Highlights:

- Fidelity Bitcoin ETF records the largest outflow since inception as Bitcoin ETFs succumb to net outflows.

- Bitcoin’s price has remained below $100,000 over the past few days.

- Ethereum ETFs recorded another net inflow to conclude the week profitably.

On December 27, Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded their last outing for the week. After staging a $475.15 million rebound on December 26, the latest data revealed that the commodities have plummeted again, led by Fidelity Bitcoin ETF’s (FBTC) highest-ever outflows since launch.

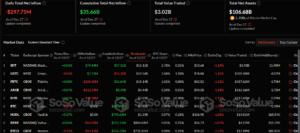

Relaying the latest Bitcoin ETFs market outing, renowned on-chain ETF tracker SosoValue noted that the commodities suffered losses valued at $297.75 million. FBTC contributed losses of about $208.20 million as BTC ETFs concluded the week with net losses worth roughly $387.54 million.

The latest setback implies that market participants’ hopes for a possible turnaround in BTC’s price fortune have become shaky, eliciting price decline concerns. Bitcoin might remain below $100,000 for an extended period if nothing happens to swing events in the token’s favor.

Bitcoin spot ETFs had a total net outflow of $298 million on December 27. Fidelity Bitcoin ETF FBTC had the largest single-day net outflow since its launch, at $208 million. BlackRock ETF IBIT still had a single-day net inflow of $79.4378 million. https://t.co/59u0BnEqLG pic.twitter.com/fdz0eQnsNl

— Wu Blockchain (@WuBlockchain) December 28, 2024

How Other Bitcoin ETFs Fared

December 27 was a busy market outing for Bitcoin ETFs with seven active commodities. However, only two entities attracted cash inflows, contributing to BTC ETFs’ recent woes. The profitable commodities include BlackRock Bitcoin ETF (IBIT) and Grayscale Bitcoin ETF (GBTC). They attracted $79.44 million and $3.75 million, respectively.

Another notable entity with losses above $100 million was ARK 21Shares Bitcoin ETF (ARKB) after forfeiting about $112.59 million in cash outflows. Other ETFs that recorded outflows were Bitwise Bitcoin ETF (BITB), Invesco Bitcoin ETF (BTCO), and Valkyrie Bitcoin ETF (BRRR). They forfeited $35.98 million, $14.15 million, and $10.02 million, respectively. Following the fresh net outflows, Bitcoin ETFs’ cumulative net inflows dropped from $35.96 billion to $35.66 billion. The total value traded was approximately $3.02 billion, while the total net assets reflected $106.68 billion. The net assets valuation represents 5.7% of Bitcoin’s market capitalization.

Bitcoin’s Price Reaction Following Recent ETF Setback

At the time of writing, Bitcoin is changing hands at about $94,500, reflecting a 1.7% decline in the past 24 hours. In a weekly timeframe price change variable, BTC’s price has depleted by 2.9%, with minimum and maximum price levels fluctuating between $92,628.82 and $99,344.95.

The above price extremes imply that Bitcoin has failed to reclaim $100,000 in the past seven days. Moreover, BTC’s 14-day-to-date and month-to-date statistics also depreciated by roughly 6.6% and 0.9%, respectively.

Meanwhile, following the recent price struggles, BTC’s market capitalization dropped to $1.87 trillion. Similarly, its 24-hour trading volume plummeted by about 19.82% to worth roughly $37.87 billion.

Ethereum ETFs Concluded the Week Profitably

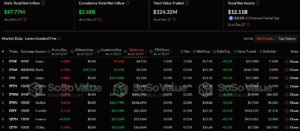

Unlike Bitcoin, Ethereum (ETH) ETFs recorded only gains between December 23 and 27. Consequently, the commodities concluded the week profitably with about $349.17 million in net profits. For its most recent market outing, SosoValue reported that the entities attracted approximately $47.77 million in cash inflows.

Ethereum spot ETF had a total net inflow of $47.7712 million on December 27, with net inflows continuing for 4 consecutive days. Fidelity ETF FETH had a net inflow of $27.543 million per day. https://t.co/Tvs2oCSxTg pic.twitter.com/utYH4WzbPZ

— Wu Blockchain (@WuBlockchain) December 28, 2024

The profitable input on December 27 happened because of two Ethereum ETFs’ gainful contributions. Fidelity Ethereum ETF (FETH) and BlackRock Bitcoin ETF (ETHA) attracted the only cash inflows, with about $27.54 million and $20.23 million, respectively. The remaining seven ETH ETFs attracted zero flows.

With the recent positive contribution, ETH ETFs cumulative net inflow soared from $2.33 billion to $2.68 billion. The total value traded was approximately $1.47 billion, while the total net assets reflected $12.11 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.