Highlights:

- Stader price pumps 28% to $0.84, with a spike of 541% in trading volume.

- This surge comes amid Bithumb’s listing.

- SD bulls eye $0.89-$1 levels, as bullish momentum with a Golden cross emerges.

The Stader price has defied the red crypto market, surging 28% to $0.84. Accompanying the price movement is its daily trading, which has spiked 541%, indicating intense investor activity. SD is now boasting a 14% rise over the past week and 1% surge over the past month. The recent rally follows Bithumb, a South Korean crypto exchange, revealing support for the SD/KRW trading pair.

🚀 스테이더(#SD) 원화 마켓 추가 안내

🚀 $SD/KRW will be listed on #Bithumb!🔸 Details : https://t.co/FWWM5i1K0P #Bithumb #SD @staderlabs pic.twitter.com/33DgXkZCUC

— Bithumb (@BithumbOfficial) August 26, 2025

This announcement on August 26, 2025, marks a significant milestone for the company as it expands into global markets. The SD token, which has been gaining traction in the decentralized finance (DeFi) sector since its introduction in South Korea, is now available for trading, potentially enhancing its liquidity and user base. According to the exchange, the trading of SD against the Korean Won (KRW) will commence at 18:00 KST today, marking a significant milestone in its adoption.

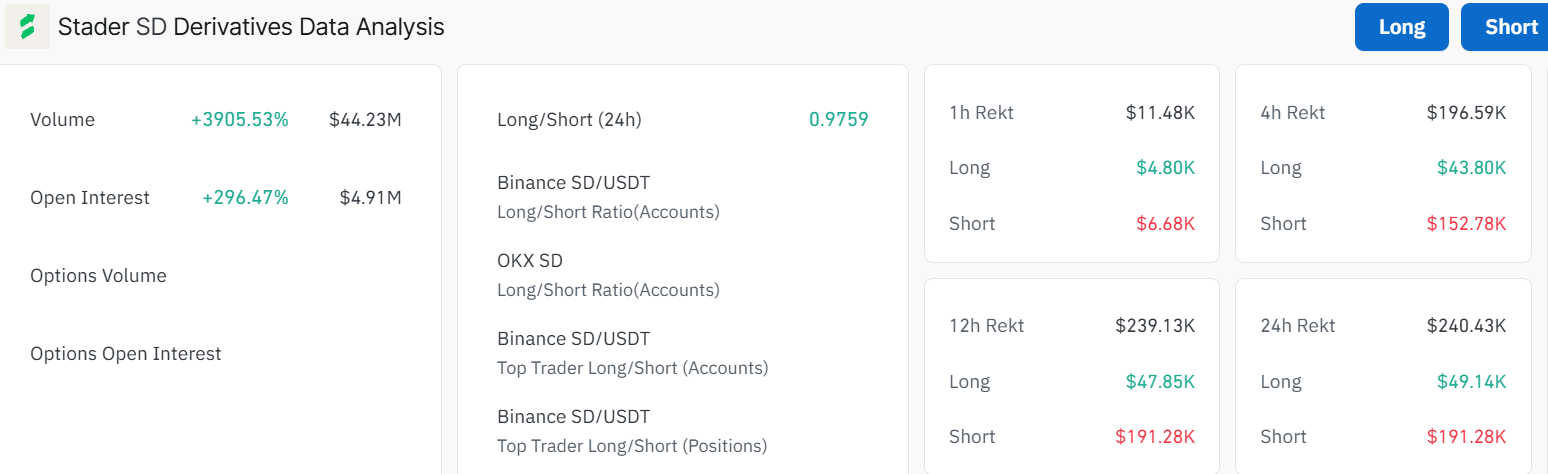

Stader Derivatives Data Analysis Portrays Positive Momentum

A closer view of the derivative market performance in Stader reveals significant growth. The trade volume of SD has increased enormously by a massive 3905.5% to a considerable amount of $44.23 million. It also has an interesting growth of its open interest of 296.47% to $4.91 million. These data indicate an increasing interest among traders, which may signal an anticipated price rally in SD.

Additionally, the long/short ratio over the last 24 hours is standing at 0.9759, indicating that the market developer is at neutral. The cumulative liquidation data, however, suggests that there are significant short liquidations on both the 1-hour and the 4-hour, indicating volatility.

Stader Price Aims to Rally Above the Falling Wedge

According to the daily chart timeframe, the Stader price is trading well within a falling wedge pattern, as the bulls aim for a breakout. The bulls have shown strength, surging from the daily low at $0.66 to $0.84. Further, the 50-day ($0.67) and 200-day ($0.58) are acting as immediate support zones, cushioning against further downside. The evidence of a golden cross, as well, supports a classic long-term uptrend in the SD market.

The RSI has been at 60.76 and is not overbought, indicating additional upside in the future. The MACD has made a bearish crossover, threatening further downside. Unless the trend changes, traders should be cautious as a sell signal is in play. With a 541% increase in trading volume, the upward thrust remains in play. If this momentum holds, the Stader price could blast past $0.89-$1. The chart’s upward trajectory post-Golden Cross supports this, especially with that high of $1.18 already in sight.

However, a sudden volume drop could trigger a pullback to $0.67 support zone. A 14% pump in a week is no small feat, but it’s all about timing. Traders will want to keep an eye on the 50-day SMA ($0.67) as it will help to show any change in trend. If it dips, it might be time to reconsider a Stader long position.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.