Highlights:

- The price of Cardano has increased by 2% to $0.76, as trading volume soars 18%.

- The crypto analyst highlights a potential breakout towards the $1.5 mark.

- ADA market activity and derivatives data call for caution among raiders despite growing interest.

The Cardano price has skyrocketed 2% to $0.76, as trading volume spiked 18% to $865M in the past 24 hours. The daily chart for Cardano (ADA) shows that it could break higher soon. Moreover, Grayscale’s ADA ETF decision is set to take place on May 29. This will also determine ADA price movement in the coming days.

🇺🇸 Grayscale's Cardano $ADA ETF deadline for decision is this week.

The SEC must approve, deny, or delay it by this Thursday, May 29.

Do you think it'll get approval this week? pic.twitter.com/84o9lyLksJ

— Cardanians (CRDN) (@Cardanians_io) May 26, 2025

The daily view of ADA suggests the coin is consolidating inside a symmetrical triangle near $0.76, slightly above the 50-day moving average at $0.70. The 200-day moving average is at $0.82 and is now a major resistance for the ADA bulls.

The RSI for this market stands close to the central 52.9, showing that momentum is well-balanced. At the same time, the MACD oscillator is barely below, indicating that a clearer signal is needed to start a significant movement upwards. Because these technical factors connect, the market appears to stand at a crucial moment, with traders looking for confirmation of an increase when resistance is breached.

Market Activity and Derivatives Data Reflect Growing Interest and Caution

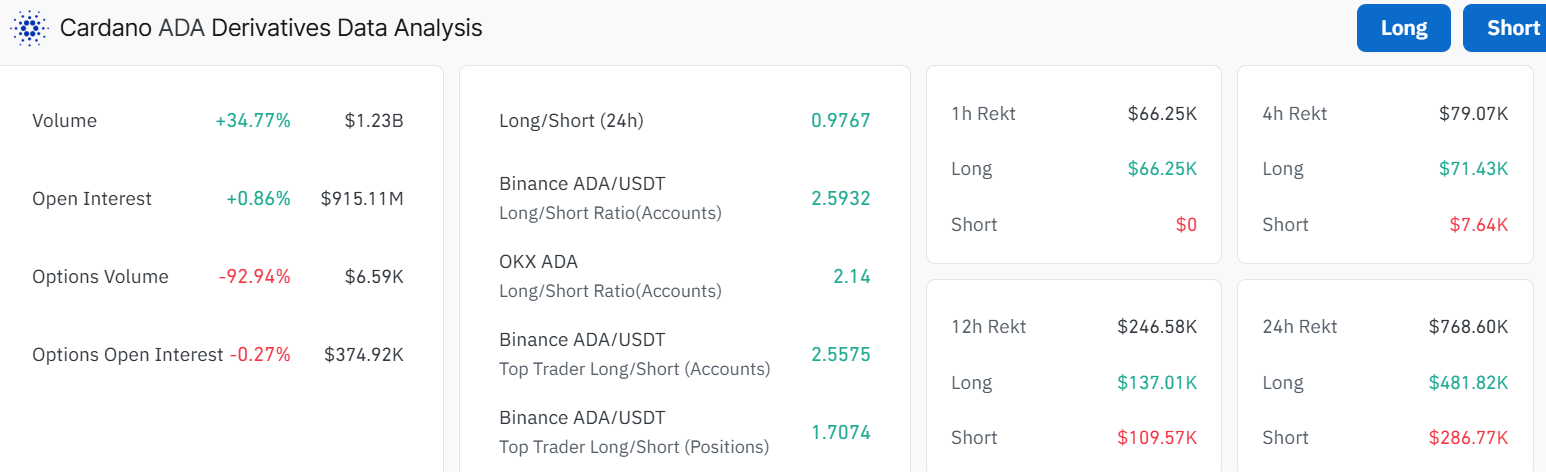

There is a sharp increase in ADA volume, with trade totaling almost $1.23 billion during the last 24 hours, up by 34% from the previous day. The $915 million is what traders now hold in futures contracts, up 0.86% from the past 24 hours. Even so, the drop in options trading reached almost 93%, pointing toward caution.

Trade on the derivatives market reflects some optimism with a little caution. The ratio indicates that there are almost equally long and short positions, however, the tiniest tip is towards short positions. It demonstrates that as the general market is at balance, veteran traders believe opportunities for gains are forming.

More people are engaging in Cardano because liquidity is available, and the number of trades and investments in derivatives has increased. Thanks to these factors, the ADA cryptocurrency could unstuck from consolidation and regain its upward momentum.

Bullish Targets and Market Outlook for Cardano Price

Key analysts predict that ADA prices will rise if it breaks out of its range. Bullish price estimates from Solberg Invest are at $1.3 and $1.5 when ADA manages to break its present resistance levels. As the triangle pattern becomes tighter, a climb above $0.82 could trigger an increase toward the predicted levels.

$ADA Update:

Setting my bull targets for $ADA! 🔥 Looking at $1.3 and $1.5 if we see a strong breakout. 🎯

What’s your $ADA price prediction? 💬 #ADA #CryptoTrading #MarketAnalysis pic.twitter.com/0zOnqeCwqO

— Solberg Invest (@SolbergInvest) May 26, 2025

Even so, traders ought to consider downside risks carefully. If the price does not overcome the $0.81 resistance, the meme coin could revisit the 50-day moving average at $0.70 or even fall to $0.65. RSI and MACD should be monitored to tell traders if the price action in the market is gaining or losing speed.

Signals from the Cardano market show that a breakout is likely after it finishes consolidating. The charts hint that a rise above resistance would start a move to the next targets at $1.3 and $1.5. Increased volume in trading and ongoing interest in derivatives show that more people are joining the market and are confident. While bullish trends are seen among seasoned traders, the entire market is steady and careful. Paying attention to major technical data will help traders identify ADA’s possible future direction.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.