Highlights:

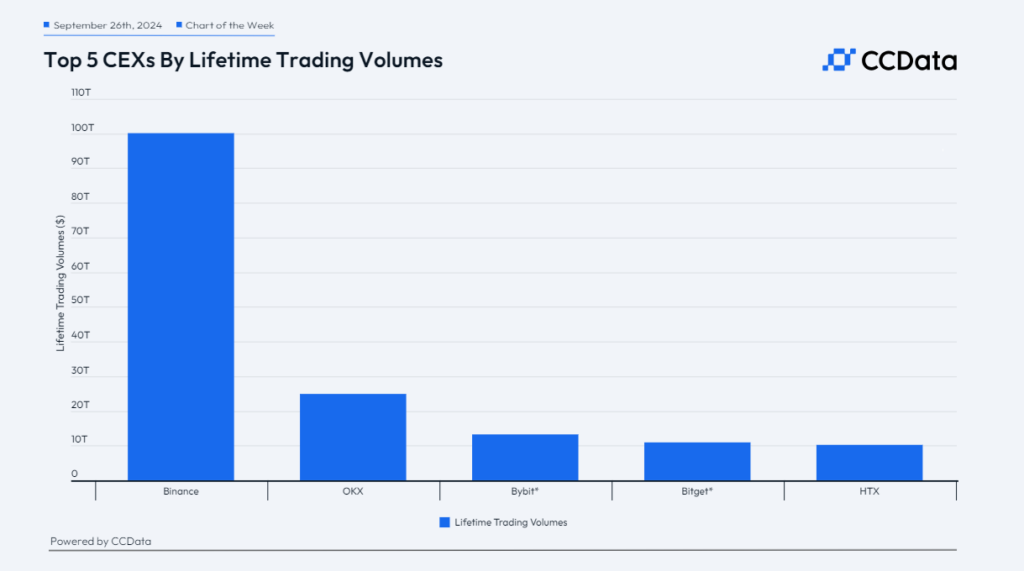

- By surpassing $100 trillion in total trade volume, Binance breaks the record and firmly establishes its dominance in the industry.

- Binance’s dominant market position is highlighted by the fact that rivals like OKX and Bybit lag far behind it.

- FTX ranks sixth worldwide in overall trading volume has demonstrated its past dominance in cryptocurrency trading despite ceasing operations.

The largest cryptocurrency exchange in the world, Binance breaks record by surpassing $100 trillion in total trading volume. With this enormous accomplishment, Binance has demonstrated its dominance in the global spot and derivatives markets consequently establishshing a new standard in the cryptocurrency sector.

According to CCData, Binance's cumulative spot and derivatives trading volume has exceeded 100 trillion US dollars, OKX ranks second with 24.9 trillion US dollars, followed by Bybit and Bitget, ranking third and fourth, with 13.2 trillion and 10.9 trillion respectively. HTX ranks… pic.twitter.com/TR6sbApfwp

— Wu Blockchain (@WuBlockchain) October 19, 2024

Binance’s Unparalleled Market Dominance

According to a recent report by CCData, Binance’s cumulative volume of spot and futures trading has surpassed $100 trillion, making it the first centralized exchange to do so. This enormous number demonstrates the exchange’s crucial position in the global cryptocurrency market and its capacity to draw in a vast user base with its wide range of products and affordable costs.

The exchange’s performance is ascribed to its assortment of more than 350 trading pairs, which accommodate a wide range of trading preferences and improve platform liquidity. This vast range draws traders worldwide and greatly strengthens Binance’s position as a market leader.

Additionally, Binance has been able to access a variety of markets thanks to its global footprint and compliance initiatives, which have increased its attractiveness globally. Users now trust the site because of its dedication to security and user safety, which is essential in the volatile world of cryptocurrency trading.

FTX’s Lasting Impact Despite Collapse

In terms of total trading volume, FTX remains sixth even after ceasing operations in November 2022. This fact highlights the extent of its trading activities before its demise and its enduring influence on the sector. The fact that FTX is still present in the rankings shows how important its activities were in the cryptocurrency industry.

Binance’s achievement reflects the cryptocurrency market’s explosive expansion and the vital role that centralized exchanges continue to play in modern times. It also highlights how Binance is still influencing the evolution of Bitcoin trading. The exchange remains at the forefront of the business thanks to its wide range of goods and services and its dedication to innovation, trust, and market access.

Challenges for Competitors

Although rivals are fighting for a larger portion of the market, Binance clearly has the advantage. The difficulties other exchanges face in matching Binance’s scale are demonstrated by this notable disparity in trade volume. Furthermore, traders from all over the world find Binance to be a compelling platform due to its large range of trading pairs and strong liquidity.

Competitors like OKX and Bybit are well behind Binance, which has a significant lead. With a total trading volume of $24.9 trillion, OKX comes in second, but it is still far below Binance’s $100 trillion. Bybit comes in third with a trading volume of $13.2 trillion. Bitget and HTX round out the top five with trading volumes of $10.9 trillion and $10.2 trillion, respectively.

However, it will be difficult for these exchanges to catch up to Binance’s overwhelming lead. Gaining clients’ attention can be achieved by increasing their offerings and enhancing their trading interfaces. But there is still a long way to go before catching up to Binance.

By the end of 2024, Binance intends to add 1,000 new workers, at least 20% of whom would work in compliance, according to plans announced in August. Richard Teng, CEO of Binance, made these announcements as part of the company’s approach to deal with regulatory issues.

Binance is hiring 1,000 people this year with many earmarked for compliance roles as the crypto exchange’s annual spending to meet regulatory requirements tops $200 million https://t.co/HIW11OWclK

— Bloomberg Crypto (@crypto) August 22, 2024

The corporation wants to increase the number of compliance professionals from 500 to 700. The employment process will also include positions in customer service. Compared to $158 million two years ago, the company anticipates spending more than $200 million this year on regulatory compliance. Nevertheless, it is expected that compliance costs will continue to increase.