Highlights:

- Solana price slips 5% to $182, as the trading volume skyrockets 72%.

- SOL hits a new all-time high with a maximum recorded TPS of 107,664 per block.

- Crypto analyst predicts a short-term rebound in SOL as a TD buy signal emerges.

Solana price, like many cryptos today, is swimming in the red region, slipping 5% to $182. On the other hand, its daily trading volume has increased 72% to $6.16 billion, showing growing market activity. Despite today’s drop, SOL is up 2% in the past week and 3% over the past month, showing growing hype in the market.

Meanwhile, Solana Floor data reveals that SOL reached a new all-time high with a maximum recorded TPS of 107,664 per block, logging the highest throughput ever witnessed on the network. Such a boom in TPS means that Solana is becoming strong and has network scalability. It also signifies the growth and spread of adoption and the potential growth in utility, which favours the long-term bullish outlook of its native token.

🚨JUST IN: @Solana hit a new all-time high with a max recorded TPS of 107,664 in a single block, setting the highest throughput ever measured on the network. pic.twitter.com/uvnPJssUhs

— SolanaFloor (@SolanaFloor) August 17, 2025

On the other hand, the token terminal statistics reveal that half of the transfers arrived in the USDC on the Solana network. This implies an increase in the usage of the network and the attraction of more users to the ecosystem.

ICYMI: ~50% of USDC transfers occur on @solana. pic.twitter.com/tIivp0PytS

— Token Terminal 📊 (@tokenterminal) August 17, 2025

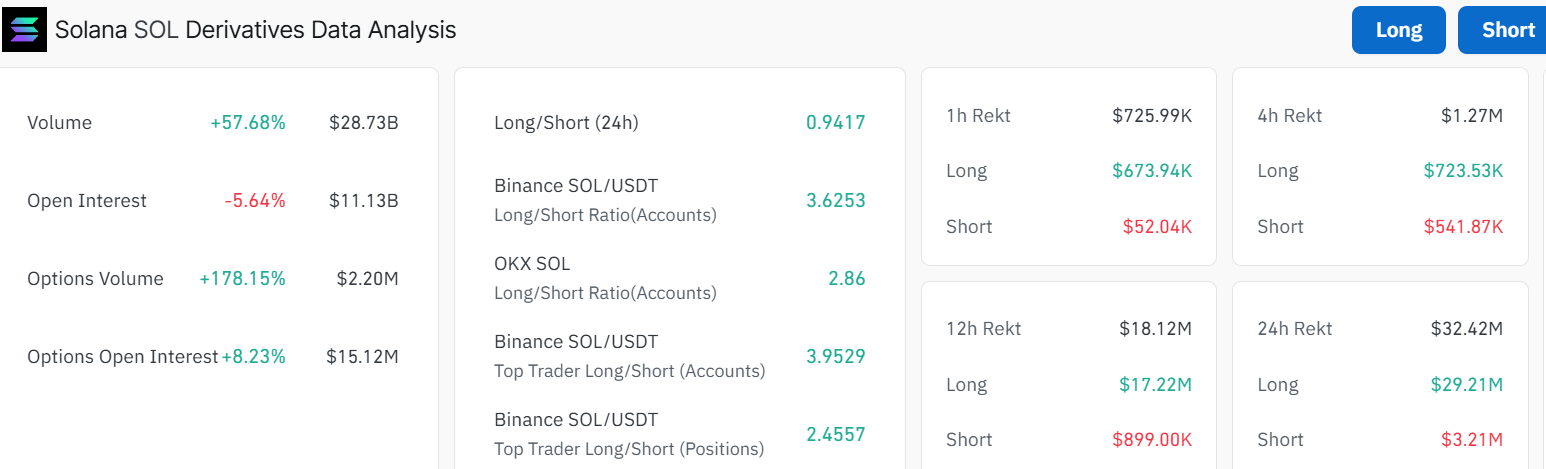

Contributing to the market activity of Solana, there is a sharp increase in the Solana derivatives market. As its trading volume rose by 57.68% to $28.73 billion, Solana is also gaining the attention of traders who seek SOL token exposure. The increase in options volume by 178.15% signals the surge in interest and a more active advanced investor base. However, its open interest has slipped 5% to $11.13 billion.

The long/short ratio sista at 0.94, indicating that the buyers are showing strength in the market. The most active traders remain long-sided as they are confident in further price increases of Solana.

Solana Price Remains Bullish Despite the 5% Dip

Despite the drop, the Solana price chart suggests this could just be a short-term dip before a bigger move up. Looking at the daily chart, SOL has formed a cup and handle pattern, with the golden cross in play.

Now, the price is pulling back and retesting the old resistance around $172. This could act as support. If it holds, the Solana price could bounce and continue rising. The next big target is between $203 and $247. This is where a lot of buy orders (liquidity) might be waiting, which might push the price higher. On the downside, support is found around $172-$157. If that breaks, the next strong support is near $130, where buyers stepped in before.

The RSI (Relative Strength Index) is at 51.57. This means Solana is at equilibrium with substantial room to move to the upside. That said, the long-term structure remains bullish unless SOL breaks down below the handle pattern and the $172 zone. A daily close above the $200 level would confirm renewed buying strength and set the stage for a move toward the $247 resistance zone. Moreover, popular analysts have depicted that the altcoin has a buy signal, indicating that a short-term rebound is plausible.

With a TD Sequential buy now on Solana $SOL, a short-term rebound before lower lows is in play. pic.twitter.com/Q9f3ssyUKi

— Ali (@ali_charts) August 18, 2025

While Solana is currently under short-term pressure, the broader price structure favours continuation to the upside. This is especially if it manages to reclaim $200 level. If support around $172 holds, Solana price could soon aim for the higher zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.