Highlights:

- Spot Ethereum ETFs could start trading by July 15, pending SEC approval.

- ETF issuers are expected to resubmit S-1 amendments by July 8 for SEC review.

- Market demand for Ethereum has surged in anticipation of the ETF launch.

In late June, the US Securities and Exchange Commission (SEC) returned the S-1 forms to prospective spot Ethereum ETF issuers for minor changes and asked them to re-file by July 8. Nate Geraci, President of ETF Store, anticipates all issuers will meet this deadline with revised S-1 filings. He emphasizes that the key focus will be on how quickly the SEC processes these amendments.

Spot eth ETF S-1 amendments supposedly due tomorrow…

How quickly will SEC turn these around?

Again, main item I’m watching for is fees (which won’t be required w/ these amendments).

Otherwise, assume issuers gearing up for launch in next week or two.

— Nate Geraci (@NateGeraci) July 7, 2024

Geraci said the primary concern will be the fees associated with these ETFs. Last week, market players like Bitwise already submitted their S-1 amendments, including details on their fee structure. Other issuers, such as BlackRock, Fidelity, Grayscale, and 21Shares, will likely submit by Monday.

Spot Ethereum ETF Could Start Trading by July 15

In a July 6 post on X, Geraci outlined a potential timeline, suggesting that applicants will submit revised S-1 forms by July 8, with final SEC approval possibly coming around July 12. Therefore, July 15 is the most likely day for Ether ETF trading to begin, he added.

Will be *shocked* if spot eth ETFs not trading w/in next 2 weeks…

Later next week a possibility, but think week of July 15th more likely.

Interestingly, price of eth ↓ 20%+ since "surprise" 19b-4 approvals in late May.

— Nate Geraci (@NateGeraci) July 6, 2024

The faster timeline shows that regulators and ETF providers are talking positively. Market analysts foresee potential Ether ETF inflows reaching $15 billion within six months post-launch.

Is Ethereum Becoming Scarcer?

According to data insights from Leon Waidmann at BTC-Echo, Ethereum is becoming scarcer than Bitcoin. Understanding how each performs individually and their connection in exchange balances is critical. According to Glassnode data shared by Waidmann, Ethereum’s current exchange balance is 10.189%, while Bitcoin’s is 15.08%.

🚨HUGE divergence between #Ethereum and #Bitcoin!

ETH is becoming SCARCER than BTC.#ETH Exchange Balance: 10.189% 📉#BTC Exchange Balance: 15.086% 📈

The gap is WIDENING! pic.twitter.com/UnuejbnS8l

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) July 7, 2024

Since talk of the spot Ethereum ETF gained attention, demand for ETH has surged. Investors have been buying Ethereum rapidly, causing strains on trading platforms. This rush is understandable, given projections that Wall Street money will flow into Ethereum once the ETF launches. K33 analysts David Zimmerman and Vetle Lunde said ETH ETF approval is expected to help ETH perform better than Bitcoin in the weeks after they begin trading in the US.

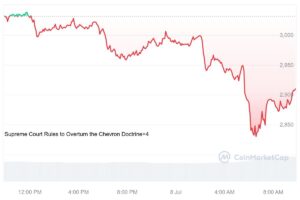

The Ethereum Price Corrects Further

After dropping below $3,000 last week, Ethereum bulls attempted to push the price above $3,100 but only held it briefly.

Over the past 24 hours, Ethereum’s price has further declined by 4.1%, slipping to $2,910, and its market cap has fallen below $350 billion. It will be intriguing to see if the approval of the spot Ether ETFs sparks upward movement or if the bears maintain control.

Grayscale Reveals Ether ETF Listing Can Attract 25% US Voters to ETH Investing

According to Grayscale, about 25% of respondents support the approval of Spot Ethereum ETFs in the S-1. They believe approval would increase their interest in investing in Ethereum and other cryptocurrencies besides Bitcoin. However, 43% of US voters surveyed said they are unfamiliar with the idea of a Spot Ethereum ETF.

Grayscale survey shows that if the Ethereum (spot) ETF is approved, nearly 25% of potential US voters will be more interested in investing in Ethereum. Nearly half of voters (47%) expect to include cryptocurrencies in their portfolios, up from 40% at the end of last year.…

— Wu Blockchain (@WuBlockchain) July 6, 2024

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Crypto Exchanges in 2024

- What Are Leading Analysts Saying About Altcoins Future As Bitcoin’s Dominance Grows?

- Vitalik Buterin Donates $300K to Support Ethereum