Highlights:

- The price of Litecoin is up 0.97% to $90.51, signaling recovery, despite a 29% drop in daily trading volume.

- A crypto analyst predicts that the Litecoin price could target $109.38 and potentially reach $121.95 if it holds above the $85 breakout level.

- Litecoin’s derivatives data shows cautious market sentiment with a slight bearish outlook, but the long/short ratio favors buying.

The Litecoin price is showing signs of potential recovery, as it is up 0.97% to trade at $90.51. Despite the surge, its daily trading volume has plummeted 29% to $333M, indicating a fall in market activity. However, key technical patterns in Litecoin’s chart point to a chance that prices can rise. Recently, LTC rebounded above $85, which shows solid demand. Because of this movement in price, traders and analysts are watching carefully for more evidence that this is a reversal.

Litecoin Price Technical Outlook

According to the daily chart outlook, Litecoin price is trading near the 50-day resistance at $90.54. If the bulls intensify the buying pressure, the altcoin could flip the $90.54 into support, igniting a short-term rally. This may see the bulls target the next major key resistance, aligning with the 200-day MA at the $101 mark. If the LTC token breaks above $101.98, it could show the start of a rising trend.

Furthermore, the Relative Strength Index (RSI) stands at 46.24, which means the market is not full of buyers or sellers, so its direction may continue to improve. MACD indicates a bearish bias now, though it might flip to bullish if the price keeps moving up.

Meanwhile, the governing technical pattern, cup and handle, often signals a potential reversal. The signs suggest that Litecoin’s future may turn bullish, and if it maintains its position above the breakout point, it could jump to new resistance levels at $109.38 and $121.95.

Litecoin’s Derivatives Data Reflect Market Sentiment and Trading Activity

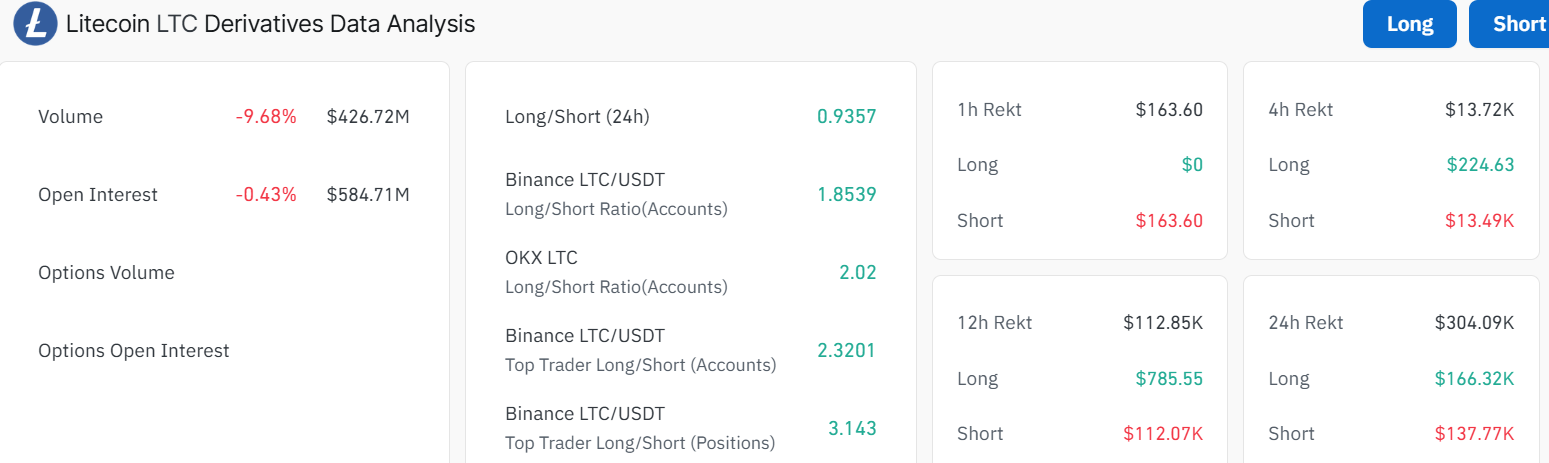

The derivatives records for Litecoin help show market sentiment and hint at upcoming price changes. Short-term transactions have gone down as the daily volume of Litecoin fell by 9.68% to $ 426.72M. The open interest stayed pretty constant, slipping by only 0.43%, which is equivalent to $584.71M. This suggests that people are being careful, probably waiting to see if a significant breakout or price level is established before moving a lot in the market.

The long/short ratio of Litecoin demonstrates a positive attitude from the market, with 1.85 on Binance LTC/USDT and 2.32 on OKX. The numbers show that, even after the market correction, traders are still preferring to buy instead of selling. However, the overall long/short ratio sits slightly below 1 at 0.93, indicating some bearish prospects in the market.

What’s Next for LTC?

According to its present tech patterns, the price of Litecoin appears ready to gain ground after its recent period of decline. According to Rose signals, a crypto analyst, she highlights that if Litecoin’s price stays above its recent breakout at about $85, the first goal might be $109.38, and a bold target is $121.95.

📊 #Litecoin ( $LTC/USDT) Analysis :

Litecoin is showing signs of a potential reversal after a period of correction:

Price has broken out of a falling channel, bouncing from a strong demand zone (~$85).

Retest of the breakout level and a successful hold could confirm a… pic.twitter.com/MOtXOqRXAp— Rose Premium Signals 🌹 (@VipRoseTr) June 3, 2025

Meanwhile, Litecoin price is moving out of the cup and handle pattern and has positive technical readings, suggesting a likely rally is coming. Key resistance levels like $101.98 and $109.38 should be monitored by investors and traders to watch for continuing bullishness. On the downside, if the bears capitalize on the sell signal from the MACD and the resistance keys prove too strong, the Litecoin price could drop. In such a case, the $85 safety net will be in line to cushion against further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.