Highlights:

- Strategy has added 7,390 BTC to expand its holdings to about 576,230 BTC.

- The American company paid roughly $103,498 for each token.

- Saylor advocates for early Bitcoin investments or risk missing out on the asset.

American-based crypto investment company Strategy has expanded its Bitcoin (BTC) holdings with new investments worth $764.9 million for 7,390 BTC. According to Saylor’s tweet, Strategy paid $103,498 for each token, with a 16.3% Year-to-date (YTD) return.

The co-founder added:

“As of 5/18/2025, we hodl 576,230 BTC acquired for ~$40.18 billion at ~$69,726 per bitcoin.”

Saylor broke the latest purchase news a few hours after he had urged his followers to buy Bitcoin now or risk losing out on the asset forever. In a separate tweet, the co-founder said that the digital gold (BTC) rush will end on January 7, 2035. “Get your Bitcoin before there is no Bitcoin left for you,” Saylor emphasized.

Strategy has acquired 7,390 BTC for ~$764.9 million at ~$103,498 per bitcoin and has achieved BTC Yield of 16.3% YTD 2025. As of 5/18/2025, we hodl 576,230 $BTC acquired for ~$40.18 billion at ~$69,726 per bitcoin. $MSTR $STRK $STRF https://t.co/QwYKgLkfPX

— Michael Saylor (@saylor) May 19, 2025

Strategy Drives Bitcoin Adoption by Influencing Companies to Invest in BTC

Strategy started investing in BTC in 2020, sparking widespread criticisms from critics who believe that Bitcoin lacks sustainable value. However, the company has recorded significant success over the past few years, spiking institutional and investors’ interest in BTC.

Earlier today, Metaplanet, commonly known as Japan’s MicroStrategy (now Strategy), announced the purchase of 1,004 BTC worth roughly $104.3 million. Metaplanet’s Chief Executive Officer (CEO) noted that the company spent $103,873 per BTC and currently holds 7,800, valued at about $712.5 million.

Aside from the purchase, a report showed that the Japanese firm recorded daily volume worth ¥61.69 billion ($425 million), exceeding values from leading firms like SoftBank, Toyota, Nintendo, and Sony Group Corp.

Metaplanet closed Monday as the 9th most liquid publicly traded stock in Japan, with ¥61.69 billion (~$425M) in daily volume, ahead of Toyota, SoftBank, and Nintendo. pic.twitter.com/5hRMY0dIde

— Dylan LeClair (@DylanLeClair_) May 19, 2025

On May 16, Crypto2Community reported that DDC Enterprise, an e-commerce-based outlet, wants to include BTC in its financial treasury. The e-commerce company started its Bitcoin investment with the purchase of 100 BTC, valued at approximately $10.4 million. Per the publication, DCC Enterprise plans to acquire 500 BTC before this year ends.

Norma Chu, DCC Enterprise founder and CEO, stated in a letter addressed to shareholders:

“This initiative underscores our confidence in blockchain technology’s transformative potential and our commitment to pioneering corporate financial strategies.”

In related news, Méliuz, one of the leading fintech companies in Brazil, recently attained a Bitcoin treasury status following shareholders’ approval. On May 15, the Brazilian firm publicized its most recent purchase of 274.52 BTC worth $28.4 million at $ 103,604 per token. As a result of the purchase, the company’s BTC holdings rose to about 320.2 BTC.

Nations’ BTC Interests Soar

Beyond companies, several countries are increasingly showing interest in Bitcoin investments. On May 19, Nayib Bukele, El Salvador’s President, announced that his nation’s BTC holdings yielded about $357 million in unrealized profits as BTC’s price nears $110,000. The president attached a screenshot to his tweet, showing that El Salvador’s Bitcoin stores appreciated by about 300%.

In other news, Saudi Arabia’s Central Bank revealed that it has purchased Strategy shares, sparking mixed reactions among crypto enthusiasts. The bank announced the latest move in a recent 13F filing, showing ownership of 25,656 Strategy shares.

