Highlights:

- Trump’s pro-crypto appointments, including SEC’s Paul Atkins, boost Bitcoin’s rally and market optimism.

- Bitcoin’s halving cycle reduces supply, driving price increase amid steady or growing demand.

- Institutional investment surged after ETF approvals, with BlackRock’s Bitcoin ETF reaching $50 billion.

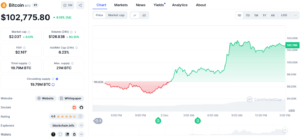

Bitcoin (BTC) has broken through the much-awaited $100K milestone, reaching a new all-time (ATH) high of $104,000 at 3:08 am UTC — about 90 minutes after hitting the $100K mark, as per TradingView. The rally followed the Republican victory, signalling the end of Biden’s crypto crackdown. Here are the key factors driving Bitcoin’s surge and market optimism.

Trump’s Pro-Crypto Appointments Spark Bitcoin Price Rally and Market Optimism

On December 4, Donald Trump declared that US SEC Commissioner Paul Atkins will replace Gary Gensler as the next SEC Chair. Atkins’ pro-crypto stance has fueled a strong Bitcoin rally and boosted optimism about pro-crypto policies coming to the US soon.

Trump praised Atkins’ accomplishments in a Truth Social post, emphasizing his support for digital assets. Moreover, Ripple CEO Brad Garlinghouse and Senator Cynthia Lumis praised the development, calling it a big win for crypto. Garlinghouse stated that Atkins would restore “common sense” to the agency.

💥 JUST IN: 🇺🇸 President-elect Trump officially selects pro-crypto Paul Atkins to replace Gary Gensler as SEC Chair.#CryptoNews #Bullrun pic.twitter.com/wplMtyEIhI

— Amonyx (@amonbuy) December 4, 2024

The rest of the administration is becoming the most pro-crypto ever. Trump also nominated Scott Bessent, founder of Key Square Capital, as Secretary of Treasury. Bessent expressed excitement about the President’s support for crypto and said, “everything is on the table with Bitcoin.” Trump also appointed Howard Lutnik as Commerce Secretary. Lutnik is CEO of Cantor Fitzgerald, which manages USDT’s backing.

The Bitcoin Halving Cycle

Bitcoin has a fixed supply of 21 million coins, with over 90% already mined. Every four years, the mining reward is halved, decreasing the supply. The most recent halving in April reduced the reward to 3.125 BTC per block. This reduced supply, coupled with steady or growing demand, can drive Bitcoin’s price up.

Crypto traders analyze past trends to predict Bitcoin’s price. Halving events show a clear pattern. A slight bull run typically begins a year before the halving. Then, a bigger surge happens the year after. However, past trends don’t always guarantee future results.

Halving events are crucial in shaping the crypto cycle, and we're just about 70 days away from the next #BITCOIN halving. It's the perfect time to delve into the past and present to forecast what might be on the horizon.

Understanding the impact of halvings is critical. Each… pic.twitter.com/ewaWlY9XgD

— MANDO CT (@XMaximist) February 3, 2024

Putin Voices Strong Support for Bitcoin, Citing its Growth and Unstoppable Nature

Bitcoin’s price rally continues as global support for the asset grows. During a speech at the Russia Calling Investment Forum in Moscow, Russian President Vladimir Putin expressed strong backing for Bitcoin and digital assets. He stated that BTC cannot be banned and that these technologies will keep evolving.

Putin added:

“Because these are new technologies and no matter what happens to the dollar, these tools will develop one way or another because everyone will strive to reduce costs and increase reliability.”

BREAKING: 🇷🇺 Russian President Putin says "Who can ban #Bitcoin? Nobody." pic.twitter.com/6mJ664BZZ8

— Bitcoin Magazine (@BitcoinMagazine) December 4, 2024

Institutions Rush into Bitcoin Following ETF Approvals

Institutions are entering Bitcoin after ETF approvals. Retail investors drove the 2017 rally, while the 2021 rally saw some big firms join in. However, institutions were hesitant due to compliance and regulations. This changed when the SEC approved spot BTC ETFs on January 10 this year. This year, institutional crypto investment surged, benefiting Bitcoin ETFs. Stocks of crypto-related companies such as Coinbase and MicroStrategy have hit new trading volume highs. Even spot Ether ETFs, which initially underperformed, are now showing signs of positive momentum.

Recently, BlackRock’s iShares Bitcoin Trust ETF (IBIT) hit $50 billion in assets under management within just 228 days. This rapid growth is unprecedented, with the next fastest ETF taking over five times longer. The milestone showcases strong demand for Bitcoin and IBIT’s market position.

$IBIT is now over $50b. It took it 228 days to reach this milestone, the next fastest ETF to reach 50b was $IEFA in 1,329 days. So over 5x faster than any ETF ever launched. Ridiculous. h/t @JackiWang17 for the data https://t.co/K9vRfAir8U

— Eric Balchunas (@EricBalchunas) December 5, 2024

Bitcoin Price Surges, Market Cap Exceeds Two Trillion Dollars

After Bitcoin’s price hit a new all-time high above $104,000, its market cap surpassed $2 trillion for the first time. This brings Bitcoin close to overtaking tech giants Alphabet and Amazon, moving into the top five global assets. BTC futures long positions have surged, with the funding rate up 81%. BTC’s daily trading volume rose above 83%, exceeding $125 billion, indicating strong bullish sentiment. At press time, Bitcoin was priced at around $102,700, marking a 6.18% increase over the past 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.