Highlights:

- NYSE Arca has submitted a 19b-4 application requesting Cardano’s ETF application on behalf of Grayscale.

- The application presented to the US SEC added to the growing number of ETFs waiting for the regulatory body’s endorsement.

- A renowned ETF analyst described Cardano’s ETF as the first of its kind in the United States.

Crypto asset management firm Grayscale has expanded its push into regulated crypto assets with a newly submitted 19b-4 application for a Cardano (ADA) Exchange Traded Fund (ETF). The New York Stock Exchange (NYSE) Arca, a subdivision of the larger NYSE Group, presented the latest filing to the US Securities and Exchange Commission (SEC) on behalf of Grayscale.

Reacting to the new development, Eric Balchunas, a senior ETF analyst with Bloomberg, said the 19b-4 ETF application for Cardano was the first in the United States. In addition, he noted that Cardano was the 60th crypto ETF filed in 2025.

Grayscale filed 19b-4 for a spot Cardano ETF. First one in US and ballpark 60th crypto ETF filed this year so far pic.twitter.com/alj7EjtfIS

— Eric Balchunas (@EricBalchunas) February 11, 2025

The surge in crypto ETF filings is linked to the anticipated wave of SEC regulatory rules following its leadership overhaul. The new SEC leadership, headed by acting chairman Mark Uyeda, is keen on establishing a crypto-friendly landscape to boost Americans’ crypto participation.

ETF Application Details

According to a publicized filing document, Grayscale said its Cardano ETF will list under the market ticker symbol GADA. The Trust sponsors include Grayscale Operating, LLC, and Grayscale Investments Sponsors, LLC. For the trustee and custodian, Grayscale mentioned that Delaware Trust Company and Coinbase Custody Trust Company will head both, respectively.

The investment firm also stated:

“The administrator and transfer agent of the Trust is expected to be BNY Mellon Asset Servicing, a division of the Bank of New York Mellon (the “Transfer Agent”). The distribution and marketing agent for the Trust is expected to be Foreside Fund Services, LLC (the “Marketing Agent”).”

Like most ETFs, Cardano’s assets will be mainly ADA. Each share will represent equal interests based on the number of outstanding shares in the Trust’s asset. Grayscale will evaluate value based on an Index Price. In addition, the investment firm will exclude the Trust’s deficits, which include expenses and accrued fees.

By offsetting the Trust’s expenses, the number of ADA in a share will gradually decrease with time. This will not change much about the ETF setup, as sponsors expect share price fluctuations in response to ADA’s market movements.

It is worth noting that the Trust’s activities have limitations, which Grayscale explicitly highlighted in its filing. They include issuing Baskets in exchange for the ADA tokens transferred to the Trust. Others were selling ADA to cover sponsor expenses and exchanging ADA for surrendered Baskets.

GRAYSCALE FILES FOR CARDANO ETF: DETAILS…

– @Grayscale, a leading crypto asset manager, has officially filed for a @Cardano ETF through NYSE Arca.

Key Details:

– On Feb. 10, NYSE Arca filed a proposed rule change to the SEC, aiming to list and trade shares of a Grayscale… https://t.co/4vf9cy7HPK pic.twitter.com/jlvUwxfxcM

— BSCN (@BSCNews) February 11, 2025

Cardano’s Price Reactions to the ETF Filing News

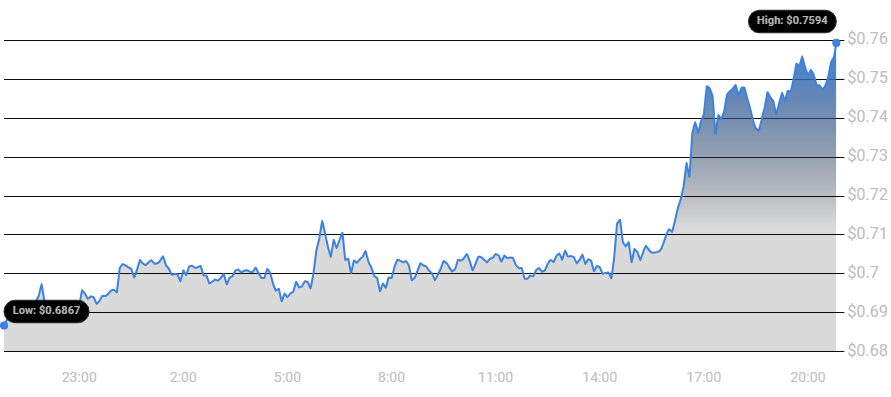

The 19b-4 application should be a positive development that could elicit ADA’s price jump. At the time of press, Cardano is up by 9.63% in the past 24 hours, reflecting $0.7595 in selling price. Within the same timeframe, Cardano has oscillated between $0.6867 and $0.7594 as price extremes.

While its short-term price change data reflected significant upswings, ADA’s other extended period statistics displayed declines, implying that the ETF news could be the positive catalyst for the impressive price actions. For context, Cardano’s 7-day-to-date, 14-day-to-date, and month-to-date saw declines of approximately 4.5%, $19.8%, and 26.1%, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.