Highlights:

- Bitcoin and Ethereum ETFs recorded net inflows on November 22.

- Bitcoin ETFs witnessed over $450 million in profits, bringing their weekly gains to over $3 billion.

- Ethereum ETFs’ latest profits did not prevent them from recording weekly net outflows.

Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs) recorded net inflows on the last weekly trading day. Before the most recent flow data emerged, the last time BTC and ETH ETF registered combined net profits was November 13. Hence, this invariably implies that both entities never recorded simultaneous gains in their previous six outings.

While Bitcoin ETFs maintained their stellar performance for the week by recording mostly gains, Ethereum ETFs recorded their first inflow after six straight losses. According to SosoValue’s ETF flow statistics, Bitcoin commodities’ latest outing resulted in roughly $490.35 million in cash inflows.

On November 22, Bitcoin spot ETF had a total net inflow of $490 million, which continued for 5 consecutive days. BlackRock ETF IBIT had a single-day net inflow of $513 million. The total net asset value of Bitcoin spot ETF is $107.488 billion.https://t.co/59u0BnEqLG pic.twitter.com/HPRzaFyOby

— Wu Blockchain (@WuBlockchain) November 23, 2024

Consequently, Bitcoin ETFs weekly net profits soared to a record high, hitting about $3.38 billion. It is worth noting that the most recent accumulated weekly gain has surpassed the previous $2.57 billion peak level, attained on March 15, 2024.

Like Bitcoin, Ethereum ETFs welcomed net inflows of approximately $91.21 million. However, the newly attracted profits were insufficient to save Ethereum ETFs’ week, as the entity plunged to its first weekly losses after three consecutive gains. The on-chain ETF tracker revealed that ETH ETFs amassed $71.60 million in weekly losses.

On November 22, the Ethereum spot ETF had a total net inflow of $91.2093 million, the first net inflow after the net outflow in the past 6 days. The BlackRock ETF ETHA had a net inflow of $99.6768 million in a single day. https://t.co/Tvs2oCSxTg pic.twitter.com/9X5D6WiAOC

— Wu Blockchain (@WuBlockchain) November 23, 2024

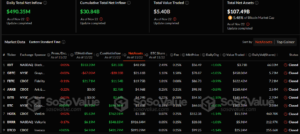

Bitcoin ETFs Statistical Flow Data

On November 22, seven Bitcoin ETFs were active, as the remaining four recognized entities recorded zero flows. Notedly, Grayscale Bitcoin ETF (GBTC) experienced the only outflows by shedding off $67.05 million.

Meanwhile, BlackRock Bitcoin ETF (IBIT) was the only entity with gains valued above $100 million. The commodity contributed a significant $513.2 million positive contribution to Bitcoin ETFs’ latest outing. Fidelity Bitcoin ETF (FBTC) followed IBIT closely with a meager $21.71 million input.

Aside from IBIT and FBTC, the remaining profitable Bitcoin commodities attracted cash inflows below $10 million. They include the Valkyrie Bitcoin ETF (BRRR) ($6.19 million), the Grayscale Mini Bitcoin ETF (BTC) ($5.72 million), the VanEck Bitcoin ETF (HODL) ($5.62 million), and the Invesco Bitcoin ETF (BTCO).

Meanwhile, Bitcoin ETFs’ cumulative net inflow has continued to soar, hitting about $30.84 billion. The total value traded was $5.4 billion, while total net assets reflected $107.49 billion. It is worth noting that the total net assets valuation represents 5.48% of BTC’s $1.95 trillion market cap.

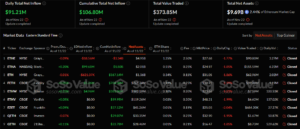

BlackRock Attracts Significant Cash Inflow to Cover up ETH ETFs Deficits

Like Bitcoin, BlackRock Ethereum ETF (ETHA) topped the profits chart with about $99.68 million in gains. Notably, five out of nine entities were active on November 22. Three commodities, including ETHA, welcomed gains as two others experienced outflows.

Aside from ETHA, Fidelity Ethereum ETF (FETH) and Bitwise Ethereum ETF (ETHW) also recorded profits of about $5.76 million and $4.96 million, respectively. Meanwhile, Grayscale Ethereum ETF (ETHE) and Grayscale Mini Ethereum ETF (ETH) accounted for outflows by forfeiting $18.56 million and $621.07K.

Following the latest profitable inputs, Ethereum ETF cumulative net inflow surged to about $106.8 million. The total value and net assets reflected roughly $373.85 million and $9.69 billion, respectively. The net assets represent 2.44% of Ethereum’s market capitalization.

Bitcoin and Ethereum Price Reactions

At the time of press, Bitcoin is changing hands at about $98,500, reflecting a 0.1% decline in the past 24 hours. Within the same timeframe, BTC displayed price extremes, ranging between $97,393.85 – $99,645.39. Hence, it underscores its propensity to break above $100K soon.

Similarly, Ethereum is down by about 0.2% in the past 24 hours, with about $3,360 in selling price. The world’s most valuable altcoin boasts roughly $404.66 billion in market capitalization, with about $38.4 billion in its $24-hour trading volume.