Ready to dive into the exciting world of cryptocurrency? You’ve come to the right page. In this guide, we walk you through the simple steps to invest in cryptocurrency in Australia.

Australia has embraced blockchain technology and cryptocurrencies, which is rightly reflected in the establishment of various crypto exchanges within the country. As interest from investors continues to grow, Australian investors have a plethora of options for purchasing cryptocurrencies online.

Let’s get started.

How to Invest in Cryptocurrency in Australia – Quick Steps

The walkthrough steps below will show you to start investing in cryptocurrency in Australia in less than 5 mins with eToro, leading crypto trading platform.

- Step 1: Open an Account – Visit the eToro website and register for a free account. Provide the necessary details as prompted by eToro.

- Step 2: Deposit Funds – Once your account is set up, deposit a minimum of $50. You can use various payment methods, such as credit/debit cards, local bank transfers, or e-wallets.

- Step 3: Explore Cryptos – eToro offers a selection of over 75 top cryptocurrencies. Navigate to the ‘Discover’ section to explore the complete list of available markets.

- Step 4: Invest in Cryptocurrency – Identify the cryptocurrency you wish to invest in and click on the ‘Trade’ button next to it. Enter the amount you want to invest (starting from $10). Finally, to confirm your investment, click on ‘Open Trade’.

Crypto assets are unregulated and highly speculative. Capital at risk.

Where to Invest in Cryptocurrency in Australia

In the sections below, we discuss the best place to buy crypto in Australia across five pre-vetted platform reviews.

- eToro – Overall the best crypto exchange globally

- Binance – The largest crypto exchange in the world

- AvaTrade – One of the most popular crypto exchanges for Australian investors

- Capital.com – Top crypto exchange with a competitive fee structure

- Coinbase – One of the best secure crypto exchanges for Australian investors

Best Places to Invest in Cryptocurrency in Australia Reviewed

Investing in cryptocurrency in Australia depends greatly on selecting the right online platform to facilitate your transactions. Whether your goal is to purchase Bitcoin or expand your crypto portfolio, the choice of exchange sets the foundation for your journey into the crypto market.

Fortunately, there’s no shortage of options available to Australian investors, with numerous exchanges and brokers catering to their needs. However, it’s essential to recognise that the quality of service can vary significantly across different platforms, particularly concerning key factors like fees, security measures, available markets, and customer support.

To assist you in navigating this landscape, we’ll delve into where and how to invest in cryptocurrency Australia securely and cost-effectively in the following sections. By prioritising safety, affordability, and several other features, you can make informed decisions about your crypto investments.

1. eToro – Regulated Leading Online Broker For Australian Investors

When exploring options for purchasing cryptocurrency in Australia, eToro emerges as a standout choice. With a stellar global reputation and over 30 million users worldwide, eToro is renowned for its reliability and user-friendly interface. The platform adopts a transparent approach regarding trading fees, charging a flat commission of 1% alongside the prevailing market spread for crypto transactions.

At eToro, investors can access many well-known cryptocurrency tokens, including Bitcoin, Ethereum, Cardano, Dogecoin, Litecoin, and Ripple. Moreover, the platform boasts support for various leading DeFi coins, such as Terra Luna, 1Inch, Theta, Shiba Inu, Algorand, and Enjin. This extensive selection of supported markets enables users to easily diversify their crypto portfolios, catering to a broad spectrum of investment preferences.

Unique Features of eToro

eToro offers unique features that set it apart in the realm of cryptocurrency investment. The platform boasts additional regulation from esteemed authorities such as the UK’s FCA, CySEC in Europe, and the SEC in the US, ensuring a safe environment for Australian investors.

Creating an eToro account is simple, requiring basic personal information and government-issued ID verification. With a minimum deposit of just $50 (approximately AUD 66), eToro provides accessibility to investors of all levels.

Supported payment methods include debit and credit cards, local bank transfers, and popular e-wallets like PayPal, Skrill, WebMoney, and Neteller. Deposit fees across all methods are set at a competitive 0.5%.

