Highlights:

- The Optimism price has risen 8% to $0.79, as trading volume surges over 700%.

- The recent rally comes following the Upbit listing.

- OP volume and OP soars, indicating increased investor confidence.

The Optimism price has seen a parabolic rise, hitting $0.88 mark, before slightly retracing to $0.80, marking 8% surge. Accompanying the price movement is its daily trading volume, which has spiked by over 740%, indicating intense investor confidence. OP token is now up 45% over the past month, despite a 1% drop in the past week. The surge comes following the Upbit listing. This listing will represent a significant leap forward for the OP, driven by increased liquidity and worldwide exposure.

Market Support Optimism(OP)

✅ Supported Markets: KRW, BTC, USDT Market

📅 Trading opens at : 2025-07-28 16:30 KST (estimated time)🔗Discover more: https://t.co/Fo0ipUYBq1#Upbit #OP @Optimism pic.twitter.com/QxIYdvpF0Z

— Upbit Korea (@Official_Upbit) July 28, 2025

According to the Upbit announcement, this listing is expected to help increase the investor base and to benefit the rising interest in the utility and governance of OP. Ethereum already boasts optimism as its most significant feature in the ecosystem, providing faster and cheaper transactions through rollups.

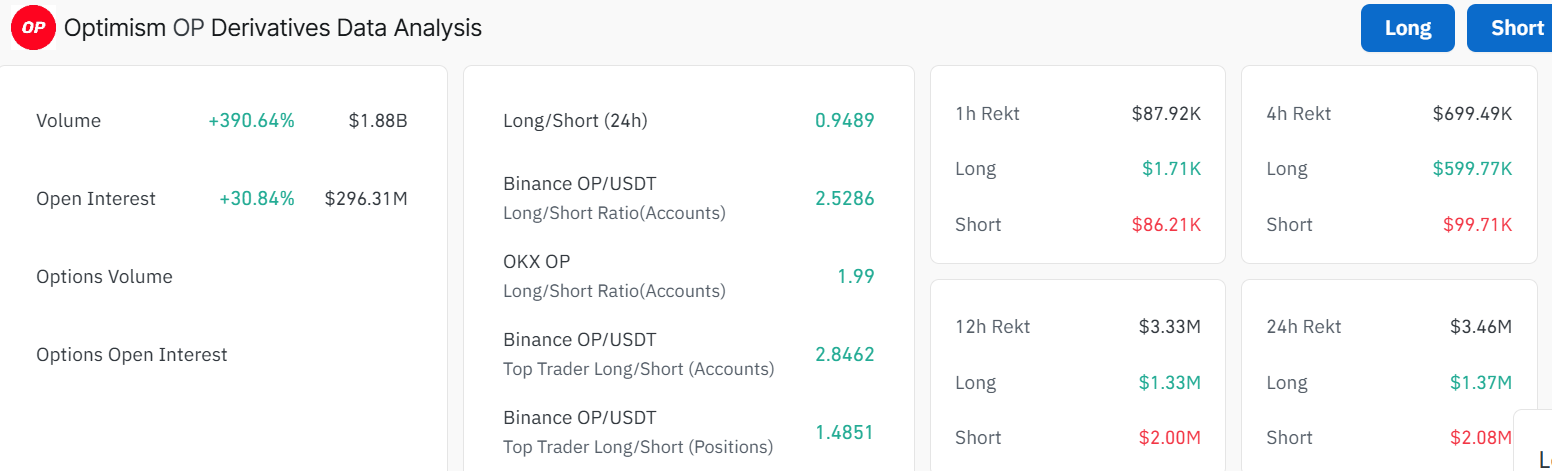

Meanwhile, the Optimism derivatives market has experienced explosive growth, indicating a strong bullish outlook. The volume has increased by 390% to $1.88 billion, and the open interest has risen 30.84% to 296.31 million. The recent surge indicates a rise in speculative activity and increased investor confidence. The long/short ratio at 0.9489 indicates a balanced market.

The bullish sentiment can also be proved by liquidation data. Over the last 24 hours, approximately $3.46 million has been liquidated, with shorts currently on the receiving end, amounting to $2.08 million. The longs have taken the rest $1.37 million. Such an imbalance suggests a possible short squeeze scenario, which may later lead to upward movement.

Optimism Price Breakout of a Falling Wedge Pattern

A closer look at the 1-day chart reveals that the Optimism price has broken out of a prolonged falling wedge pattern, indicating a bullish reversal ahead. After the OP formed a clear ABC corrective structure inside the wedge, the Optimism price bottomed near $0.48 and then began forming higher lows, signalling accumulation.

The breakout above the wedge resistance around the $0.68 zone was accompanied by a strong bullish candle and a daily gain of over 15%, pushing the price of Optimism to $0.88 before it retraced to $0.79. This breakout has also propelled the price of OP decisively above the 50-day Simple Moving Average (SMA) at $0.6271, flipping it into an immediate support zone. In the meantime, the bulls need to overcome the $0.8807 immediate resistance, aligning with the 200-day SMA, to continue the upward movement.

Currently, the Relative Strength Index (RSI) of 65.99 is slightly below the overbought line, yet it still indicates strong momentum that is not overextended. The MACD bullish cross indicates a potential upside movement. This is reinforced by the buy signal from the MACD line (0.393) crossing above the orange signal line (0.0385). This requires traders to continue buying OP tokens, unless the MACD indicator changes. There is also histogram support by the positive momentum bars.

How High Can OP Go?

With a volume spike of over 700%, the market’s waking up, and that’s a green flag for momentum. If the recent support at $0.62 holds strong, Optimism price could break out above $0.88 mark. A breach above the $0.88 area may cause a short-term rally towards $1.97. However, despite the bullish outlook, there are risks. If the RSI reaches overbought levels or volume subsides, a fake-out may occur. Based on this chart snapshot, the OP price has the potential to drop towards $0.68 support zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.