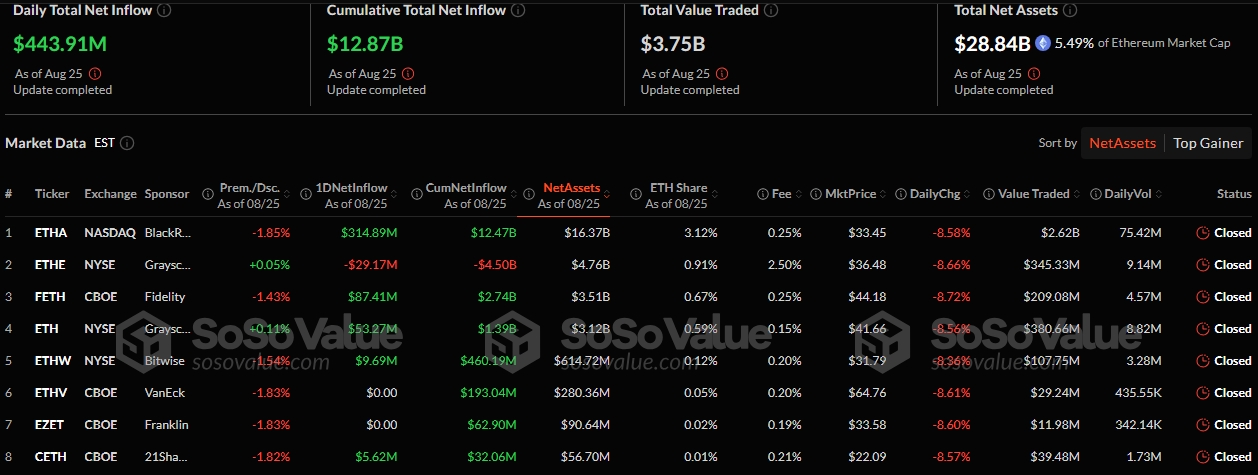

Ethereum ETFs See Increased Activity Levels

Yesterday, seven out of nine Ethereum ETFs were active. Six of these funds attracted cash inflows while Grayscale Ethereum ETF (ETHE) recorded the only outflow, valued at $29.17 million. Notably, VanEck Ethereum ETF (ETHV) and Franklin Ethereum ETF (EZET) had neither inflows nor outflows.

As usual, BlackRock Ethereum ETF (ETHE) topped the inflows chart by attracting $314.89 million. Two other funds, including Fidelity Ethereum ETF (FETH) and Grayscale Mini Ethereum ETF (ETH), saw profits worth over $50 million. These ETFs added $87.41 million and $53.27 million, respectively.

Other Ethereum funds that recorded cash inflows were Bitwise Ethereum ETF (ETHW), 21Shares Ethereum ETF (CETH), and Invesco Ethereum ETF (QETH). These ETFs gained $9.69 million, $5.62 million, and $2.2 million, respectively. Overall, the total net inflow increased from $12.43 billion to $12.87 billion. Total value traded was $3.75 billion, while total net assets reflected $28.84 billion.