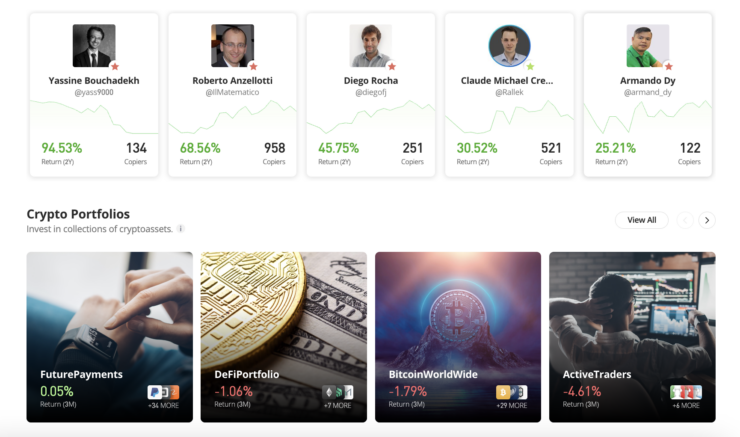

Upon funding your account, you can access a diverse range of over 75 cryptocurrencies. Another appealing aspect of eToro is its diversified smart portfolios, allowing investors to access a wide range of cryptocurrencies with a single trade. These portfolios managed and rebalanced by eToro, alleviate the need for extensive market research, making them particularly attractive to beginners. However, it’s important to note that a minimum investment of $500 is required to opt for a smart portfolio.

Platform Overview

| Number of cryptos available | Over 75+ |

| Minimum Deposit | $50 |

| Debit card fee | 0.5% |

| Trading commission | 1% plus market spread |

Why Choose eToro?

When choosing a platform for cryptocurrency investment, eToro offers compelling reasons to consider its services. eToro’s copy trading feature is worth exploring for those interested in passive investment strategies. As mentioned before, this innovative tool enables users to replicate the trades of seasoned investors, providing an opportunity to benefit from their expertise.

eToro provides convenience through its dedicated crypto app, which is available on iOS and Android devices. This mobile application allows investors to stay connected and manage their portfolios on the go.

eToro is a preferred choice among Australian investors due to its authorisation and licensing by ASIC, the regulatory body overseeing the Australian financial markets. This regulatory compliance adds an extra layer of trust and security for investors engaging with eToro’s services.

- Users can buy Bitcoin instantly with POLi, debit/credit cards, and e-wallets

- Free and secure crypto wallet for storing Bitcoin safely

- Supports dozens of coins

- The platform is safe and is regulated by ASIC

- Offers Copy trading tools

- Charges no deposit fees

- It has super low trading fees

- Users can deposit funds with a debit/credit card, e-wallet, or bank transfer

- User-friendly charting tools may be too basic for experienced traders

Crypto assets are unregulated and highly speculative. Capital at risk.

2. Binance – One of The Best The Globally Accredited Low-Cost Crypto Exchange

Next platform to invest in cryptocurrency in Australia is Binance. With over 100 million registered users, Binance continues its upward trajectory, attracting more users worldwide. Australian investors particularly benefit from the platform’s extensive offerings, gaining access to a diverse range of cryptocurrencies, including pairs denominated in AUD.

For those looking for a top-rated cryptocurrency exchange, Binance is certainly worth considering. Renowned for its vast asset library and competitive fees, the platform caters to traders in Australia with over 600 individual cryptocurrencies available across 1,000+ markets.

Platform Overview

| Number of cryptos available | 1,000+ markets |

| Minimum Deposit | Varies by payment method |

| Debit card fee | Depends on the third-party processor |

| Trading commission | Up to 0.10% |

Unique Features Of Binance

Binance stands out with its inclusive exchange platform designed to cater to both novice and seasoned traders. Offering a wide array of digital currencies for buying, selling, and trading, Binance supports diverse investment strategies to help users achieve their cryptocurrency goals. Moreover, investors benefit from remarkably low fees, with Binance imposing a maximum commission of just 0.10% per transaction. This translates to a mere $0.10 commission for every $100 traded.

Furthermore, holding Binance Coin (BNB) in your exchange wallet unlocks an additional perk, reducing commission fees by a further 25%. In terms of deposit fees, Binance imposes no charges for funding your account with cryptocurrency. Additionally, users can enjoy fee-free deposits when transferring funds via PayID.

Why Choose Binance?

If you want decentralised storage with full control over your private keys, Binance offers an excellent solution through Trust Wallet, available via a convenient mobile app.

Another compelling option is to utilise a Binance crypto savings account, which allows you to earn interest on your idle tokens and is particularly beneficial for long-term crypto investments. With attractive Annual Percentage Yields (APYs) on offer, though rates may vary depending on the crypto asset and lock-up terms.

Opening a Binance account is a breeze, taking just minutes, with the KYC (know-your-customer) process being swiftly completed. Australian users can deposit funds seamlessly and free of charge via PayID. While debit/credit cards are also supported, a 1.8% fee is incurred. Nevertheless, the minimum purchase with debit/credit cards is reasonable, starting at just $25.