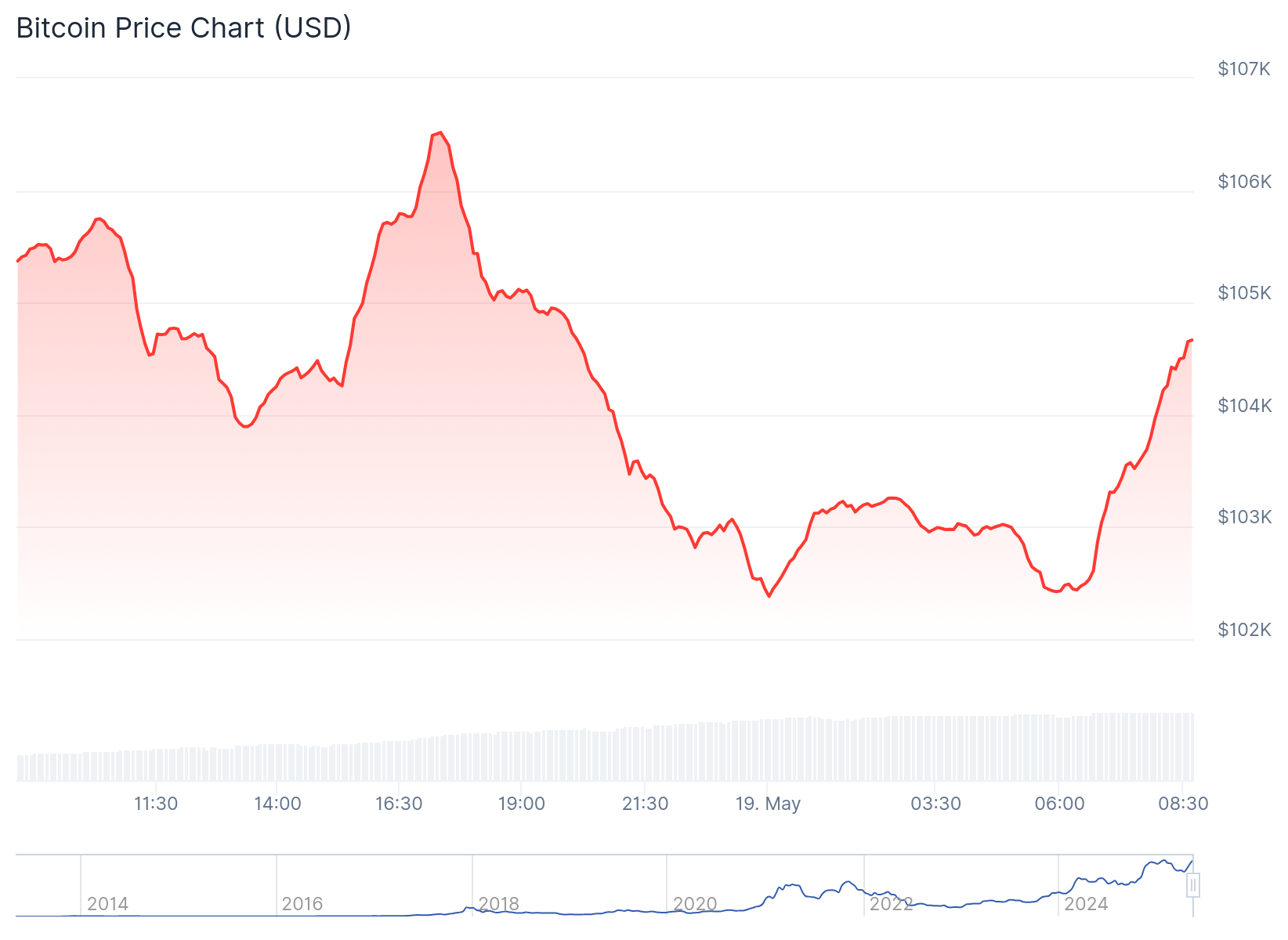

Meanwhile, Bitcoin dropped 0.8% in the past 24 hours, trading at approximately $104,500 and oscillating between $102,381 and $106,518. The slight price decline had minimal impact as BTC’s market cap remained above $2 trillion. In the past 24 hours, BTC’s trading volume surged 79.68% to reach $67.14 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.