Highlights:

- VanEck registers a trust in Delaware for a Binance Coin ETF application.

- BNB is now the fifth cryptocurrency with its own ETF registration by VanEck.

- The crypto community stays optimistic about BNB’s future despite the price drop.

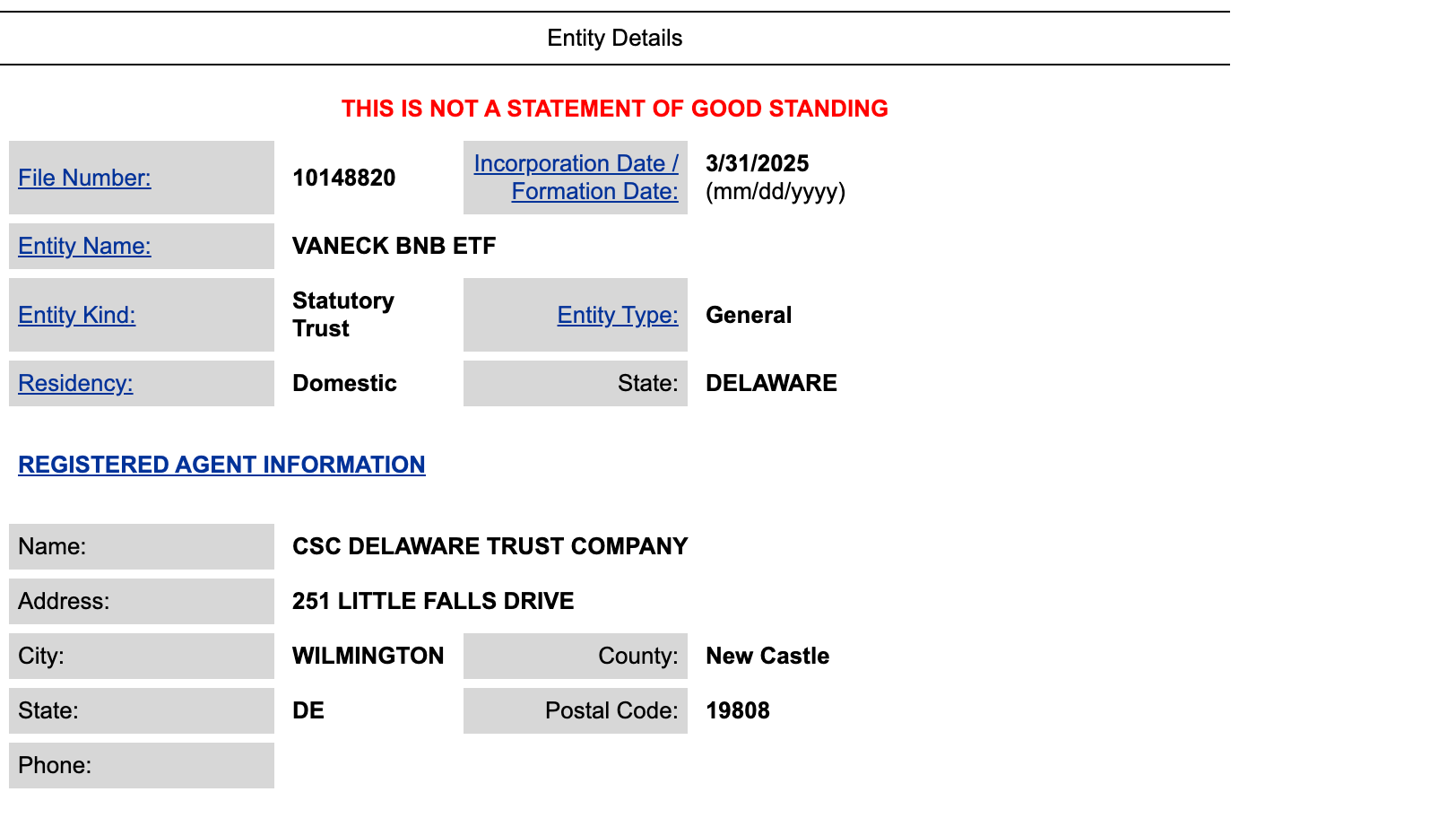

On March 31, VanEck, an asset management firm overseeing approximately $115 billion, registered a statutory trust in Delaware for a Binance Coin (BNB) exchange-traded fund (ETF). Changpeng Zhao, the co-founder and CEO of Binance, shared the announcement on X earlier today. The trust’s establishment is a key step before filing an official ETF application with the Securities and Exchange Commission (SEC). It prepares the groundwork for the launch.

BNB ETF filing by VanEckhttps://t.co/4GuXMDkzCc

— CZ 🔶 BNB (@cz_binance) April 2, 2025

VanEck’s filing is the first attempt to introduce a Binance Coin ETF in the U.S. market. Similar BNB-related products, such as the 21Shares Binance BNB ETP, already exist. However, these products are not U.S.-based ETFs. The proposed BNB ETF will follow BNB’s price movements. BNB is the native cryptocurrency of the BNB Chain ecosystem, which was developed by the cryptocurrency exchange Binance.

VanEck first needs to submit an S-1 registration to the SEC, which provides details about the ETF and starts the review process. After that, an exchange, like Cboe or NYSE Arca, must file a 19b-4 form requesting regulatory approval to list and trade the ETF. These filings are essential steps in the approval process.

