Highlights:

- The price of Solana has surged 2% to $177 in the past 24 hours, despite the 1% drop in trading volume.

- Solana’s active addresses have jumped back to 6 and 7 million, indicating growing network activity.

- SOL technical indicators show mixed signals calling for caution among traders.

Solana (SOL) price has spiked 2% to trade at $177 in the past 24 hours. Meanwhile, its daily trading volume has dropped 1%, indicating a fall in market activity. However, the Solana price has rebounded from the weekend lows of about $169, as President Trump delayed the European Union trade tariffs to July 9. Today, the crypto market, led by Bitcoin price, has reclaimed the $109K mark, sparking bullish sentiment.

Solana Price Technical Outlook

Solana appears to indicate that a bullish breakout could be near. The SOL daily chart shows a typical “cup and handle” pattern and this pattern is believed to suggest rising prices ahead. Solana’s price currently broke above the 50-day moving average at $151 and is now headed toward the 200-day moving average at $181. If the key support level holds and the bulls breaks out of the governing pattern, Solana’s price could be set towards $270.

Based on the Relative Strength Index, there is a positive trend, as it sits above the 50-mean level at 61.01. Besides, the MACD is close to making a bullish crossover, as it still flirts with the positive territory. Expected by technical analysts, including Ali (@ali_charts), is that a breakout from the current stage could begin an even stronger Solana price increase.

— Ali (@ali_charts) May 26, 2025

Active Address Growth Highlights Increasing Network Usage

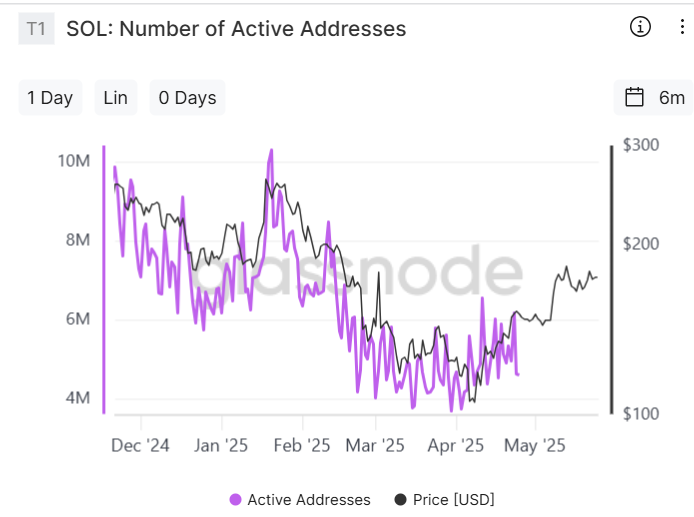

Technically, Solana is moving in a good direction, supported by its network activity. Active addresses, which measure activity on the Solana network, have jumped back since early 2023. After active addresses fell from about 10 million last year to just 4 million in April, the data now shows that number has recovered to between 6 and 7 million addresses.

The increase in user numbers tracks with Solana’s price rise, supporting the belief that more adoption and use are building investors’ confidence. Increasing numbers of active addresses are usually a sign that a larger group of people are interacting with the network, which is good for the overall network and its value.

Market Sentiment and Derivatives Data Reflect Balanced but Optimistic Positioning

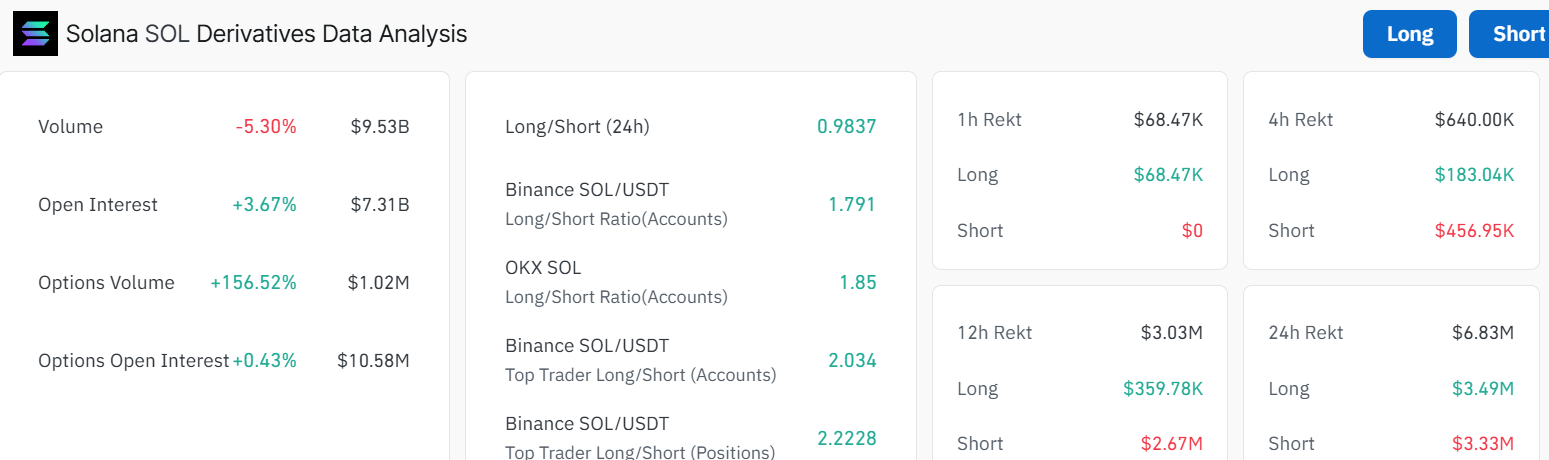

CoinGlass data shows that the derivatives market on Solana helps to understand the current trader mentality. The volume is down 5.3% to $9.53 billion over the past day, but open interest is currently up by 3.67% to $7.31 billion.

Trading options has boosted by more than 150%, which could mean both hedging and betting on market moves are on the rise. Meanwhile, the overall long-to-short ration sits at 0.98 which calls for strength among bulls above 1, to maintain the bullish grip.

What’s Next for Solana Price?

The cup and handle pattern and active addresses on the chart reflect more people are re-entering Solana. At the same time, traders are positioning themselves to benefit, even as volatility continues to rise. If the $151 support level holds steady, the bulls could build momentum, obliterating the immediate resistance level at $181. A close above the $181 mark will open the doors towards further upside, to $$205, $247, and $270.

On the downside, if the $181 resistance proves too strong, the altcoin could drop. In that, the $175 support level will be in line to absorb the potential selling pressure. A breach below this mark will call for furher downside towards $167, $156, and $151 support areas. In the meantime, traders and investors should closely monitor rising trading volume and technical indicators to detect the next move in SOL market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.