The Book Of Meme (BOME) price is winning on the charts today. The token is up 26% in a week and 6% in the past 24 hours, with the BOME/USD trading at $0.01123. Accompanying the noticeable price movement is its 24-hour trading volume, which has surged 18% to $401.64 million. As the broader crypto market dumps, the popular Solana-based token, BOME, displays immense resilience as it breaks above the rising channel.

The BOME price has triggered a healthy rebound from the lower crucial support zone after consolidating for weeks. The bulls managed to trigger a rebound, which caused a bullish market sentiment in the past couple of days. Moreover, the price is believed to maintain a healthy upswing, as the bulls eye the $0.012 mark.

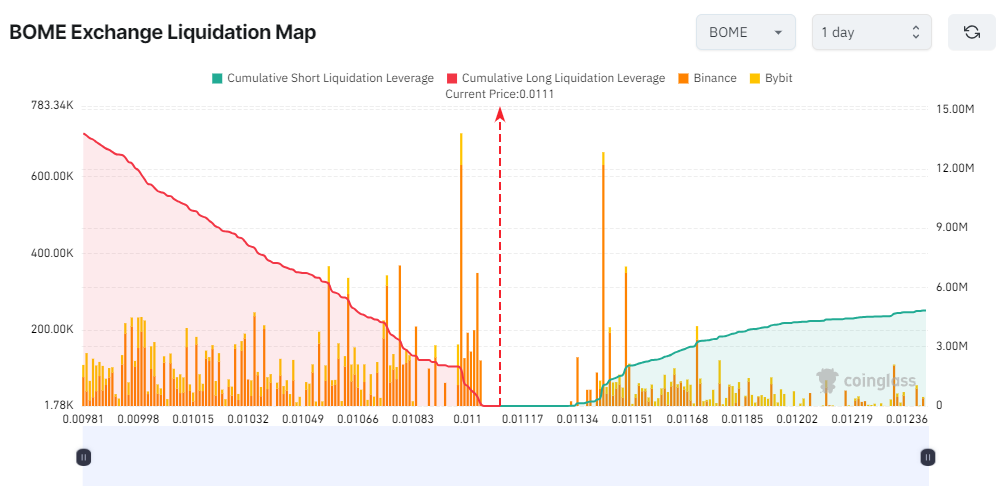

Meanwhile, with the token overbought, Coinglass data signals dwindling bull momentum. This is evident as short positions in BOME are comparably higher than long positions. Often, a long position is interpreted with a bullish outlook as the short position is versed with the notion of price decrease.

On the other hand, some investors have bagged profits as they are optimistic that BOME will break out, compelling them to more gains.

Just hit a 10% profit milestone with $BOME! Loving the journey so far. Let's see where this goes!! #CryptoSuccess #Investing #BOME #ToTheMoon pic.twitter.com/LJrG2iLfkU

— RuchiDegen (@RuchiDegen) July 30, 2024

Book Of Meme Statistical Data

Based on Coinmarketcap data:

- BOME price now – $0.01123

- BOME market cap – $764.18 million

- BOME total supply – 68.96 billion

- BOME circulating supply – 68.96 billion

- BOME ranking – #88

BOME Technical Indicators Suggest an Overbought Token

The BOME price has broken above the rising channel setup, which paints a bullish picture. Meanwhile, the Book Of Meme price holds above the crucial bull market indicators, the 50-day(green) and 200-day(blue) Simple Moving Averages (SMAs). In this scenario, the $0.008925 and $0.008670 act as immediate support keys in the BOME market.

In the same way, the Relative Strength Index (RSI) reinforces the uptrend as it has already crossed the 70 overbought region, currently at 77. However, the RSI on the four-hour chart cautions traders to anticipate a reversal following overbought conditions. However, this reversal might be brief enough to allow more investors to buy BOME, thus building momentum for a breakout above $0.012.

Based on the Moving Average Convergence Divergence (MACD) indicator, the BOME price is suitably positioned to maintain the uptrend. This is after it recorded a bullish crossover when it crossed above the signal line (orange). Such a move is often interpreted as a buy signal, inclining traders to continue buying BOME unless the trend in the MACD changes.

BOME Price Future Outlook

Although the BOME price suggests bullish sentiment, the technical outlook reveals an overbought token. In other words, the Book Of Meme is on the cusp of a reversal. The high influx of traders could also put the accrued gains at risk as profit-booking activities may intensify.

Immediate support at $0.010 would be anticipated, but investors should start accommodating a more extended correction if declines overwhelm the bulls. Meanwhile, the 50-day SMA, currently holding at $0.0089, and the 200-day SMA, at $0.0086, are in line to help absorb the selling pressure ahead of the next breakout.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024