Highlights:

- Miner revenues have dropped by 55%, forcing them to sell more Bitcoin driving prices down.

- Reduced issuance of stablecoins like USDT and USDC decreases market liquidity and increases price volatility.

- Significant withdrawals from major ETFs are adding to the selling pressure on Bitcoin, impacting market stability.

Amid fluctuating sentiments in the crypto market, the overall market capitalization has declined 2.29%, settling at $2.33 trillion. Meanwhile, the trading volume has significantly increased by 60% to reach $95.63 billion. This rise underscores traders’ robust engagement despite the prevailing market challenges.

Stablecoins have notably dominated the scene, accounting for over 90% of this escalated trading volume. This trend highlights traders’ preference for less volatile options amid current market uncertainty. Despite the general crrypto market downturn, the increased activity could signal a gearing up for potential future movements.

Moreover, the cryptocurrency fear and greed index now stands at 55, reflecting a neutral sentiment among investors. This indicates a cautious but not entirely pessimistic outlook as stakeholders watch for possible upward trends.

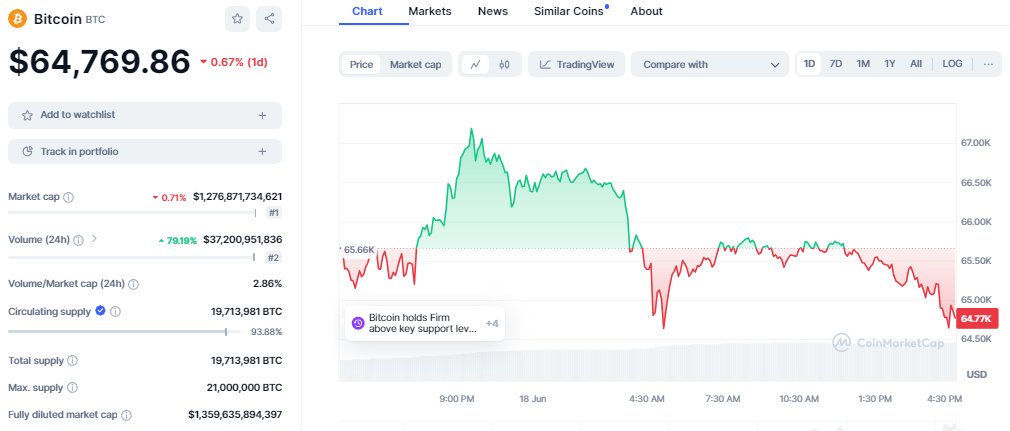

However, the leading cryptocurrency, Bitcoin, has recorded a slight decline of 0.67% over the past day, trading at $64,769. This dip has contributed to the broader market’s bearish stance, with most cryptocurrencies experiencing losses.

Bitcoin has been trading downward in most of today’s sessions, dropping below the immediate support level at 65k. BTC’s market capitalization has dropped below the $1.30 trillion mark, while the trading volume has seen an impressive surge of 79% at the $37 billion mark.

Key Factors at Play on the Current Market Downturn

The crypto market is experiencing notable declines, driven by several key factors. Outflows from ETFs and increased Bitcoin sales by miners are contributing to this downward trend. Additionally, the reduced issuance of stablecoins like USDT and USDC leads to decreased market liquidity.

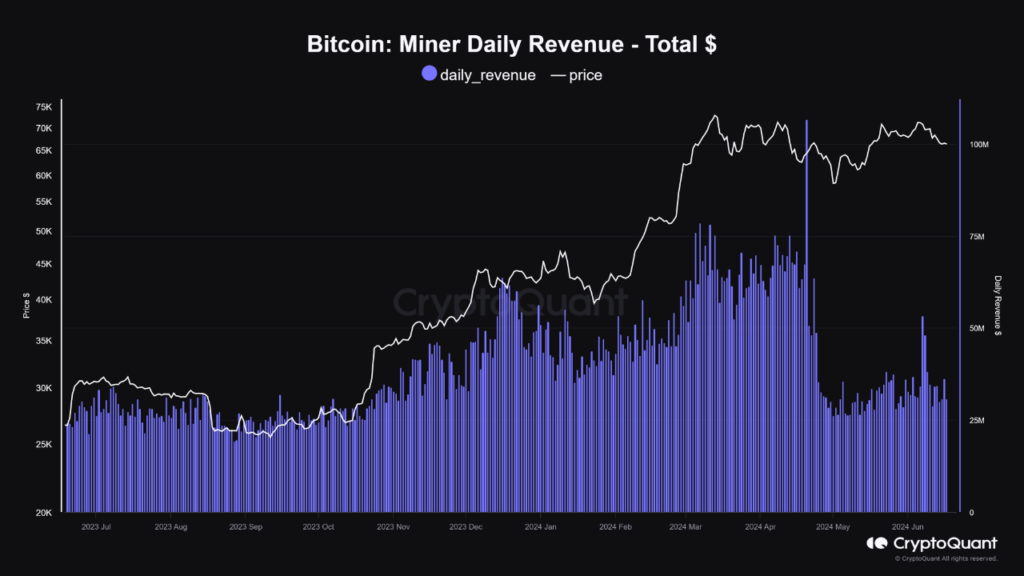

Miner Capitulation Impacts Market

Miners are facing significant revenue drops, leading to increased Bitcoin sales. Miner revenues have plummeted by 55%, forcing them to sell more Bitcoin to cover operational costs. Consequently, there has been a notable rise in Bitcoin transfers from miners’ wallets to exchanges, indicating that selling activity is driving prices down.

