Highlights:

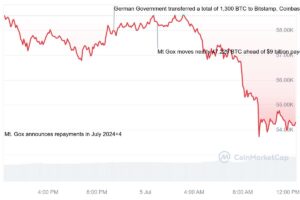

- Bitcoin dropped significantly to $53,499 as Mt. Gox moved billions in BTC.

- Crypto liquidations surged to $684.73 million, marking a two-month high.

- Analysts warn of Bitcoin dropping to $50K amid ongoing volatility and market uncertainty

On July 5, Bitcoin (BTC) fell to a four-month low of $53,499 after news broke that Mt. Gox, the defunct Japanese crypto exchange, had transferred 47,229 BTC valued at $2.7 billion to an undisclosed wallet. Additionally, Crypto liquidations have soared to $684.73 million in the past 24 hours, marking their highest level in two months, as reported by CoinGlass data. Bitcoin has bounced back slightly to $54,288, down about 7.31% in the last 24 hours.

Other highly traded cryptocurrencies, such as Ethereum (ETH) and Solana (SOL), also saw significant drops today. Currently, the entire crypto market cap stands at $1.97 trillion, reflecting a 7.59% decrease over the past 24 hours.

More than $684M Liquidated in the Past 24 Hours

According to data from Coinglass, over $684 million worth of leveraged positions have been liquidated on centralized crypto exchanges (CEXs) over the past 24 hours. Over $589 million in longs and $95 million in short positions have been liquidated. This widespread liquidation activity has affected 235,833 traders. Most liquidations happened on Binance and OKX, with $336 million and $165 million, respectively.

Bitcoin saw liquidations totaling $231 million, with $185 million from long positions and $45 million from short positions. The second-largest crypto, Ethereum, also witnessed a 9.86% downturn over the past day — now trading at $2,852. ETH recorded liquidations amounting to $167 million, comprising over $144 million from long positions and $22 million from short positions.

Solana’s SOL fell 9.28% to trade at $122, while Dogecoin (DOGE) dropped over 15.28%. Dogecoin and Solana saw the liquidation of $5 million and $24, respectively, in the past 24 hours.

Key Reasons Behind Bitcoin Collapse

Traders are concerned about potential sell pressure from $8.5 billion in Bitcoin paybacks to creditors of the collapsed Mt. Gox exchange. On July 5, Mt. Gox transferred 47,229 BTC (about $2.6 billion) to a new address, its first major move since May.

Head of research at Presto Research, Peter Chung, said that the selling pressure may be stronger for BCH than BTC, “given BCH doesn’t have a strong investor base like BTC, so the [Mt Gox] creditors will probably seek to cash out immediately just like any other airdrop.”

Adding to the pressure, the German government has sold 7,583 BTC ($419.5 million) since June 19 but still holds 42,274 BTC, worth around $2.3 billion. German lawmaker and Bitcoin activist Joana Cotar urged the German government to halt rapid BTC sales and use it as a “strategic reserve currency” for financial protection.

Statt #Bitcoin als strategische Reservewährung zu halten, wie es in den USA bereits debattiert wird, verkauft unsere Regierung im großen Stil. Ich habe @MPKretschmer, @c_lindner & @Bundeskanzler @OlafScholz darüber informiert, warum dies nicht nur nicht sinnvoll, sondern… pic.twitter.com/v9FpzmfLbp

— Joana Cotar (@JoanaCotar) July 4, 2024

Positive sentiment toward crypto has hit its lowest point since January last year. On July 5, the Crypto Fear and Greed Index scored 29 out of 100, indicating the market is experiencing “Fear.”

Bitcoin Will Crash to $50K, 10x Research Warns

On July 4, 10x Research analyst Markus Thielen predicted Bitcoin could drop to $50,000 due to selling pressure on the cryptocurrency. Thielen advises traders to focus on risk management due to expected volatility.

#Bitcoin Is Crashing to $50,000 – But You Are Prepared…!!! -> here -> https://t.co/oCgSsi3t0r pic.twitter.com/H1HY0kGkV7

— 10x Research (@10x_Research) July 4, 2024

Moreover, trading firm QCP Capital stated in a Thursday Telegram broadcast that they expect a sluggish market in the coming months.

QCP Capital noted:

“We anticipate a subdued Q3 for BTC as the market remains uncertain around the supply from the Mt. Gox release.”