The past week brought significant developments in the crypto space, including fraud accusations against Argentine President Milei over LIBRA’s collapse, Elon Musk’s xAI unveiling Grok 3, and Bybit losing $1.4 billion in a suspected Lazarus Group hack. Meanwhile, Bitcoin neared the $100K milestone, while Ethereum struggled against key resistance levels. With regulatory and security shifts on the horizon, investors brace for heightened market volatility.

Argentina’s President Charged For Fraud Over LIBRA Token

Argentine President Javier Milei underwent investigation after he hyped up Solana-based meme coin LIBRA, which reached an all-time high of more than $4 billion before losing 94% after he deleted his post on X. He first stated that the project would be assisting small businesses and was being privately operated with no individual monetary gain to himself.

Following criticism, the Anti-Corruption Office (OA) investigated whether Milei or other officials engaged in wrongdoing. Milei also created an Investigation Task Unit (UTI) to investigate the LIBRA token and submit findings to judicial authorities.

Am putting out a preliminary response to $LIBRA: a longer one will follow:

As per President Milei’s original post a few hours back, Project Libertad was done to boost the Argentine economy by funding small projects and local businesses, supporting those who seek to grow their…

— Julian @ 𝗞𝗜𝗣 ㊋⫸ (@julian_kip) February 15, 2025

A criminal complaint was filed, accusing Milei of being complicit in fraud. The President’s Office clarified that he frequently supports firms but was not involved in creating LIBRA. Milei promised transparency and accountability as authorities still assess potential legal violations and the token’s market impact.

Elon Musk’s xAI Launches Grok 3

Billionaire entrepreneur and special government employee Elon Musk’s artificial intelligence company, xAI, launched Grok 3, its latest chatbot. Musk described it as “scary smart” with better reasoning, computational power, and versatility.

🚨Breaking: Elon Musk Just Launched Grok 3

It's xAI's new reasoning model beating Deepseek, ChatGPT o1, Gemini, and all others.

Here is everything you will know about Grok3 in 2 minutes: pic.twitter.com/Fwr1LRNiq7

— Hamza Khalid (@Whizz_ai) February 18, 2025

xAI credits its Colossus supercomputer, which was built in eight months, for accelerating the development of Grok 3. With 100,000 Nvidia H100 GPUs, it provides 200 million GPU hours of training, 10 times that of Grok 2.

The chatbot’s training process also evolved, adopting synthetic datasets, self-correction mechanisms, and reinforcement learning. These processes facilitate more effective learning, greater accuracy, and easier privacy maintenance. Synthetic datasets also allow for diverse training, while self-correction mechanisms allow the AI to identify and rectify errors over time.

SEC Acknowledges Nasdaq’s CoinShares XRP ETF Filing

The U.S. Securities and Exchange Commission (SEC) has formally received the filing of Nasdaq for the CoinShares XRP ETF, marking a crucial step in the approval process. The regulator started a 21-day public comment period after publishing the filing in the Federal Register. This follows Nasdaq’s filing of 19b-4 forms earlier last week in an effort to request a rule change to enable listing and trading of shares in both the CoinShares XRP and Litecoin ETFs.

🚨 BOOOOOOM 🚨

The SEC has officially acknowledged CoinShares' Spot #XRP ETF filing!

🟢 Bitwise

🟢 21Shares

🟢 Grayscale

🟢 CoinShares pic.twitter.com/uz59XnpbcO— GA Spark • 🟠 (@XRP_Spark) February 19, 2025

While the notice of consideration does not convey approval, it guarantees that the SEC is actively being considered. After closing the public comment period, the regulator can approve, reject, or extend the review.

The SEC has also approved spot XRP ETF filings by 21Shares, Grayscale, and Bitwise, with Canary Capital and WisdomTree’s applications in the pipeline. This reflects a shift in regulatory sentiment, as compared to previous instances where reluctance led to ETF withdrawals.

But uncertainty abounds. The SEC previously said it would reject Solana ETF applications and isn’t likely to approve new crypto ETFs on its watch while the Biden administration is in office. Additionally, the ongoing court case between the SEC and Ripple Labs could potentially complicate matters for XRP ETF approvals even further, and investors are closely watching developments.

Bybit Struck by a Massive Security Attack

Dubai-based cryptocurrency exchange Bybit was struck by a massive security attack when intruders got away with over $1.4 billion of Ethereum in an ultra-fast smash-and-grab attack on Friday.

Crypto analyst ZachXBT blamed the exploit on the North Korean Lazarus Group, a well-known cybercrime gang behind several high-profile crypto heists. Arkham Intelligence, crediting ZachXBT’s finding, confirmed his “irrefutable evidence,” such as test transactions, wallet linking, forensic graphs, and timing analysis. The attack was also identical to the $30 million Phemex hack in January.

Lazarus Group just connected the Bybit hack to the Phemex hack directly on-chain commingling funds from the intial theft address for both incidents.

Overlap address:

0x33d057af74779925c4b2e720a820387cb89f8f65Bybit hack txns on Feb 22, 2025:… pic.twitter.com/dh2oHUBCvW

— ZachXBT (@zachxbt) February 22, 2025

Arkham explained that the hackers moved 400,000 ETH valued at $1.37 billion into 53 wallets in a bid to launder funds using DEXs and cross-chain bridges. Bybit CEO Ben Zhou revealed the hack resulted from a tampered multisig transaction on one of the exchange’s Ethereum cold wallet. As sound as it is, Bybit is also seeking bridge loans to cover losses. To stabilize liquidity and prevent fear, Binance transferred 50,000 ETH to Bybit.