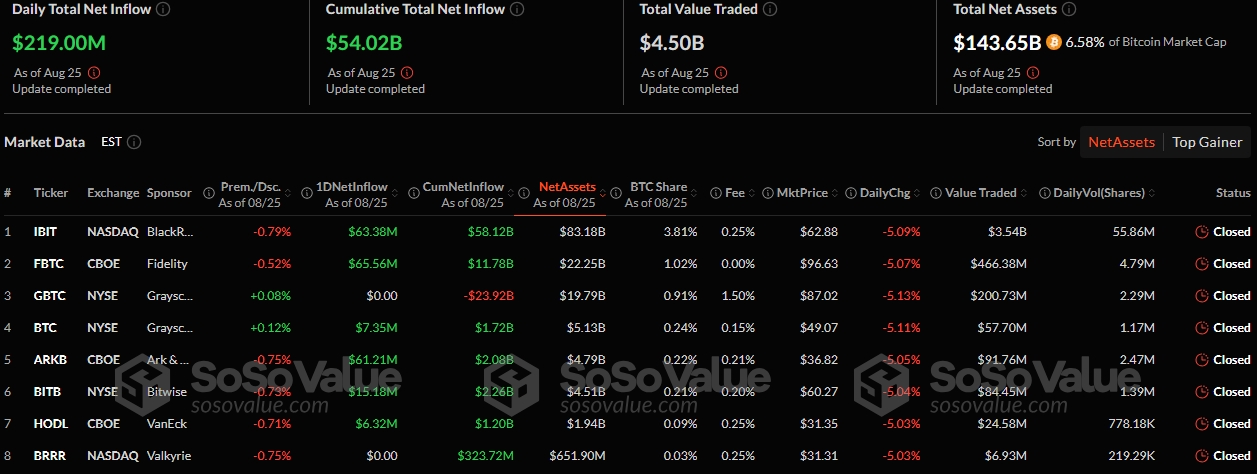

Bitcoin ETFs Flow Statistics

Unlike Ethereum, only 50% of Bitcoin ETFs were active on August 25. All active ETFs recorded cash inflows led by the Fidelity Bitcoin ETF (FBTC), which attracted $65.56 million. BlackRock Bitcoin ETF (IBIT) and ARK 21Shares Bitcoin ETF (ARKB) followed closely with $63.38 million and $61.21 million inflows, respectively.

The remaining profitable ETFs were Bitwise Bitcoin ETF (BITB), Grayscale Bitcoin ETF (BTC), and VanEck Bitcoin ETF (HODL). These funds had inflows of $15.18 million, $7.35 million, and $6.32 million, respectively. Consequently, the ETFs’ cumulative net inflow increased from $53.8 billion to $54.02 billion. However, the total value traded and net assets dropped to about $4.5 billion and $143.65 billion, respectively.

