Highlights:

- Semler Scientific has invested $50 million in 455 BTC, boosting its treasury holdings to over 4,000 tokens.

- The healthcare firm intensified its Bitcoin investments with over 1,000 BTC purchases in this year’s Q2.

- Semler Scientific stated that the capital for its most recent purchase was from its ATM offering program.

Digital healthcare diagnostic firm Semler Scientific has boosted its Bitcoin (BTC) holdings with new investments worth $50 million for 455 BTC. The company’s chairman, Eric Semler, announced the latest purchase in a May 23 filing. According to the publicized document, the healthcare company paid an average of $109,801 per token and has achieved a 25.8% year-to-date (YTD) profit.

Semler Scientific disclosed:

“Between May 13, 2025, and May 22, 2025, Semler Scientific acquired 455 Bitcoin for $50.0 million with an average purchase price of $109,801 per Bitcoin, inclusive of fees and expenses, using proceeds from its ATM offering program.”

As a result of the purchase, Semler Scientific’s Bitcoin holdings rose to about 4,264 Bitcoin worth roughly $390.0 million at $91,471 per token. As of May 22, Semler Scientific noted that its Bitcoin holdings valuation was approximately $474.4 million, which suggests profits worth roughly $84 million.

Aside from disclosing its latest Bitcoin purchase, the healthcare company reported its shares’ trading and offerings statistics. The firm stated, “As of May 22, 2025, Semler Scientific has issued and sold 3,003,488 shares of its common stock.” In addition, the company noted that proceeds from these sales amounted to about $114.8 million.

$SMLR acquires 455 #Bitcoins for $50 million and has generated BTC Yield of 25.8% YTD. Now holding 4,264 $BTC. Flywheel in motion. 🚀

— Eric Semler (@SemlerEric) May 23, 2025

Semler Scientific Intensifies BTC Buying Spree

Semler Scientific publicized its 2025 first-quarter financial report, which showed the company had 3,192 BTC worth $263.5 million as of March 31, 2025. The investment firm noted that this valuation reflected a cumulative decrease in fair value of $16.9 million. Semler Scientific also noted that during this year’s Q1, it purchased 894 BTC, valued at approximately $90.7 million.

Meanwhile, between the end of Q1 and May 12, the healthcare firm added 616 BTC, valued at roughly $59.6 million. Semler Scientific’s most recent purchase implies that the company accumulated 1,071 BTC between March 31 and May 22, exceeding the entire BTC purchased in this year’s Q1.

$SMLR reports first quarter 2025 financial results and acquires 174 #Bitcoins for $17.8 million and has generated BTC Yield of 22.2% YTD. Now holding 3,808 $BTC. 🚀

— Eric Semler (@SemlerEric) May 13, 2025

Bitcoin Drives Global Crypto Adoption

Like Semler Scientific, several other institutions and individuals have intensified their Bitcoin investments. In one of its most recent news articles, Crypto2Community reported that H100 Group AB bought 4.39 BTC for about $475,000, making it the first publicly listed Swedish Bitcoin Treasury Firm.

According to the company’s X post, the purchase marks the beginning of a long-term strategy to diversify its balance sheet with an innovative asset class. On May 21, Crypto2Community reported that asset management firm Strive wants to increase its Bitcoin holdings by acquiring Mt. GOX distressed 75K BTC at discounted prices.

Strategy and Metaplanet have accumulated significant Bitcoin holdings worth over $800 million this week. Overall, Strategy and Metaplanet BTC holdings have increased to about 576,230 and 7,800 BTC, respectively. Bitcoin ETFs have also recorded profitable spells this month. Currently, the funds are on a seven-day consecutive gains. Meanwhile, in their recent outing on May 22, these ETFs attracted cash inflows worth $934.74 million.