Bybit detected unauthorized activity involving one of our ETH cold wallets. The incident occurred when our ETH multisig cold wallet executed a transfer to our warm wallet. Unfortunately, this transaction was manipulated through a sophisticated attack that masked the signing…

— Bybit (@Bybit_Official) February 21, 2025

The hack eroded investor confidence, with Ethereum dropping to $2,616 and Bitcoin struggling around $97,000. Regulatory pressure will only mount, with U.S. regulators keenly observing sanctions violations. Traders, on the other hand, are still concerned about CEX safety as they reevaluate risks.

SEC Restructures to Cyber and Emerging Technologies Unit

Renamed the Cyber and Emerging Technologies Unit, the unit will continue to address crypto-fraud but also monitor AI abuse and cybersecurity breaches. SEC Acting Chair Mark Uyeda elaborated that the unit is to “root out those who would seek to exploit innovation” while maintaining authentic growth in the industry.

The reform precedes Elon Musk’s Department of Government Efficiency (DOGE) auditing the SEC for inefficiency. Redoing the SEC is not on the agenda but is possibly a pre-emptive move. The reform is part of U.S. President Donald Trump’s campaign vow to make America the “crypto capital” of the world, a potential loosening of regulatory rules for the sector.

Market Overview: Week of February 17–21

Bitcoin (BTC)

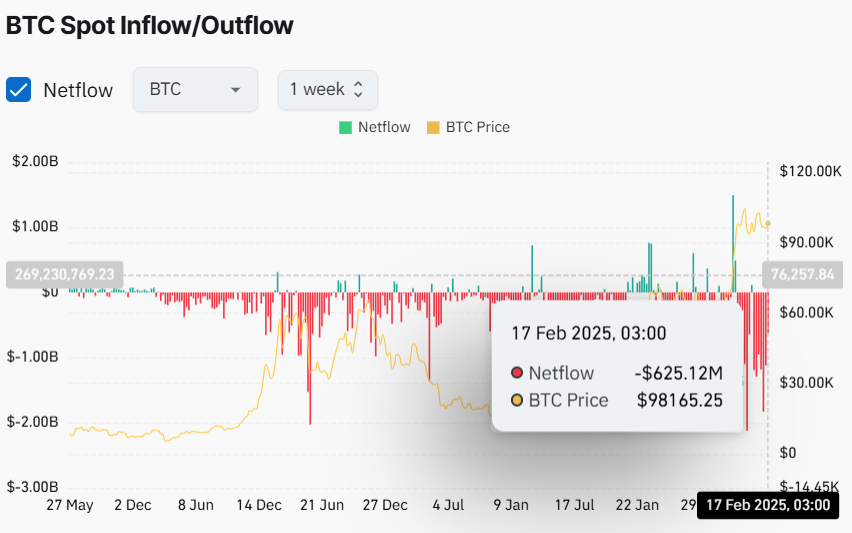

Digital asset investment saw $415 million in net outflows, ending a 19-week inflow streak. Bitcoin exchange-traded products were hit hardest, with $430 million in outflows, as Spot Bitcoin ETFs recorded two consecutive weeks of withdrawals. Bitcoin briefly dipped to $91,000 before rebounding to $96,957. Meanwhile, Coinglass data shows exchange reserves are still declining as long-term holders shift BTC to self-custody.

Negative market flows continue after Fed Chair Jerome Powell’s hawkish comments on interest rates and January’s CPI coming in at 4.2%, above the expected 3.8%, fueling inflation concerns.

Bitcoin traded between $93,000 and $97,000 over the week, maintaining its bullish outlook despite a three-month consolidation. At the time of writing, BTC was priced at $98,218, up 1.4% in 24 hours.

The Relative Strength Index (RSI) on the daily chart is 50, its neutral level, and is trending upwards, reflecting mild bullish momentum. RSI needs to stay above 50 to sustain this momentum. The next few days will be crucial as BTC/USD reaches the $96,400 resistance level—a breach to the upside could send BTC toward the psychological $100,000 figure.

Conversely, if bears move in and break the pivotal $90,320 support, Bitcoin could be vulnerable to steep losses, with stops at $87,200, $81,900, and $75,884. The bulls must keep $90,320 intact to preserve momentum in gear and move higher toward the $96,400 midpoint.

Ethereum (ETH)

The price of Ethereum made an impressive recovery last week, appreciating by nearly 6%. This gain fell slightly towards the beginning of the week, with Monday trading fluctuating at $2,754. ETH/USD has been struggling to break above the channel’s upper boundary, with the latest rejection occurring in January 2025. After trending downward for five weeks, Ethereum now holds support at $2,610.

If this level holds, the price could rebound toward $3,110 and potentially extend to $3,638. However, failure to maintain support at $2,610 may trigger a bearish move, with downside targets at $2,027 and $1,492.In case of continuation of this relapse, Ethereum may slide lower, even touching its next daily support of $2,359.

The RSI on the daily chart confirms this bearish outlook, at 46, after facing a rejection from the neutral 50 level on Sunday, showing a bearish trend as it declines. Alternatively, if ETH keeps rebounding, it might take the recovery further to test the $3,000 level.

Ripple (XRP)

Ripple (XRP/USD) forms a symmetrical triangle pattern, reflecting the same market uncertainty as Bitcoin, Ethereum, and Dow Jones. It formed in early January 2025 following a pullback to the $2.00 support level and a rally to the $3.36 resistance level.

XRP is now trading at around $2.60, which is a make-or-break level that will see key market participants determine the cryptocurrency’s direction going forward. A break above that level could see the price plummet towards $2.85 and possibly re-test the January open price level at around $3.10.

But if $2.60 fails to hold strong as support, then the price could drop towards $2.35 and $2.00. A breakdown below the $2.00 mark would likely trigger a more serious sell-off, with a downside potential of perhaps $1.60.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.