Highlights:

- Bitcoin makes a minor rebound as the market eyes liquidity at $90k

- EU tariff pronouncements could trigger another round of selloffs

- Bitcoin is increasingly tracking the NASDAQ, which is bearish

Bitcoin is slightly in the green today, but after several days, it is in the red. At the time of going to press, Bitcoin was up by 0.82% to trade at $82,182. However, this is a small move to conclude that Bitcoin may have finally found the bottom. Besides, volumes have dropped in the day, down by 19% to stand at $47 billion.

This could be an indicator that investors are on the sidelines, waiting for a clearer picture on the macroeconomic front. The intra-day rebound could also be an indicator of a search for volumes bounce.

Technical Analysis – Bitcoin Price In A Rebound as Market Hunts for Liquidity

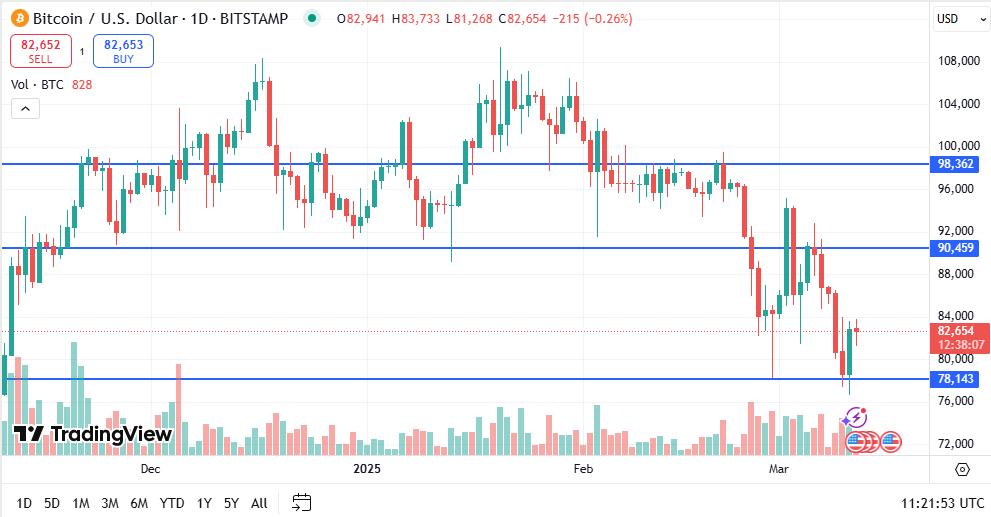

There is a huge wall of short sellers between the $90k and $90,500 price levels. This may explain why, despite the gloomy climate across the financial world, Bitcoin has held on to the $78,143 support pretty well in the last 24 hours.

If the rebound in search for liquidity continues, then Bitcoin could rally to around $90,459 in the short term. This could then be followed by a second wave of selloffs that could easily push Bitcoin to prices as low as $60k in the short term.

However, there is a scenario where the rebound fails, and Bitcoin experiences a sudden crash through the $78,143 support. This could be triggered by a sudden worsening of the global economic environment, which could see a massive dumping of financial assets across the spectrum.

US Taking Trade War A Notch Higher Could Affect Bitcoin

From ongoing events in the global economic landscape, such a scenario is quite plausible. A key factor that could trigger such a rush through support is the US upping its trade war and the kind of countermeasures that other countries could take.

An example of why this can play out is the US’s sudden move to increase tariffs on Canadian aluminum. This saw the markets drop heavily for an hour before the Trump administration announced a pause, which slowed down the selloff. This is not an isolated event, and the emerging countermeasures could lead to more market selloffs.

Donald Trump’s tariffs on imports of metals kicks in. They impose 25% duties on shipments of steel and aluminum. The EU fires back with $28 billion in reciprocal duties https://t.co/rSQnw0fkjd pic.twitter.com/8FwKl9uj9Y

— Reuters Business (@ReutersBiz) March 12, 2025

Today, the EU, one of the US largest trading partners has announced reciprocal tariffs to US tariffs that are coming into effect today. The EU tariffs are meant to match the US tariffs and amount to around $28 billion. If the Trump administration takes this reciprocal move the wrong way and adds more tariffs on the EU, then the markets could crash even further, and that includes Bitcoin.

Interest Rates Likely to Remain High – Bad for Bitcoin Price

Bitcoin could also be pushed lower by expectations that interest rates are likely to remain high for the better part of 2025. This is driven by the fact that inflation is already high, and the entry of tariffs is expected to push it even higher. In the past, Bitcoin thrived in low-interest rate environments.

I have a feeling that the US will go into a recession.

The US has trillions of dollars of debt.

I think Trump is purposely trying to tank everything using these extreme methods so interest rates plummet down.

And they can refinance all their national debts and start to pay… pic.twitter.com/3wF42UUDmr

— Matt Pukas (@mattpukas) March 9, 2025

Low interest rates make it easy to get money that then goes into high-risk assets such as cryptocurrencies. Now that some analysts are forecasting that the US economy could be headed for stagflation, investor interest in high-risk assets could slow down. This could keep the money flow into Bitcoin slow and add to the ongoing selloff.

Bitcoin Increasingly Tracks Stock Indices

To add to the bearish sentiment around Bitcoin is the fact that Bitcoin increasingly tracks stock indices, especially the NASDAQ. Recently, the NASDAQ has been in a selloff driven by the Trump administration.

Interestingly, if you price Bitcoin vs the Nasdaq, we just done a double top verses last cycles ATH pic.twitter.com/j6GxnZ00vr

— Trader Travis 🇦🇺 (@trader_travis) March 12, 2025

With tariffs on European goods coming into effect, the NASDAQ and other stock indices could be going lower in the short term. This could mean that Bitcoin could be headed for a strong selloff since it is moving at a faster pace in the direction of the stock indices.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.