Bitcoin, the leading cryptocurrency, faces increased competition from Ethereum and Solana. Investors focus on these lesser-known digital currencies as the excitement grows around potential cryptocurrency exchange-traded funds in the U.S.

Ethereum ETFs are drawing significant attention as their launch date approaches early next week, likely between July 2nd and July 4th. Market anticipation is heightened by the smooth progress of the SEC’s review process under Chairman Gary Gensler’s oversight.

Anticipation Grows for Ethereum ETF Launch

According to insights from top analysts, these ETFs could start operations very soon. Furthermore, investment giants like VanEck entice investors by offering zero fees on their upcoming Ether ETFs. Galaxy Digital Holdings LP projects substantial interest, forecasting about $5 billion in inflows within the initial six months.

I am excited to announce that VanEck just filed for the FIRST Solana exchange-traded fund (ETF) in the US.

Some thoughts on why we believe SOL is a commodity are below.

Why did we file for it?

A competitor to Ethereum, Solana is open-source blockchain software designed to… pic.twitter.com/XwwPy8BXV2— matthew sigel, recovering CFA (@matthew_sigel) June 27, 2024

Adding to the excitement, VanEck disclosed plans to file for a Solana-based spot ETF last Thursday. This announcement helped propel Solana’s price to a high of $150, marking substantial gains.

As Ether and Solana’s ETFs prepare for launch, market dynamics suggest they might replicate the bullish trends seen in Bitcoin earlier this year after its own ETF debut in January. Currently, Ethereum price is trading at $3,451, with a surge of 2% over the past day.

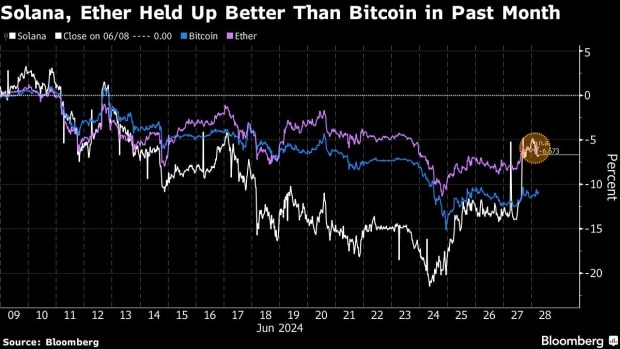

While Bitcoin experienced a downtrend this June, Ether and Solana demonstrated more robust performance. Reports from Bloomberg highlight that both altcoins have outpaced Bitcoin over the past month. At the time of writing, BTC is at $61,587, with a slight surge surge of 0.81%.

This shift in market focus is partly due to the upcoming Ethereum and Solana ETFs, which generate considerable buzz and potentially reshape investment flows in the crypto market.

Solana’s Prospects Brighten with Potential ETF Approval

On Thursday, June 27, market discussions highlighted by GSR, a key player in cryptocurrency trading, suggest that Solana (SOL) could see significant benefits from approving a spot exchange-traded fund (ETF) in the US. The anticipation hinges notably on political changes, specifically if Donald Trump returns to office. Solana price is currently at $145, with a surge of more than 4% over the past day.

GSR’s analysis suggests that Solana is well-positioned for an ETF if the U.S. broadens its regulatory acceptance of spot digital asset ETFs. Introducing such an ETF could trigger Solana’s most substantial price increase.

A recent analysis by GSR compares SOL’s prospective price trajectory to that of Bitcoin, which experienced a significant boost following its own ETF approval. GSR outlines three growth scenarios for Solana: a conservative estimate with a 1.4-fold increase, a moderate forecast predicting a 3.4-fold surge, and an optimistic “blue sky” outlook forecasting an 8.9-fold jump.

These projections are underpinned by what GSR dubs an “ETF Possibility Score,” which evaluates factors like decentralization and market demand. According to GSR, Solana ranks highly on these metrics, positioned just behind Ethereum in potential.

The GSR has substantial holdings in Solana. The firm states that cryptocurrency regulation will likely be a significant topic in the forthcoming 2024 U.S. elections.

Read More

- Binance Lists 7 New FDUSD Trading Pairs with Zero-Fee Trading

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins