Highlights:

- Trump signed an executive order to create a strategic Bitcoin reserve using seized BTC holdings.

- The government will also establish a Digital Asset Stockpile, including forfeited cryptocurrencies other than Bitcoin.

- Trump’s Bitcoin reserve plan reduces the risk of a BTC ban and may drive global adoption, says Hougan.

In a recent post on X, White House AI and crypto czar David Sacks disclosed that President Donald Trump has officially signed an Executive Order to establish the Strategic Bitcoin Reserve. Sacks stated that the reserve will be funded solely by Bitcoin seized in forfeiture cases. The reserve will contain an estimated 200,000 BTC held by the government, though no full audit exists.

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it…

— David Sacks (@davidsacks47) March 7, 2025

The Executive Order grants authority to the Secretaries of Treasury and Commerce to develop budget-neutral strategies for acquiring additional Bitcoin. This ensures that these acquisitions do not create an extra financial burden on American taxpayers. Trump’s order mandates that the government keep all Bitcoin in the crypto reserve without selling it. This policy ensures that Bitcoin remains a long-term store of value.

David Sacks said:

“The U.S. will not sell any Bitcoin deposited into the Reserve. It will be kept as a store of value. The Reserve is like a digital Fort Knox for the cryptocurrency often called “digital gold.”

Executive Order Creates U.S. Digital Asset Stockpile

In addition to Bitcoin, the Executive Order establishes a U.S. Digital Asset Stockpile. Sacks clarified that the government would not purchase additional cryptocurrencies for the stockpile beyond those acquired through forfeiture proceedings. The Treasury Secretary may also establish strategies for responsible management, including potential sales from the stockpile.

Arkham Intelligence data reveals that the U.S. government holds no XRP, SOL, or ADA among its $18.28 billion in crypto assets. Its largest holding is 198,109 Bitcoin, valued at $17.87 billion. ETH ranks third at $119 million, just behind $122 million in Tether holdings.

The announcement highlights President Trump’s goal of positioning the U.S. as the leading hub for cryptocurrency. His administration has actively supported digital asset innovation and clear regulations.

Earlier Thursday, Sacks voiced his dismay on social media. He noted that the U.S. government’s decision to sell seized Bitcoin over the past decade instead of holding it has cost taxpayers around $17 billion in potential gains.

Over the past decade, the federal government sold approximately 195,000 bitcoin for proceeds of $366 million. If the government had held the bitcoin, it would be worth over $17 billion today. That’s how much it has cost American taxpayers not to have a long-term strategy.

— David Sacks (@davidsacks47) March 6, 2025

The Executive Order arrives just ahead of the first-ever White House Crypto Summit, which is scheduled for Friday afternoon in Washington, D.C. Several crypto executives will attend the summit. Last Sunday, President Trump revealed plans for a U.S. crypto strategic reserve, including XRP, Solana’s SOL, and Cardano’s ADA alongside Bitcoin and Ethereum. Many in the industry questioned the inclusion of XRP and ADA, arguing they lack the developer activity and decentralization found in BTC and ETH.

Trump’s Bitcoin Reserve Plan Lowers Ban Risk and Boosts Adoption, Says Bitwise CIO

Bitwise CIO Matt Hougan stated that Trump’s Bitcoin reserve plan lowers the chances of a future U.S. ban on Bitcoin. He also noted that the move might push other nations to secure Bitcoin reserves early, anticipating possible U.S. purchases. The Bitwise executive added that it limits institutions like the IMF from portraying Bitcoin as risky or unsuitable to hold.

Impacts of the Strategic Bitcoin Reserve

1) Dramatically reduces the likelihood the US government will some day "ban" bitcoin;

2) Dramatically increases the likelihood that other nations will establish strategic bitcoin reserves;

3) Accelerates the speed at which other nations… https://t.co/S8LtFxq4ik

— Matt Hougan (@Matt_Hougan) March 7, 2025

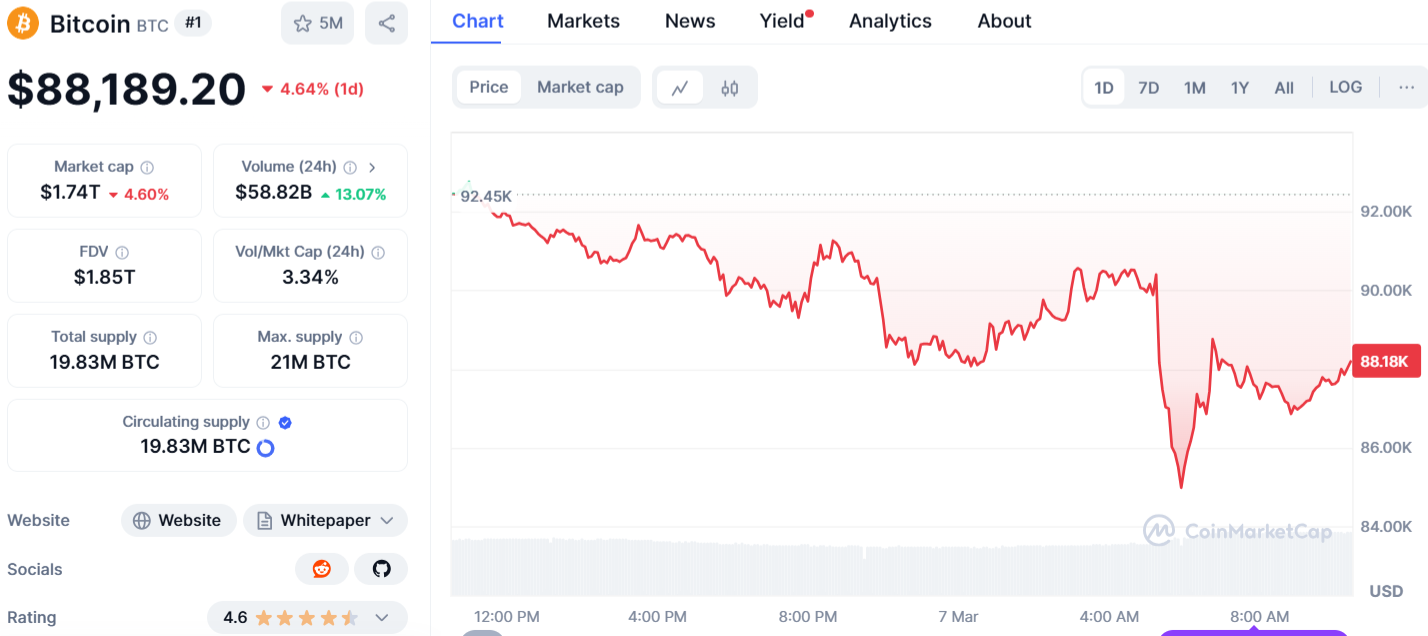

After David Sacks ‘ X post about the executive order, Bitcoin dropped to $85,400 from $90,200 on Thursday night. It later recovered to $88,189, down 4.64% in 24 hours, per CoinMarketCap. Ether fell 6.3% to $2,170.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.