Highlights:

- Bitcoin and Ethereum ETFs have surged significantly to sustain their remarkable runs.

- Bitcoin ETFs attracted over $200 million to extend its profitable days to ten consecutive outings.

- Ethereum ETFs recorded over $100 million, prolonging its gainful streak to thirteen days.

On December 11, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) continued their impressive runs, mirroring the generalized market rally. Bitcoin ETFs extended their remarkable market actions to 10 consecutive days, while the Ethereum commodities recorded 13 days of attracting cash inflows.

On December 11, the total net inflow of Bitcoin spot ETFs was $223 million, and the net inflow continued for 10 consecutive days. The Bitcoin spot ETF with the largest net inflow in a single day yesterday was Fidelity ETF FBTC, with a net inflow of $122 million in a single day.… pic.twitter.com/8e8Pap25cj

— Wu Blockchain (@WuBlockchain) December 12, 2024

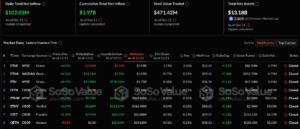

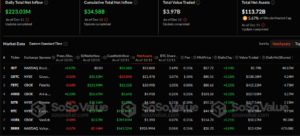

According to the renowned ETF on-chain tracker SosoValue, BTC ETFs witnessed roughly $223.03 million in gainful contributions. Similarly, the ETH commodities recorded approximately $102.03 million in net inflows. After underperforming significantly during most of its early days, Ethereum ETFs’ recent demand spikes imply that individuals and institutional investors have embraced the prospect of the offerings.

Ethereum spot ETF had a total net inflow of $102 million on December 11, continuing its net inflow for 13 consecutive days. BlackRock ETF ETHA had a single-day net inflow of $74.1591 million. https://t.co/Tvs2oCSxTg pic.twitter.com/C6bnbBPGXT

— Wu Blockchain (@WuBlockchain) December 12, 2024

ETH ETFs Cumulative Net Inflows Near $2 Billion, with the Fresh Profitable Inputs

Per the on-chain ETF tracker, six commodities contributed to Ethereum ETFs’ latest outing. The remaining three, including Fidelity Ethereum ETF (FETH), Invesco Ethereum ETF (QETH), and 21Shares Ethereum ETF (CETH), recorded zero activities. Five attracted gains among the active entities, while only Grayscale Ethereum ETF (ETHE) witnessed about $2.26 million in net outflows.

In gains, two commodities topped the chart with over $10 million in profitable inputs. They include BlackRock Ethereum ETF (ETHA) and Grayscale Mini Ethereum ETF (ETH), with about $74.16 million and $13.38 million, respectively. Other gainful entities include Bitwise Ethereum ETF (ETHW) ($8.23 million), VanEck Ethereum ETF (ETHV) ($5.60 million), and Franklin Ethereum ETF (EZET) ($2.91 million).

With the latest inputs, Ethereum ETF cumulative net inflows soared from about $1.87 billion to $1.97 billion. The total value traded was approximately $471.42 million, while the total net assets jumped to about $13.18 billion. It is worth noting that the valuation of the net assets represents 2.86% of Ethereum’s $472.96 billion market capitalization.

Fidelity Bitcoin ETF Leads Bitcoin ETFs Surge

In their most recent outing, seven commodities witnessed activities, with six profitable entries and one that attracted cash outflows. Valkyrie Bitcoin ETF (BRRR) witnessed the only losses valued at about $2.44 million. On the other hand, gainful inputs worth over $100 million came from Fidelity Bitcoin ETF (FBTC) ($121.90 million.

Other profitable Bitcoin ETFs include four entities with over $10 million contributions and VanEck Bitcoin ETF (HODL) with only $2.87 million input. Notedly, ARK 21Shares Bitcoin ETF (ARKB), Grayscale Bitcoin ETF (GBTC), Grayscale Mini Bitcoin ETF (BTC), and Bitwise Bitcoin ETF (BITB) all attracted profits of about $52.67 million, $20.13 million, $15.74 million, and $12.16 million, respectively.

Following the significant gains from the latest outing, Bitcoin ETF’s cumulative net inflows have continued to soar. It is now worth roughly $34.58 billion. Similarly, the total value traded and net assets have spiked to about $3.97 billion and $113.72 billion, respectively. The total net assets worth represents 5.67% of Bitcoin’s $1.99 billion.

Bitcoin and Ethereum Prices Record Considerable Spikes

At the time of writing, Bitcoin is changing hands at about $100,700, reflecting a 3.3% upswing in the past 24 hours. Within the same time frame, BTC has fluctuated between $97,314.50 – $101,961, underscoring a remarkable recovery within the short timeframe.

On the other hand, Ethereum is up by about 7.3% in the past 24 hours, boasting approximately $3,900 in selling price. The world’s most valuable altcoin is on the verge of reclaiming $4,000 for the second time this month. Despite its impressive market actions, Ethereum’s 24-hour trading volume is down by about 27.91%, with a $36.9 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.