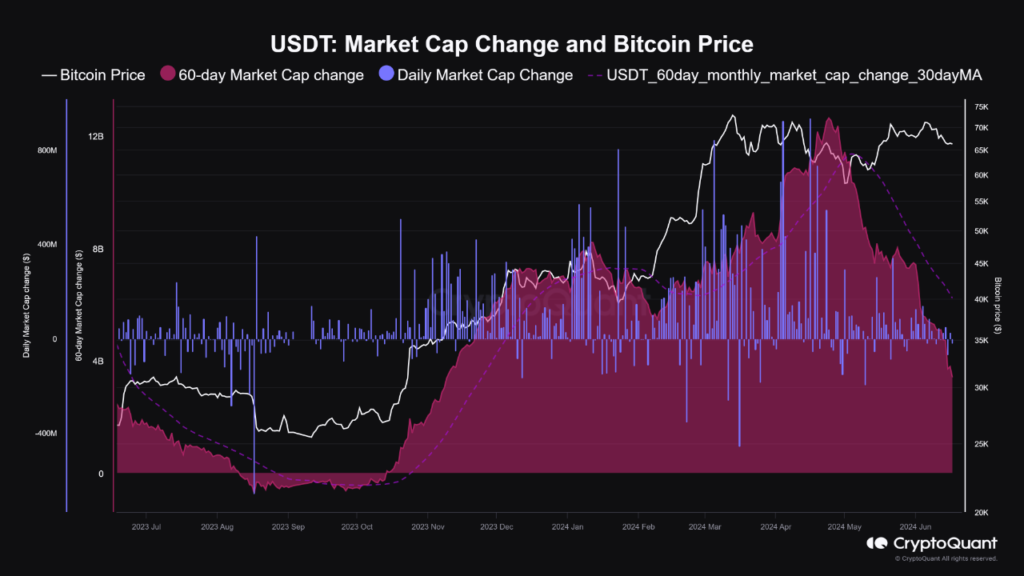

Stablecoin Issuance Slows

The stablecoin market is also contributing to the market decline. New issuances of USDT and USDC are limited, resulting in less new money entering the crypto market. This reduction in liquidity is increasing price volatility and contributing to the overall decline.

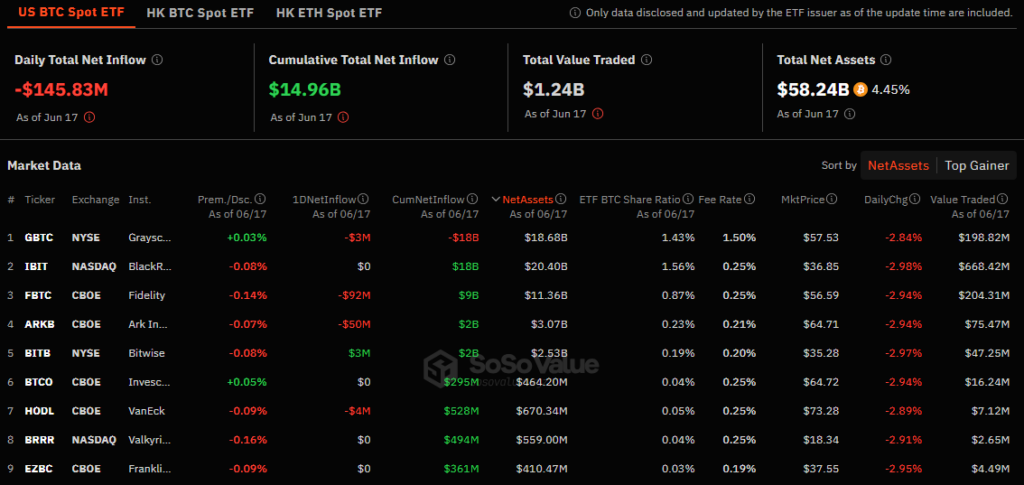

ETF Outflows Create Selling Pressure

Net outflows from Bitcoin spot exchange-traded funds (ETFs) have been recorded in five of the past six days, indicating investor caution. On June 17, Bitcoin spot ETFs experienced net outflows totaling $146 million, highlighting ongoing market volatility and investor uncertainty, according to data from SoSo Value.

Fidelity’s FBTC led the withdrawals with $92 million, followed by ARK 21Shares Bitcoin ETF (ARKB) with $50 million in outflows. The consistent outflows from Bitcoin spot ETFs underscore the cryptocurrency market’s challenges. Investors are increasingly cautious, balancing potential opportunities with the inherent risks associated with digital assets.

The recent trend of net outflows from Bitcoin spot ETFs signals a shift in investor sentiment as market conditions fluctuate. The movement of significant funds away from these ETFs may indicate a broader trend of reevaluation within the crypto investment community.

What to Expect From the Current Market Dynamics

Historically, periods of sustained low miner revenues combined with a high hashrate have indicated potential market bottoms. This scenario often points towards possible stabilization or even a market rebound.

Despite current fears and selling pressures, the strong support level of around $62,400 for short-term holders’ average realized price could help stabilize prices in the near term. However, new inflows, especially from stablecoins, and reduced selling pressure from miners and ETFs will be critical for a sustainable recovery.

Read More

- Shiba Inu Price Prediction as SHIB is Poised For A 294% Rebound Despite Recent Decline, According to Experts

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.