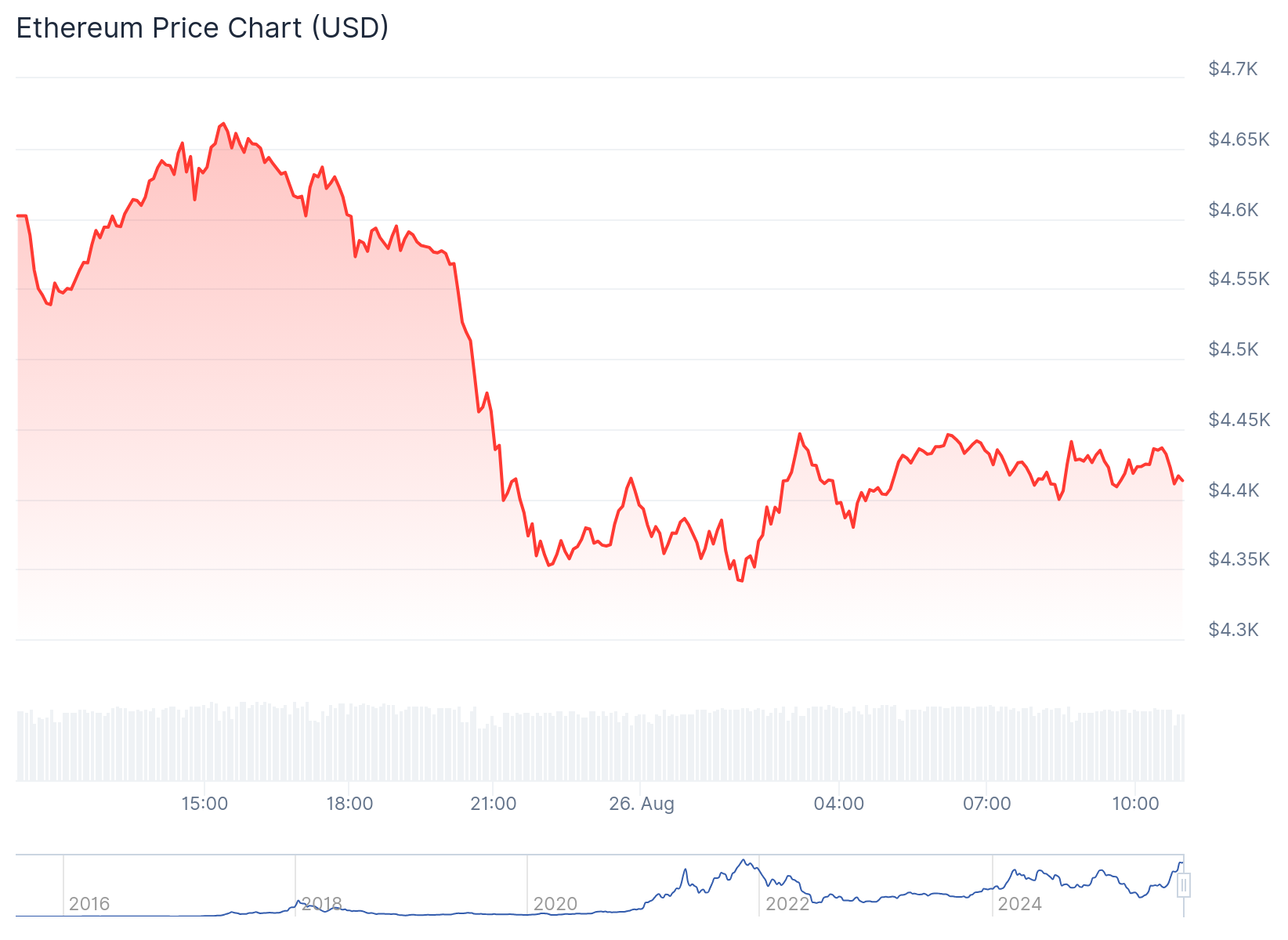

Ethereum ETF Gains Could not Salvage the Token’s Price

Despite reaching a $4,946 all-time high (ATH) two days ago, Ethereum has struggled to sustain the positive momentum. At the time of press, ETH’s market valuation has dropped to $4,413, following a 4.1% downturn in the past 24 hours, with price extremes fluctuating between $4,341.54 and $4,667.76.

While Ethereum’s short-term price actions seem unimpressive, its long-term variables appear strong. For context, its 7-day-to-date, month-to-date, and year-to-date data reflected increments of about 4.2%, 17%, and 61.2%, respectively, implying that the current dip might be transient.

Aside from ETFs, individual investors and firms are also capitalising on ETH’s price struggle to accumulate the tokens at discounted rates. According to the on-chain crypto transactions tracker, Lookonchain, Bitmine recently purchased 4,871 ETH for $21.28 million. This acquisition comes a few hours after the company had procured 190,526 ETH for $883 million. Currently, Bitmine owns 1,718,770 ETH, valued at about $7.65 billion. In a separate tweet, Lookonchain reported that a whale had acquired 6,334 ETH worth $28.08 million from Kraken, highlighting massive ETH accumulation trends.

Bitmine(@BitMNR) bought another 4,871 $ETH($21.28M) 2 hours ago and currently holds 1,718,770 $ETH($7.65B).https://t.co/P684j5Yil8https://t.co/1QXovuIOyq pic.twitter.com/ktkDLrqMk5

