Highlights:

- Bitcoin fell below $61,000 on June 25, triggering $361 million in liquidations.

- Mt. Gox’s repayment news and the German government’s significant BTC selling pushed Bitcoin’s price further down.

- Bitcoin could plummet to $50,000 as 10x Research warns of a looming double-top pattern.

On June 25, the price of Bitcoin (BTC) fell below $61,000, triggering widespread liquidations of crypto positions across the market. As of writing, Bitcoin is trading at $60,611, down 3.83% in the last 24 hours.

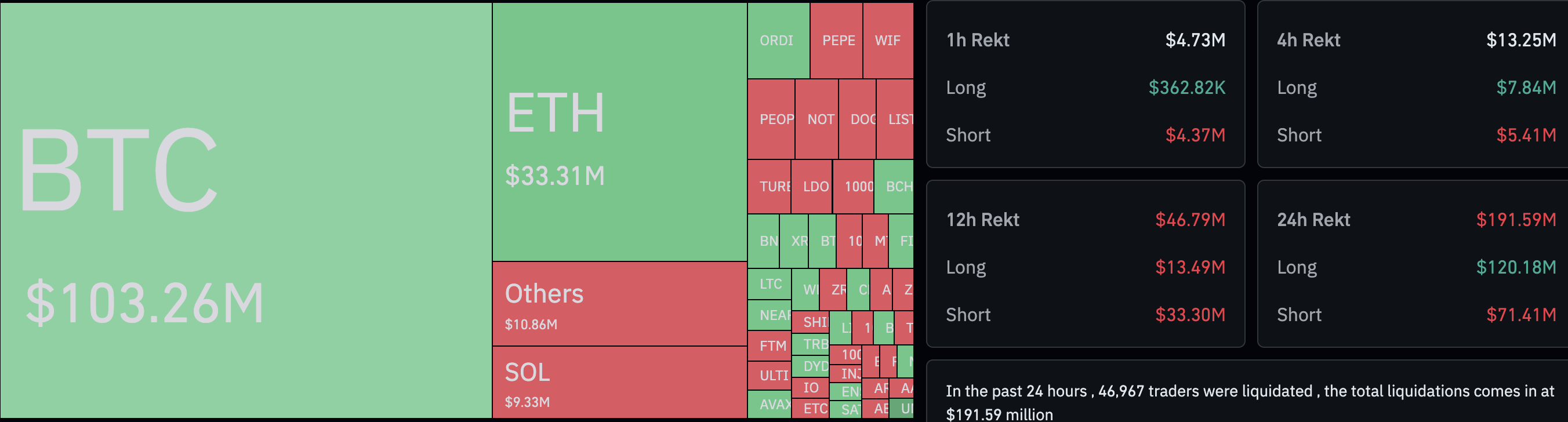

According to data from Coinglass, $361 million worth of crypto has been liquidated on centralized exchanges (CEXs) over the past 24 hours alone. Over $279 million in longs and $81 million in short positions have been liquidated. This widespread liquidation activity has affected 86,741 traders. Most liquidations happened on Binance and OKX, with $141 million and $97 million, respectively.

Bitcoin and Ethereum Face Massive Liquidations

Source: CoinGlass

Bitcoin saw liquidations totaling $176.80 million, with $145.99 million from long positions and $30.81 million from short positions. The second-largest crypto, Ethereum (ETH), also witnessed a 1.05% downturn over the past day — now trading at $3,354. ETH recorded liquidations amounting to $75.90 million, comprising $57.93 million from long positions and $17.97 million from short positions. Currently, the entire crypto market cap stands at $2.26 trillion, reflecting a 1.10% decrease over the past 24 hours.

Why Did Bitcoin Price Fall Sharply?

On June 24, the collapsed cryptocurrency exchange Mt. Gox announced it would start repaying its former users in July. More than $9.4 billion worth of Bitcoin is owed to approximately 127,000 creditors of Mt. Gox. They have been waiting for over 10 years to recover their funds, which could introduce significant selling pressure for Bitcoin. Following the news, Bitcoin’s price dropped by over 5%, breaking key support levels amid concerns of impending sell-off pressure in the market.

JUST IN: Bankrupt Mt. Gox will begin $9 billion #Bitcoin repayments in July 👀 pic.twitter.com/Rph2AupnTY

— Bitcoin Magazine (@BitcoinMagazine) June 24, 2024

According to Eric Balchunas, a senior ETF analyst at Bloomberg, this could exert significant selling pressure on the market.

That’s like over half of all the ETF inflows being negated in one shot. Damn. https://t.co/rBrFb6xpX1

— Eric Balchunas (@EricBalchunas) June 24, 2024

This decline coincided with recent selling from a wallet associated with the German government. In February 2024, Arkham Intelligence disclosed that German agencies had seized 50,000 Bitcoins, valued at approximately $2.12 billion at the time. The Bitcoins were confiscated from Movie2k.to, a film piracy website that was active in 2013. Bitcoin’s recent gains pushed the total value of the coins above $3 billion. However, according to Arkham Intelligence, the wallet has recently sold off a considerable amount of BTC, potentially influencing the selling pressure.

UPDATE: German Government Still Selling BTC > $195M So Far.

In the past 2 hours, the German Government sent $65M in BTC to 2 likely exchange deposits including Coinbase.

The German Government moved $600M BTC yesterday, sending $130M BTC to 4 likely exchange deposits including… pic.twitter.com/in2urlDBE0

— Arkham (@ArkhamIntel) June 20, 2024

Bitcoin Could Fall Further to $50K: 10x Research Research

On Monday, 10x Research expressed concerns about Bitcoin’s price direction, suggesting that the world’s leading crypto could be on the verge of a significant downturn. Founder of 10x Research Markus Thielen said BTC appears to be following a double-top pattern technically and is currently testing its support level.

A double top pattern forms when the price hits two similar highs with a small dip in between, staying above a support line called the “neckline.” This pattern usually completes when the price drops below the neckline, possibly falling by the same distance as between the peaks and the neckline. The report highlights $61,500 as a key level to monitor, cautioning that if Bitcoin falls below this mark, prices could potentially decline to the low $50,000 or even lower.

#Bitcoin Double Top? Is It Time to Panic? How Low Prices Could Plunge?

👇1-11) Bitcoin continues to tumble, and liquidity sharply declines with falling prices. Many are afraid to look at their crypto holdings and take action. Bitcoin prices are still relatively high, but this… pic.twitter.com/33hmmt0blj

— 10x Research (@10x_Research) June 24, 2024

Read More

- Trump in Discussions to Speak at Bitcoin 2024 Convention in Nashville in July

- Best Crypto Exchanges in 2024