Highlights:

- Solana’s price has decreased 15% to trade at $176 as bearish momentum bolsters.

- Despite the drop, its daily trading volume has soared 51% to $10.27 B, signaling renewed investor interest.

- With the altcoin oversold, the bulls may initiate a buy-back campaign, which could result in a rebound to the $234 mark.

The Solana price has dropped 15% to trade at $176 as the crypto market experiences a market-wide sell-off. Despite the plunge, its daily trading volume has surged 51% to $10.27 billion, showing increased investor confidence. Moreover, with the altcoin in the oversold region, the bulls would buy the dip resulting in a rebound.

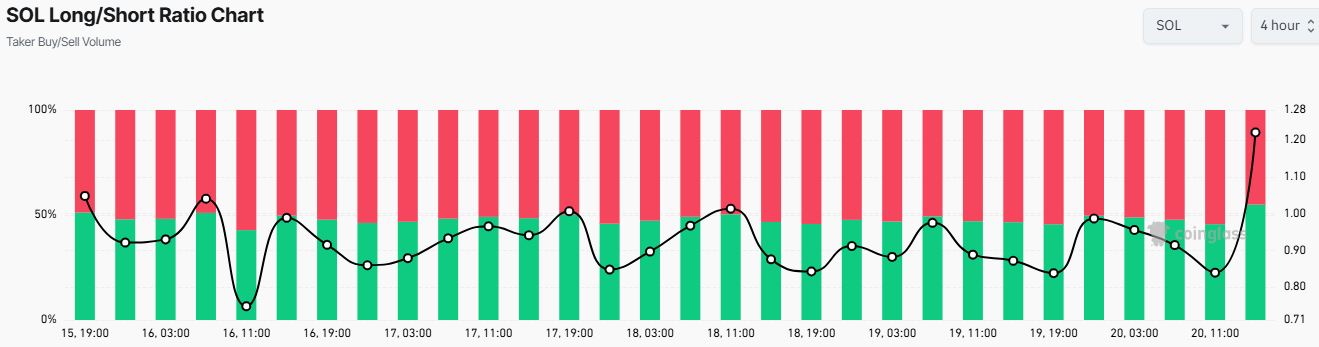

Although the Solana market paints a bearish picture, the Long/short positions suggest some cautious optimism. In a 4-hour outlook, SOL’s long/short ratio showed 54.97% long positions versus 45.03% short, suggesting rekindling investor interest.

However, despite the bearish lean, SOL has displayed resilience, with buyers gradually gaining control. If the buyers gain momentum at this level, the odds could shift towards the buyers as they extrapolate the gains above the $234 mark.

Solana Statistical Data

Based on CoinmarketCap data:

- SOL price now – $176

- Trading volume (24h) – $10.27 billion

- Market cap – $84.53 billion

- Total supply – 590.51 million

- Circulating supply – 479.25 million

- SOL ranking – #6

Solana Technical Indicators Signal Waning Bullish Momentum

The cryptocurrency market is experiencing a downturn, with BTC falling below $96,000. This decline has notably affected Bitcoin and ETH ETFs, which have seen outflows after a prolonged period of positive growth. Solana price is also not an exception, as it has declined 15% to $176, forming a double-bottom pattern. Basically, this technical pattern suggests a bullish reversal in most instances.

However, looking at the technical outlook, the Death Cross in the 4-hour chart timeframe suggests that the bears are leaving no stone unturned. They have breached below the $232 and $216 support levels, dwindling the price like a dead weight in the air, with no strong guards to keep the bullish sentiments in check.

The RSI notably reinforces a bearish grip as it has plunged to the undervalued region. Currently at 19.83, suggests intense selling pressure in the Solana market. Meanwhile, the Bulls might initiate a buy-back campaign at this level, resulting in a rebound.

Traders should watch how Solana’s price reacts to this potential floor price. An immediate rebound would bring the altcoin closer to the double-bottom breakout, which cannot be validated until the price exceeds the neckline resistance. The double-bottom breakout would be accompanied by increasing trading volume. Therefore, buy orders should be placed slightly above the neckline.

However, it is worth mentioning that the momentum indicator—the Moving Average Convergence Divergence (MACD)—warns that bulls don’t have the reins yet and that dips could still occur before the Solana price begins to reverse the trend. The indicator will flip bullish, with the blue MACD line crossing above the signal line while trending upwards to positive territory.

Will Solana Price Rebound to $234?

The Solana price is flashing bearish as the crypto market is experiencing a market-wide correction. However, with the altcoin oversold and the double-bottom pattern in place, the bulls could gain momentum and rebound above the $200 mark. Solana’s price is expected to climb 37%, which targets the pattens neckline. In such a case, the Bulls would take the reins, hitting the $234 mark.

In a highly bullish case, Solana’s price would climb to $247 or above. As for whether Solana can hit $300 will depend on how aggressive the next bull run will be. On the flip side, if the bears keep dominating the market, the Solana price will fall through. In such a case, the $154 support level will cushion against further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.