It is no longer news that the crypto market is in a state of turmoil that has rendered almost all charts across several crypto assets red, leaving many investors in losses and eliciting fear-induced sell-offs among some of them, particularly those who invested more than they can afford to lose in case of any eventuality.

Despite the market downtrends existing for some time now, no reasonable explanations have satisfactorily stated, particularly what could be inducing the declines, leaving almost everyone confused, even though some market experts are speculating that it could be a mare transient retracement, with the potential to birth an unprecedented bull season.

this #btc price action reminds me so much of the bear market.

doesn’t matter how many shorts pile in, they get bailed out by spot simply selling more and more in a clumsy way. pic.twitter.com/wsqTzQQpRg

— few (@fewseethis) June 18, 2024

Altcoins’ Prices Suffering Debilitating Losses As Downtrend Worsens

While Bitcoin (BTC) was significantly affected by the widespread downtrends, altcoins’ prices seem to have suffered the most, as many of them retraced massively, setting new lower price levels as support and resistance marks.

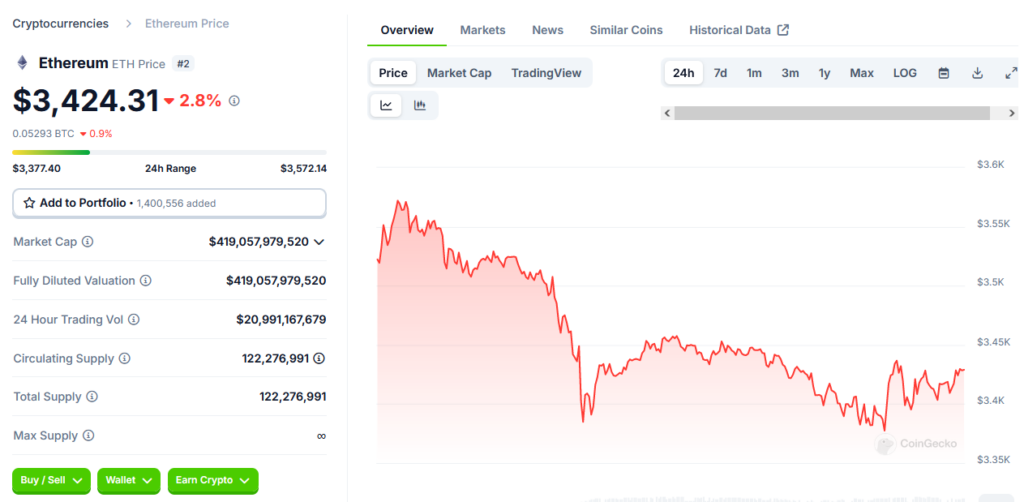

Notably, Ethereum, the world’s most valuable altcoin, had dipped below the $3,500 price level and is trading around the $3,400 region, reflecting a 2.8% decline from the previous day and a 24-hour minimum and maximum prices of approximately $3,377.40 and $3,572.14, respectively, implying that the ether-based token is already testing the possibilities of breaking below $3,400 price level.

Amid the uncertainties clouding the crypto market’s future outlook, a renowned crypto trader and market observer, Ash Crypto, recently took his time to highlight three significant factors that have contributed to the present market predicament via a lengthy post on his verified X handle, boasting over 1.1 million followers.

No Narrative

According to Ash Crypto, past 2024 market surges were orchestrated by different events, which ordinarily might not make up the market cycle. The market expert noted that the Q1 market rally was because of meme coin massive pumps emanating from presale hypes.

Fast forward to Q2, Real World Assets (RWAs) took center stage, orchestrating digital assets price appreciation because of BlackRock. Conversely, Q3 lacks a new narrative to elicit new liquidity that could catalyze market rallies.

Ethereum’s ETF Trading Delay

While Ethereum’s spot Exchange Traded Fund (ETF) approval by the United States Securities and Exchange Commission (SEC) graced the crypto space with subtle market rallies, the impact seems to have gradually disappeared as the ETFs have not begun trading.

Interestingly, Ash Crypto spotlighted the delay in ETF trading as the second factor responsible for altcoins’ prices decline. Part of his tweet read thus, “It could take another three weeks before the trading starts, which has caused the sentiment to shift from altcoins. Remember, alts big rally always starts with ETH, so until and unless ETH makes a new ATH, Altseason won’t start.”

Too Much Greed

Per Ash Crypto, excessive greed has eaten deeply into the crypto market space, evidenced by celebrities’ meme coin launch frenzies. Retailers are not left out as they are also grossly involved in the new trend.

The market analyst noted that the recent wave of meme coins launch excitement will only result in an undesirable effect, plunging the market into unredeemable losses.

Why Are Altcoins Dumping?

In the past 24 hours, several large caps

have dumped 15%–20% despite BTC’s

3% corrections.Here are some reasons behind the alts

flash crash 👇1) No narrative

In Q1, memecoins pumped because of presale hype.

In Q2, RWA coins pumped because… pic.twitter.com/zJK7v1taxh

— Ash Crypto (@Ashcryptoreal) June 18, 2024

When Will Altcoins’ Prices Recover

Commenting on when he anticipates altcoins’ price recovery, Ash Crypto noted that it depends mainly on when the Ethereum ETFs begin trading, adding that if the ETF brings in good inflows like that of Bitcoin, it should birth the altcoins’ season.

Concluding his takes, the market expert remarked, “This could even lead to institutions applying for other altcoins, which will set the next big narrative. Until then, most altcoins are in completely oversold territory, and historically, buying fear has always yielded great returns.”

Read More

- ZKsync Price Prediction: ZK Plunges 8% as ZK Airdrop Recipients Liquidate

- Biaoqing (BIAO) Price Rallies 160% In a Week – Why It Has 1000X Potential

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.