Highlights:

- Bhutan transferred 406 BTC to QCP Capital, continuing a trend of selling BTC during the recent price surge.

- The country still holds 11,688 BTC ($1.15 billion) and remains the fourth-largest government holder of Bitcoin.

- BTC faces strong resistance at $100K amid heavy selling by long-term holders and strong institutional buying

According to on-chain data analysis provided by Arkham Intelligence, the Royal Government of Bhutan transferred 406 BTC, valued at approximately $40 million, to QCPCapital. The transfer has sparked speculation, with many thinking it could be a selling move. In the past two months, the Bhutan government has been gradually selling its stake during the Bitcoin price surge, particularly following Donald Trump’s victory.

Bhutan moved through four separate transactions to QCP Capital. After these transfers, the govt’s wallet made another major transfer. According to data, the wallet moved 103 BTC ($10.14 million) to a new wallet, “bc1qwug,” by 11:54 (UTC) on the same day. The wallet held the tokens for nearly two hours before transferring 100 BTC ($9.81 million) to the Binance Hot wallet.

Just In: Royal Government of Bhutan has sent 406.074 $BTC worth $40M to #QCP Capital.https://t.co/q4dW3qJBT5 pic.twitter.com/3TK1fvBoOk

— Onchain Lens (@OnchainLens) December 9, 2024

Bhutan Government’s Bitcoin Holdings and Recent Sales

The Government of Bhutan now holds 11,688 BTC, worth $1.15 billion. It is the fourth-largest government holder of Bitcoin and the largest holder, not counting confiscated government assets.

As of the current Bitcoin price, Bhutan’s BTC holdings are worth about $1.164 billion. Notably, the country has become a hub for BTC miners, with the government acquiring most of its BTC through hydro-powered mining operations. Since Bitcoin’s price surge in late October, the Royal Government of Bhutan has sold 1,696 BTC, worth around $139 million. The sales were made at an average price of $81,999 per Bitcoin. These transactions were carried out through Binance and QCP Capital.

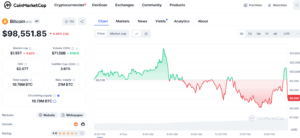

The sales happened during a broader market correction, with Bitcoin and other assets falling. Bitcoin is down nearly 2% in the last 24 hours, trading below the $100,000 mark. However, Bitcoin has risen 1.71% in the past seven days and 29% in the past 30 days. At the time of writing, Bitcoin is priced at $98,551 with a market cap of $1.95 trillion.

Bitcoin Price Faces Resistance Amid Heavy Selling and Strong Institutional Buying

Bitcoin price faces strong resistance at the $100K level due to heavy selling by long-term holders. Over the past 30 days, they sold more than 827,000 BTC. Institutional players like MicroStrategy and Bitcoin ETFs are actively buying, but selling pressure remains high.

Institutional players have been buying Bitcoin aggressively, with large inflows into spot Bitcoin ETFs. According to crypto analyst Maartunn, MicroStrategy purchased 149,880 BTC in the last 30 days. Additionally, spot Bitcoin ETFs saw total inflows of 84,193 BTC during this period. However, these combined inflows are still significantly smaller than the total sell-off by long-term holders.

Last week, spot Bitcoin ETFs saw record weekly inflows of $2.73 billion, the highest since their launch. BlackRock’s Bitcoin ETF, IBIT, accounted for $2.6 billion of this, crossing $50 billion in assets under management (AUM).

Short-term holders, mainly retail investors, are absorbing much of the supply. Retail activity extends to derivatives, with altcoin open interest at $53.3 billion and Bitcoin at $30.6 billion. This strong retail presence creates a risky “musical chairs” dynamic, prompting caution during sentiment shifts, said Maartunn.

🚨Long-Term Holders sold 827,783 BTC in 30 days.

This is one of the bearish on-chain signals behind this BOLT statement.

A thread on more key signals behind this claim📉👇 https://t.co/C2M9CHM83c pic.twitter.com/NgIBf8i3Vm

— Maartunn (@JA_Maartun) December 8, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.