VanEck registered a BNB exchange-traded fund in Delaware, marking its fifth crypto asset ETF registration in the state. VanEck’s filing marks the first attempt to launch a Binance Coin (BNB) ETF specifically in the US market. The filing means BNB joins Bitcoin, Ether, Solana, and…

— Wu Blockchain (@WuBlockchain) April 2, 2025

This filing makes BNB the fifth cryptocurrency with its own ETF registration by VanEck in Delaware. Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) are the others. VanEck’s BTC and Ether ETFs launched last year after SEC approval. SoSoValue data indicates VanEck Bitcoin ETF (HODL) had $1.21 billion in locked assets on April 1, with net inflows surpassing $849 million.

BNB Faces Challenges, but Optimism Remains

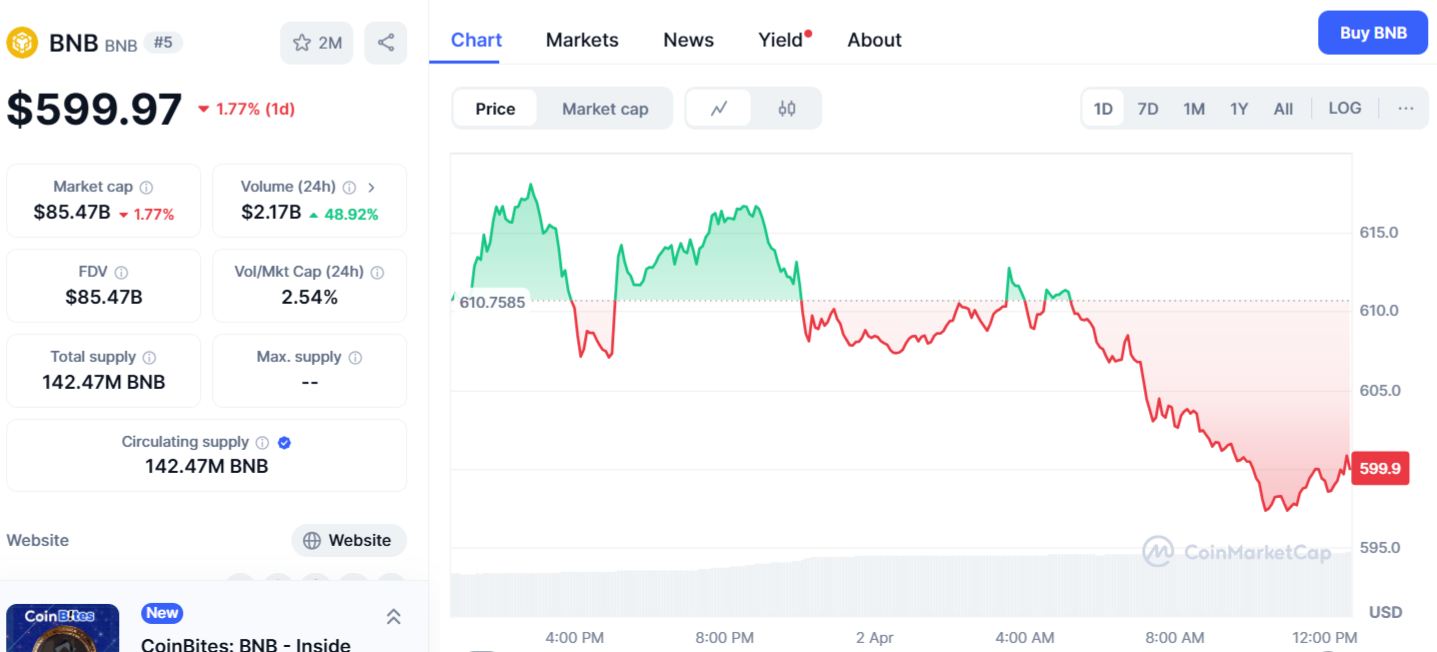

According to the latest data, BNB is the fifth-largest cryptocurrency by market capitalization, valued at $85.47 billion. Despite its strong market position, both BNB’s price and the overall cryptocurrency market have faced challenges recently. In the past month, the value of the altcoin has dropped by 2.2%.

As of writing, BNB is trading at $599. This reflects a 1.77% decline in the last 24 hours, based on data from CoinMarketCap. Meanwhile, BNB Coin’s trading volume has surged by 48.92%, reaching over $2.17 billion following VanEck’s move.

Although the recent development didn’t raise BNB’s price, the crypto community remains optimistic about its future.

🚨 BREAKING 🚨

VanEck just filed for a #BNB ETF.

Send $BNB to the moon now🚀 pic.twitter.com/nueWRfeneu

— Evan Luthra (@EvanLuthra) April 2, 2025

Surge in Cryptocurrency ETF Applications

Following the election of a pro-crypto administration, there has been a notable increase in cryptocurrency fund applications submitted to the U.S. SEC. This surge shows a growing optimism within the investment community regarding the regulatory environment’s shift.

A recent survey indicates that 71% of ETF investors are bullish on cryptocurrencies. They intend to increase their allocations to cryptocurrency ETFs within the next 12 months. This sentiment aligns with the industry’s broader trend toward embracing digital assets.

“Three-quarters of allocators expect to increase their investment in cryptocurrency-focused ETFs over the next 12 months, with demand highest in Asia (80%), and the US (76%), in contrast to Europe (59%),” the survey revealed.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.