Highlights:

- Bitcoin fell below $96,000 after positive US economic reports raised inflation fears.

- The ISM Services PMI increased to 54.1 in December, indicating economic growth and expansion.

- The crypto market dropped with $625 million in liquidations, affecting major digital assets significantly.

Bitcoin price dropped below $96,000 Today, losing the $100,000 mark. At the time of writing, BTC was trading at $95,696, down 6.07% in 24 hours. The drop came after positive US economic reports on Tuesday. These reports sparked fears that inflation might rebound. As a result, it could delay the Federal Reserve’s plans to ease monetary policy.

The ISM Services PMI, which tracks services, orders, backlogs, and business activity, increased to 54.1 in December from 52.1 in November. A reading above 50 signals economic growth, making this a positive indicator for the economy.

Moreover, the JOLTS report revealed that job openings rose to 8.1 million in November, up from 7.8 million in October. A strong job market lowers the chances of rate cuts. Rising interest rates usually hurt riskier assets like Bitcoin by raising borrowing costs and making safer options, like bonds, more attractive.

The data showed a strong economy, pushing 10-year Treasury yields to 4.699%. This was the highest since April 26. Strong data has shifted rate cut expectations. Investors now expect only one 25-basis-point cut this year. The chance of a March rate cut has dropped to 37% from nearly 50% last week.

Cryptocurrencies saw a sharp correction due to plummeting U.S. stocks such as Nvidia and Tesla, with Bitcoin dropping below $100,000 again, and Altcoins dropping even more violently, as market sentiment turned pessimistic.

In terms of options data, short-term IVs rebounded… pic.twitter.com/FJZWgI3Mdn— Greeks.live (@GreeksLive) January 8, 2025

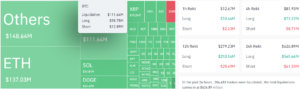

Crypto Market Hit with $625 Million in Liquidations

In response to the data, the crypto market dropped, leading to over $625 million in liquidations, according to Coinglass. Of this, $275 million occurred within just four hours.

The decline affected major digital assets, with Ethereum down 9.53%, XRP falling 5.89%, Solana dropping 9.89%, and Dogecoin slipping 11.44% in the past 24 hours.

The crypto market rose over 11% in the first week of 2025, but the recent drop wiped out nearly half of those gains. Traders are now focused on how President Trump’s pro-crypto stance may influence market sentiment. The effect of possible regulatory changes is still unclear.

Bitcoin Price Rally May Face Setback Ahead of January FOMC Meeting, Analyst

In a report from January 5, Markus Thielen, founder of 10x Research, discussed his Bitcoin outlook for January. He mentioned that Bitcoin’s performance will hinge on inflation data and the Federal Reserve’s actions. Thielen anticipates a strong start to the month, fueled by optimism ahead of the January 15 release of the Consumer Price Index (CPI) data.

He noted that momentum may fade, with the market likely to pull back before the Federal Open Market Committee (FOMC) meeting on January 29. According to the CME FedWatch tool, there’s a 90% likelihood the Federal Reserve will hold its target rate between 425 and 450 basis points.

Our #Bitcoin/Crypto Game Plan for January – This Indicator Signals a BTC Rebound

👇1-12) The crypto trading environment remains mixed following the December FOMC meeting and the subsequent holiday season. However, opportunities for returns persist in specific areas. For… pic.twitter.com/otODXb7GgZ

— 10x Research (@10x_Research) January 5, 2025

Bitcoin price has shown volatility in response to past FOMC decisions. For instance, it fell nearly 15% to $92,800 after the December 18 meeting, when the Fed reduced its forecasted rate cuts from five to two. Thielen anticipates inflation will decline this year, though he expects the Federal Reserve to take time to adjust its policies.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.