Highlights:

- Chainlink whales capitalized on the token’s recent decline to scoop 3.58 million LINK tokens.

- Reporting the LINK buying sprees, Santiment quoted the Age Consumer metric to back its claims.

- Citing his analysis findings, Ali Martinez warned that LINK could still suffer more declines.

In one of its most recent tweets, market intelligence firm Santiment reported a new trend involving Chainlink (LINK) whales. According to Santiment, the large investors are capitalizing on the recent dip to amass significant LINK stores. The on-chain intelligence firm described whales as investors holding one to ten million LINK tokens.

The market intelligence firm added that the latest buying sprees saw Chainlink whales accumulate 3.58 million tokens valued at approximately $76.9 million within three days. Describing Chainlink’s declining state, Santiment stated: “Chainlink has retraced in the second half of December as the vast majority of crypto has.”

In its shared chart, the on-chain market analytical outlet noted that it spotted Age Consumed spikes on two LINK dips. In crypto, the Age Consumed metric measures how frequently dormant coins move within the blockchain. Therefore, a spike in the variable highlighted by Santiment implies dip buying from previously dormant addresses.

🔗🐳Chainlink has retraced in the second half of December, like the vast majority of crypto has. Interestingly, though, their key active whales that hold between 1M-10M LINK have accumulated 3.58M coins (worth $76.9M) in just the past 3 days. 👀 pic.twitter.com/6JlDtPUqb2

— Santiment (@santimentfeed) December 28, 2024

Moreover, in a separate tweet, Ali Martinez, a renowned crypto market chartist, corroborated Santiment’s claims. According to Martinez’s X post, the past 48 hours witnessed over 2.7 million LINK purchases. While his timeframe might seem a day less, one could assert that he invariably communicated a trend similar to what Santiment shared with its X followers.

Whales bought over 2.70 million #Chainlink $LINK in the past 48 hours! pic.twitter.com/kBJLLhzBvh

— Ali (@ali_charts) December 27, 2024

LINK’s Recent Market Struggles Persist with Marked Price Declines

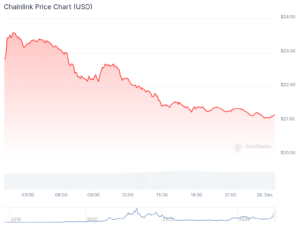

After spiking considerably to hit as high as $30 around the second week of this month, Market participants thought that LINK was on the verge of reclaiming its $52.70 peak price, which it attained in May 2021. However, the reverse has remained the case. LINK has continued to plummet and could drop below $20 if nothing drastic happens to salvage the situation.

At the time of press, Chainlink is changing hands at approximately $21.29, reflecting a 7.1% decline in the past 24 hours. Aside from its month-to-date price-change data, with a 17.4% upswing, other extended period variables reflected declines. For context, LINK’s 7-day-to-date and 14-day-to-date displayed price drops of about 9.1% and 27.6%, respectively.

Meanwhile, Chainlink ranks as the fifteenth most valuable cryptocurrency on CoinGecko, with about $13.488 billion in market capitalization. Despite its declining state, LINK’s 24-hour trading volume is up by about 14.05% and boasts roughly $806.47 million in valuation.

In a tweet, Ali Martinez warned that Chainlink could suffer further declines. He envisages a further price slump that would plummet the token as low as $14.

#Chainlink $LINK could go as low as $14 if this head-and-shoulders pattern is confirmed! pic.twitter.com/86uhsV4UQ9

— Ali (@ali_charts) December 26, 2024

LINK Boasts Significant Profitable Holders Pool Despite the Price Drops

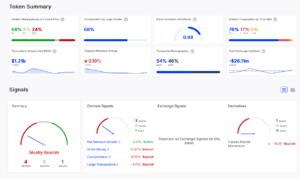

According to IntoTheBlock’s Chainlink statistical summary, 68% of the token holders are profitable at their current price. 8% are neither gaining nor losing, while 24% are accumulating losses. Meanwhile, LINK concentration by large holders reflected 68%, highlighting a whale-dominated investor pool.

In the past seven days, transactions greater than $100K reflected approximately $1.2 billion, which signifies an active network. For holders’ composition by time held, 78% have held on to the token for over a year. 17% have owned the token between a month and a year, and 5% have held on to the token for less than a month.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.