— Lookonchain (@lookonchain) August 26, 2025

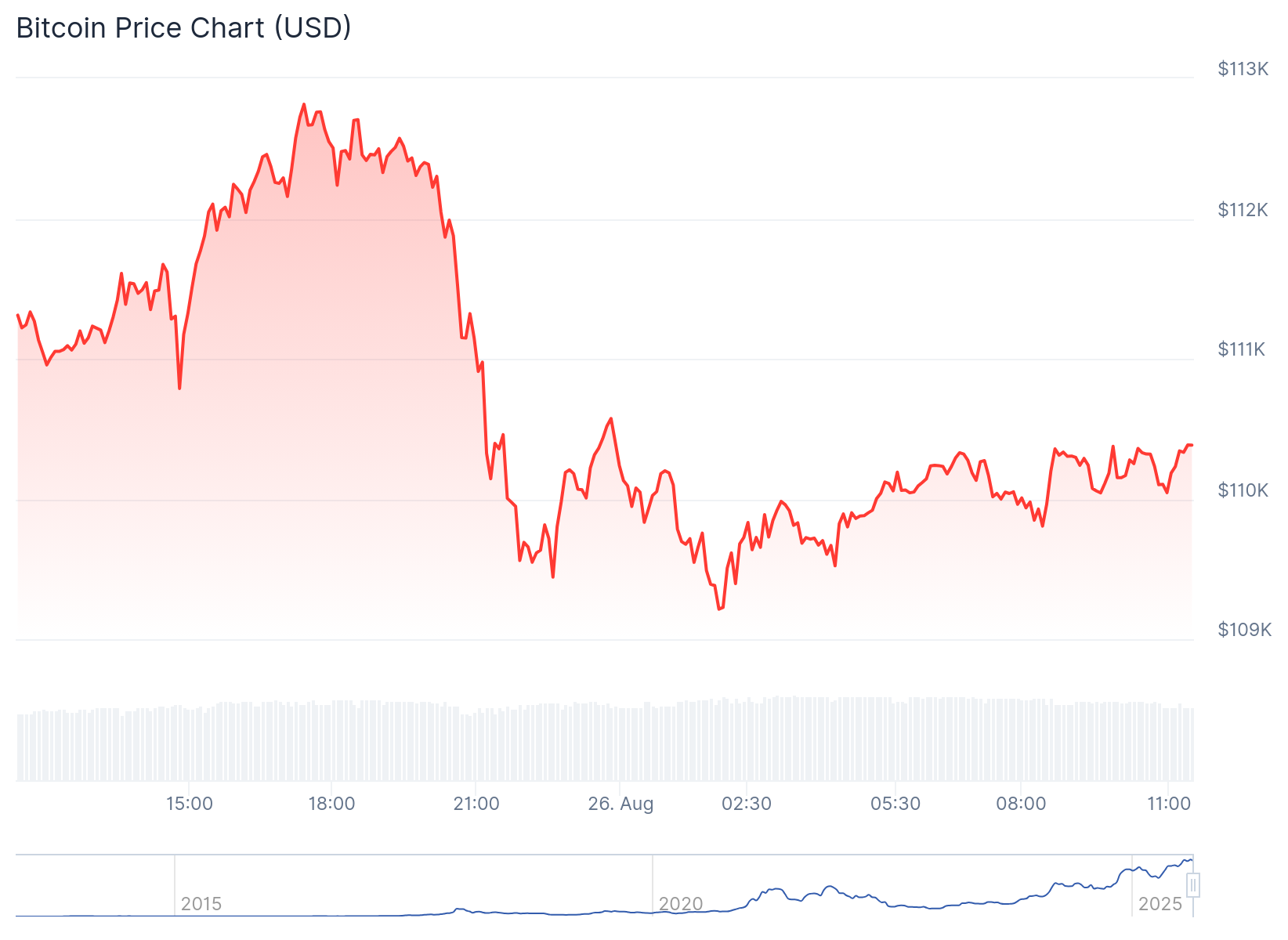

Bitcoin Reclaims $110,000 as Ethereum Leads ETF Gains

After dropping below $110,000 earlier today, BTC has since reclaimed that level. However, the token is still 0.8% down in the past 24 hours, trading at about $110,340. Unlike Ethereum, Bitcoin’s long-term variables are in red. Notably, BTC is down 4.3% 7-day-to-date, 7.1% 14-day-to-date, and 6.5% month-to-date.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.