Highlights:

- The price of Cardano has decreased by 4% to $0.72 in the past 24 hours.

- A crypto analyst has highlighted that if $0.72 holds, the Cardano price could surge to $0.92.

- ADA technical indicators signal some bearish prospects, calling for the bulls to build momentum.

The Cardo price is down 4.25% to trade at $0.7221, after hitting $0.78 in recent days. The recent downtrend is evident in the crypto market as a whole, led by Bitcoin. Currently, BTC is down 0.76% to $102K. The meme coin market has, however, notably maintained an upward movement, recording a 2% surge to $71.6B in the past 24 hours. Despite the drop, the ADA token is still boasting a 34% rise in trading volume to $1.09B. This is a clear indication of rising market activity in ADA, hence increased investor confidence.

Cardano Price Outlook

The Cardano price daily chart shows that the meme coin is still trading well within the confines of a rising parallel channel. This outlook shows that the bulls are attempting to rise towards higher levels. This is evident as the bulls have flipped the $0.68 mark, which is in line with the 50-day into an immediate support zone.

If the support level holds steady and the crypto market sentiment turns positive, the Cardano price could soar. In such a case, the bulls could target the $0.78 resistance mark. However, for a bullish grip to be validated in the market, the bulls must overcome the $0.80 resistance key, opening the doors for further upside.

On the other hand, Ali Martinez, a popular crypto analyst, has highlighted that with the current structure of an ascending parallel line in ADA, holding above $0.72 could pave the way for an upswing toward $0.92.

If the current structure on #Cardano $ADA is an ascending channel, holding above $0.72 could pave the way for an upswing toward $0.92. pic.twitter.com/vgNNfuudPd

— Ali (@ali_charts) May 18, 2025

A quick look at ADA technical indicators suggests some bearish prospects. To start with, the Relative Strength Index is sitting below the 50-mean level, tilting the odds towards the bears. Its position at 47.9 shows that the bears are somehow in control of the market. Until the RSI crosses the 50-mean level, the bulls should build stamina to dominate the market.

Moreover, the Moving Average Convergence Divergence has made a bearish crossover. This is manifested as the blue MACD line crossing below the orange signal line. This shows that the traders are at liberty to sell their ADA tokens. In such a case, this may cause further downside if the buyers do not step into the market.

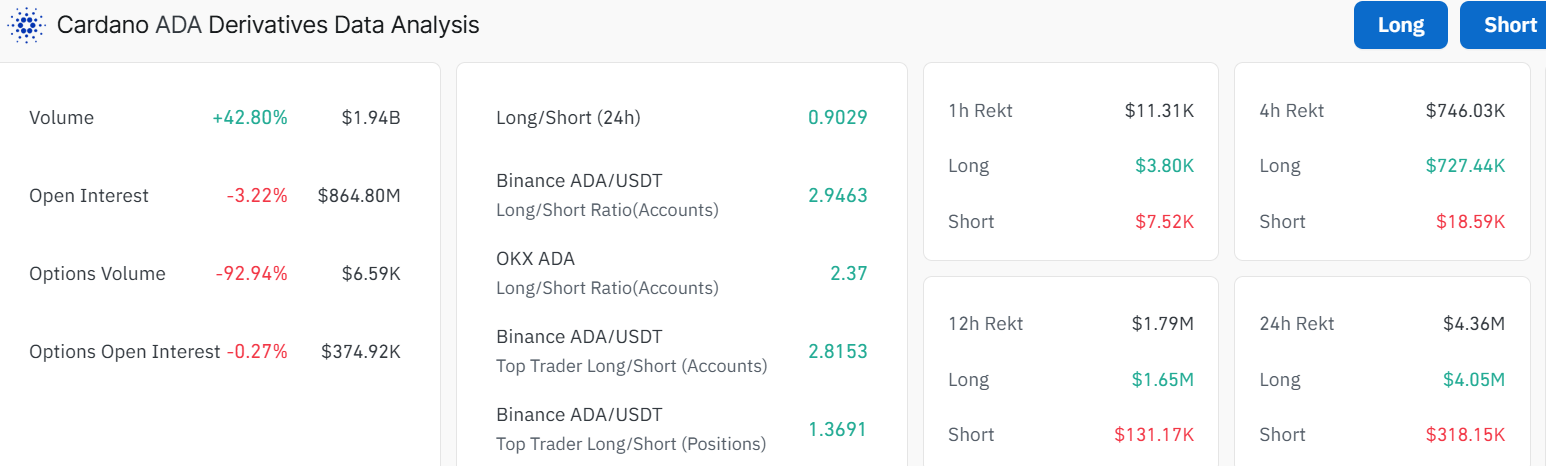

ADA Derivatives Analysis

On the other hand, Coinglass data shows mixed signals in Cardano derivatives data. The ADA volume has soared 42% to $1.94B, indicating intense market activity. However, its open interest has plunged 3.22% to $846.80M, indicating that traders are closing out their position, which may lead to a weakening of the current trend. Additionally, the ADA long-to-short ratio sits at 0.90, slightly below 1. This shows that the bearish momentum is slowly growing in the market if the bulls don’t gain stamina and push past 1.

On the downside, if the bears prove too strong and regain dominance, the Cardano price will drop. In such a case, if the $0.72 area breaks, the ADA price may fall to the $0.68 mark. If this support level gives way, the $0.66 mark will be in line to absorb the selling pressure, tilting the odds towards the bears. In the meantime, traders and investors should closely monitor the technical indicators and rising trading volume to determine the next direction in Cardano price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.