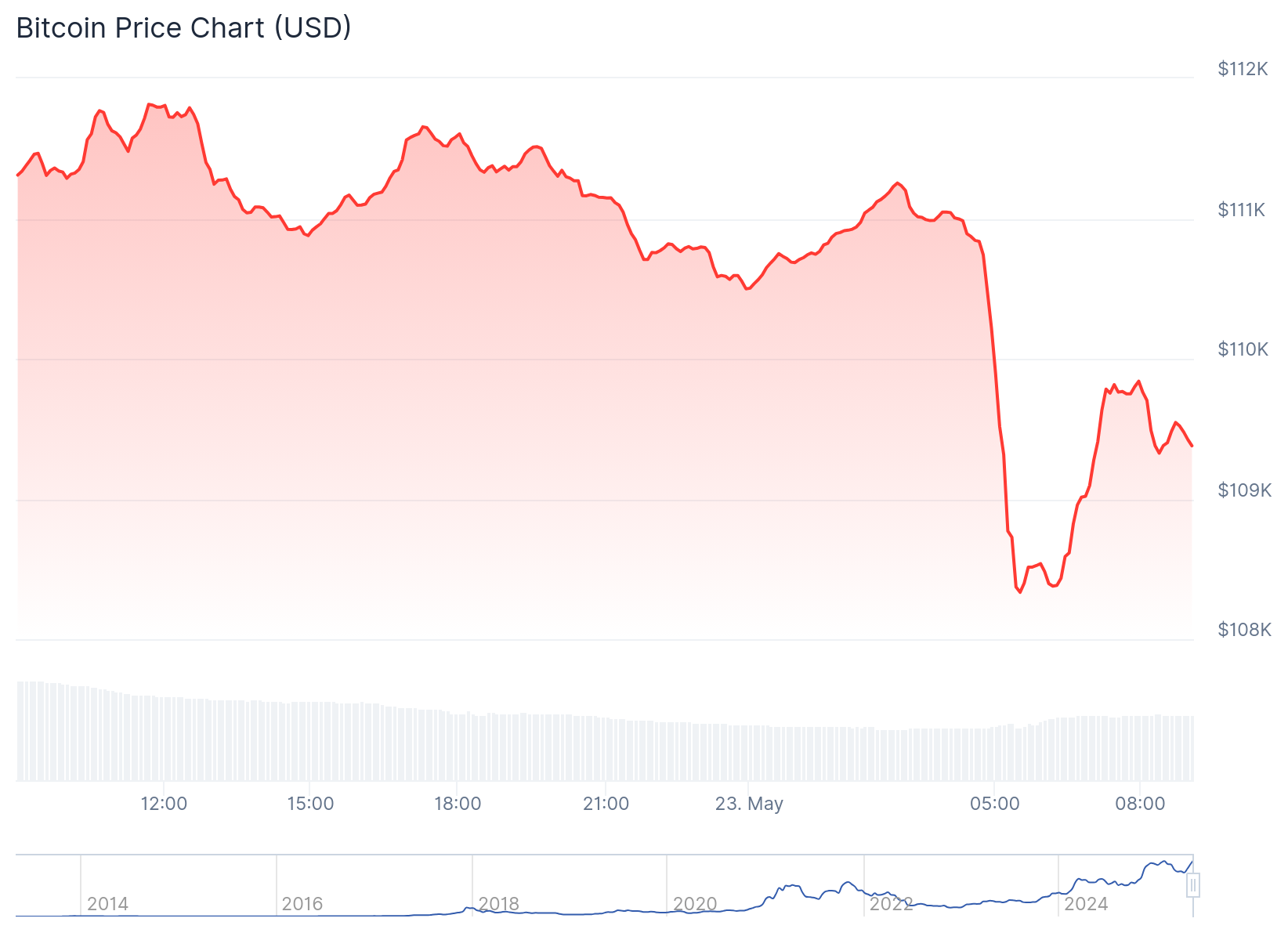

Bitcoin Price Retraces Slightly Below $110,000

Bitcoin broke above $110,000 in the early hours of yesterday to establish its current peak value of $11,814. However, it depreciated 1.8% in the past 24 hours, trading at about $109,300, with a $2.17 trillion market cap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.