Highlights:

- Bloomberg estimates a 95% chance of spot XRP ETF approval, which is expected to boost investor sentiment.

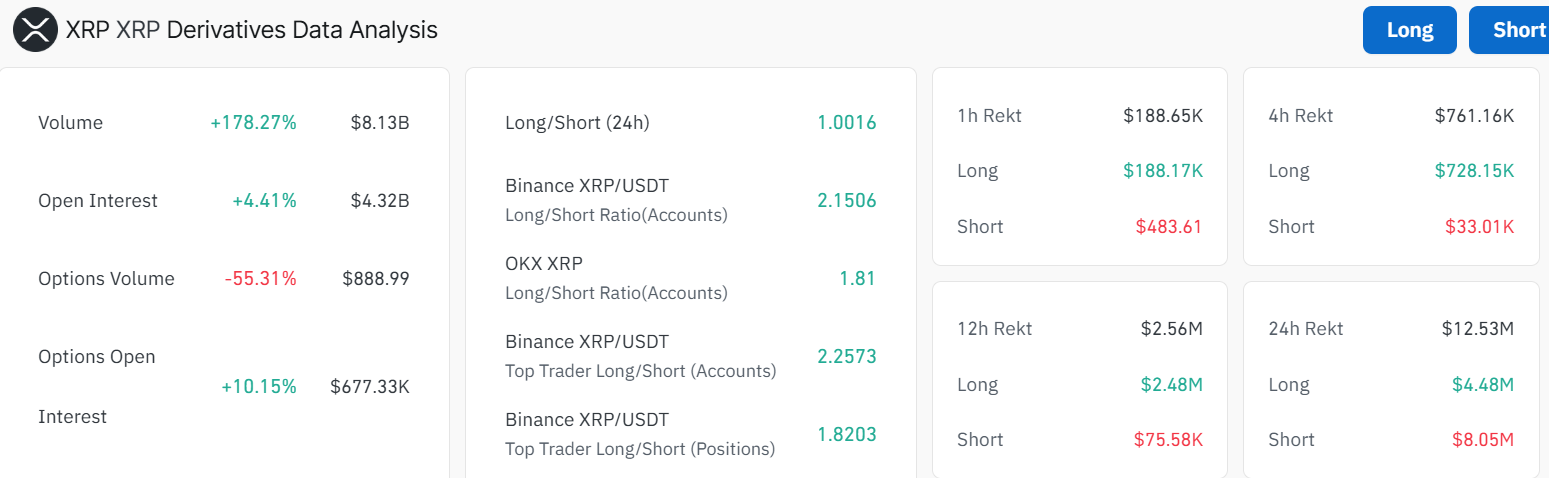

- XRP futures volume jumps 178% to $8.13B, with open interest rising 4.41% to $4.32B.

- The XRP chart indicates a falling wedge pattern with a breakout target of $2.70–$3.00, representing a 37% gain.

The XRP price has experienced a strong rebound, reaching the $2.34 mark on 30 June, before retracing to $2.20, marking a 1% surge as of the time of writing. The daily trading volume has increased by 116% compared to the previous day, indicating heightened market activity. The recent spike comes as the likelihood of the spot XRP ETF receiving approval recently hit 95% at Bloomberg. This positive outlook is a landmark development for XRP, which had been embroiled in legal battles and regulatory challenges.

🚨 BREAKING 🚨

Bloomberg just raised the odds of a spot $XRP ETF approval to 95%.

Yes, ninety-five.

Once sued, ignored, and counted out… now it’s knocking on Wall Street’s front door.

XRP wasn’t the villain. It was the prologue. 👀 pic.twitter.com/EhZvvWBQ7n

— John Squire (@TheCryptoSquire) June 30, 2025

Based on the tweet by John Squire, the crypto community and institutional investors are also starting to pay more attention to the path XRP takes toward approval.

XRP Volume and OI Spike 178% and 4% Respectively, As Bullish Sentiment Builds

The XRP derivatives market exhibits an interesting trend of increasing open interest and volume. Additionally, the XRP derivatives market has experienced explosive growth. XRP futures contracts have seen a 178% increase in volume, reaching a total value of $8.13 billion. This volume growth is due to increased market activity and a growing demand for XRP derivatives. Additionally, the open interest in these derivatives increased by 4.41%, attracting a total of $ 4.32 billion, which is again an indication of bullish sentiment in the market.

A closer look at the XRP derivatives analysis reveals that investors hold mixed positions, with some executing long positions in the cross that are outperforming their short positions. The long-to-short ratio stands at 1.00, indicating that market participants anticipate the upward trend in XRP to persist.

XRP Price Faces Resistance at $2.24 as Bears Push for Rejection

The XRP daily chart shows a tight falling wedge pattern, with potential for a breakout. However, the bulls need to show more strength and overcome the first resistance at $2.24 mark, which aligns with the 50-day MA. Meanwhile, the bears are showing the bulls total dust, as they have established immediate resistance at $2.24 and $2.36, respectively.

The Relative Strength Index (RSI) is currently at 52.40, indicating a neutral equilibrium condition. Moreover, there is more room for the upside before XRP is considered overbought. The MACD momentum indicator also upholds a buy signal, encouraging traders to rally behind XRP. This may trigger a breakout towards the $2.36 mark in the short term.

XRP Price Poised for a Breakout – Bulls Target $3

With the technical indicators showing mixed signals, if the bulls capitalize on the buy signal from the MACD, the XRP price could surge. In such a case, a break above the $2.24 resistance will pave the way for further upside towards $2.36, $2.50, and even $2.64 mark. In the medium term, the bulls could target a 37% gain, reaching the approximately $2.70 to $3.00 mark.

On the downside, if the resistance levels prove too strong, the XRP price could drop or consolidate. In such a case, the safety net, which ranges from $2.18 to $1.99, will cushion against further downside. Only a breach below $1.99 may trigger panic selling in the market, causing further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.