Highlights:

- Solana’s price rises 5% to $173, with a 48% increase in daily trading volume.

- Solana’s DePIN ecosystem has reached $3M YTD, with $716k in May and $629k in April, demonstrating a significant Web3 presence.

- SOL bullish technical indicators signal a potential spike to $200 in the short term.

The Solana price has soared 5% to the $173 mark, accompanied by a 48% increase in its daily trading volume. The recent spike indicates heightened investor confidence as various analysts foresee a potential rally. According to CW, Solana’s price is poised for a rally to $270 if the $185 barrier is broken.

If $SOL breaks through $185, it will continue to rise to $270. pic.twitter.com/QI8N1I1aog

— CW (@CW8900) July 17, 2025

Meanwhile, the physical Infrastructure network of the ecosystem (DePIN) has also been growing, with Solana scoring a new July peak, hitting $3 YTD. Syndica data shows that the Solana DePIN economy achieved a revenue of $3 million, including $716,000 in May and $629,000 in April.

Monthly DePIN revenues hit a new high in June, with $3M earned YTD, per @Syndica_io

Build your business on Solana https://t.co/wl9zl3QWLB pic.twitter.com/FgelW20o4U

— Solana (@solana) July 15, 2025

The progressive growth in DePIN’s revenue base indicates the growing presence of the platform in the Web3 environment, attracting more developers and users to join and build on Solana. DePIN of Solana has paved the way for further revenue growth.

Solana Price Aims for a Sustained Rally

Solana has been advancing considerably, scoring a noticeable improvement in both price and market activity. By July 17, the token was trading at a price of $173.23, maintaining a bullish grip.

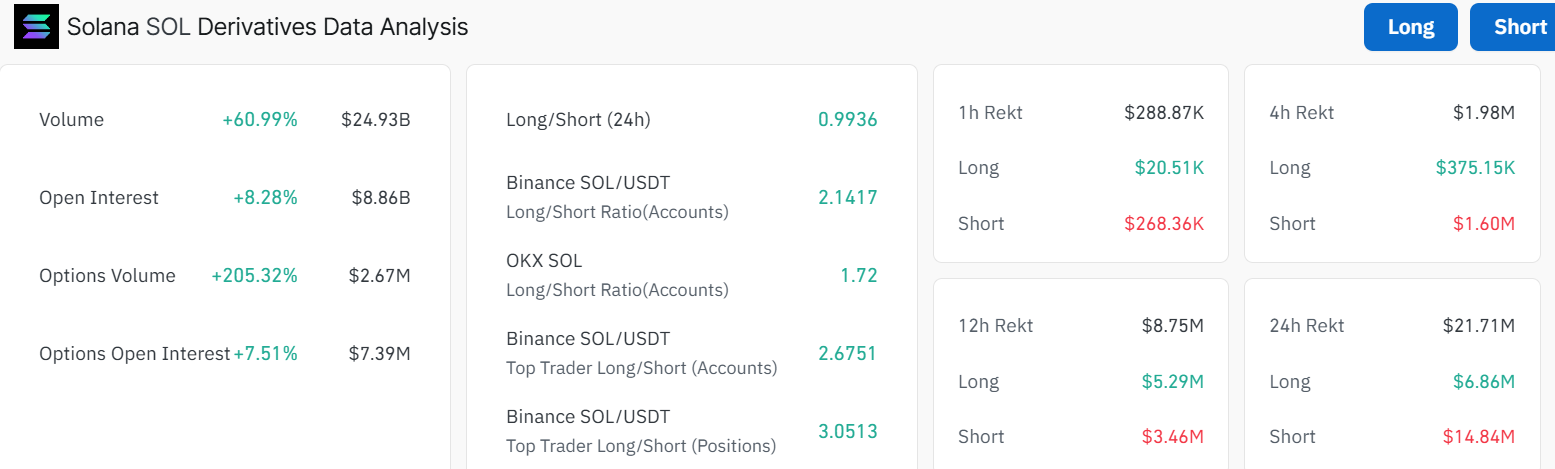

The 60.99% rise in trading volume, which reached 24.93 billion, is an indication of increasing interest in Solana. The open interest has also increased by 8.28% to reach 8.86 billion. Such indicators imply a higher level of confidence among both institutional and retail traders. Technically, the Solana price trades well within the confines of a rising parallel channel, as shown in a 4-hour chart outlook. The altcoin has broken through the $150 and $160 resistance barriers, flipping them into support zones.

The price is now in a bullish pattern, and with the RSI at 65.78, it indicates significant buying pressure. Nevertheless, given that the token is nearing the overbought levels, traders should be cautious. However, the general prospect is positive, as analysts forecast increased possibilities of upside, especially if the Solana support level at $162 holds.

Additionally, the MACD indicator displays a strongly positive trajectory, indicating a sustained bullish trend. The evident strong positive crossovers signal that traders are at liberty to buy more SOL tokens, unless the MACD changes.

Is It Too Late to Buy SOL?

If SOL maintains the $162 support level and breaks above the $180, it could test the $187-$200 resistance next. However, the current market structure suggests that the Solana price may head in one of two directions. If the price is rejected at $180, it could result in the price dropping as low as $169-$162, serving as a safety net.

Solana $SOL is about to melt faces! pic.twitter.com/WRrav5aAfM

— Ali (@ali_charts) July 16, 2025

However, with the crypto market maintaining a bullish outlook, reinforced by technical indicators, SOL could reclaim the $200 level within the next 24 to 48 hours. Additionally, SOL could rally to $270 by late July, if the current conviction holds. Further, a popular analyst, Ali Martinez, is confident that “SOL is going to melt faces.”

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.