- Offers low commissions of just 0.10% per slide

- Access to hundreds of coins across 1,000+ markets

- Supports fiat money deposits and withdrawals

- Offers great tools for advanced traders

- Fee-free PayID deposits

- One of the largest crypto exchanges for liquidity

- Minimum debit/credit card payment of just $25

- Previously been hacked

3. AvaTrade – Crypto Exchange That Specialises Exclusively In CFDs

AvaTrade positions itself as a top-notch option for Australian traders. This brokerage prioritises adherence to global regulations while providing appealing trading terms for its clientele. It provides diverse investment opportunities, including stocks, ETFs, bonds, indices, metals, energies, and forex, all offered as CFDs.

Like cryptocurrency trading, these CFD markets can be accessed without commission fees, complemented by competitive spreads. The platform offers flexibility in trading through its proprietary web and mobile platform or by integrating your account with popular platforms like MT4/5.

Platform Overview

| Number of cryptos available | 13, plus a crypto index market |

| Minimum Deposit | $100 |

| Debit card fee | FREE |

| Trading commission | 0% commission plus market spread |

Unique Features Of AvaTrade

AvaTrade stands out for its low-fee policy, making it an attractive option for traders. Notably, all AUD deposits and withdrawals incur no fees, and no commissions are charged for buy and sell orders. However, leverage trading may result in a daily overnight funding fee, which is standard for CFDs.

Moreover, AvaTrade offers a variety of trading platforms tailored to different trading styles and experience levels. With two proprietary platforms, a full suite of MetaTrader platforms, ZuluTrade and DupliTrade, traders have a comprehensive range of options to choose from.

When it comes to markets, AvaTrade focuses on offering 13 digital currency CFDs, all paired against the US dollar. While this selection may be limited compared to other platforms, it includes popular coins like Bitcoin, Ethereum, Litecoin, and Uniswap.

Why Choose AvaTrade?

If you’re interested in trading the future value of the broader cryptocurrency market, AvaTrade offers an index that tracks the performance of 10 leading coins. This index is weighted based on market capitalisation and volume, with Bitcoin and Ethereum dominating the index with an allocation of just over 50%.

AvaSocial, a recent addition to AvaTrade, provides a mobile app that allows traders to follow and chat with other traders and copy their trades. AvaSocial is powered by a third-party provider called Pelican Trading, which is regulated by the FCA.

Within AvaSocial, traders can discover successful traders to copy, review their trading history, set budgets and limits, and access automated trading. This platform particularly benefits new traders looking to develop their skills and knowledge.

The mobile trading experience at AvaTrade is characterised by its modern and polished interface, offering a wealth of excellent functionality. Traders have three options for mobile trading apps, including the comprehensive MetaTrader suite, AvaOptions, and AvaTrade’s mobile trading platform, AvaTradeGO.

- Top-rated mobile app

- Minimum deposit is just $100

- It does not charge any transaction fees

- Regulated by several bodies, including ASIC

- Leverage and short-selling supported

- Easy and hassle-free account opening

- It does not have a user-friendly interface

- Access to the limited number of crypto markets

4. Capital.com – One of The Top-Rated Crypto Exchange For Australian Users

Capital.com is a highly regulated broker that holds three top-tier licenses from CySEC, ASIC, and FCA. It specialises in financial derivatives covering a wide range of assets such as stocks, ETFs, forex, metals, indices, and cryptocurrencies. Users can actively participate in trading activities by offering access to over 470 cryptocurrency markets.

What sets Capital.com apart is its comprehensive market research offerings, including News, Market Analysis, Webinars, Capital.com TV, and an Economic Calendar. This wealth of information empowers traders to stay informed and make well-informed trading decisions.

Platform Overview

| Number of cryptos available | 470+ markets |

| Minimum Deposit | $20 (debit/credit cards, e-wallets) $250 (bank wire) |

| Debit card fee | FREE |

| Trading commission | 0% commission plus market spread |

Unique Features of Capital.com

One of the notable advantages of trading with Capital.com is its competitive fee structure. The platform does not charge any trading commissions, and spreads, especially for major markets like BTC/USD, are kept tight. Australian residents can also take advantage of leverage facilities, with retail clients capped at a leverage of 1:2 in compliance with ASIC regulations, while professional clients have access to higher limits.

At Capital.com, trading Contracts for Difference (CFDs) allows you to speculate on the future value of cryptocurrencies like Bitcoin without owning or storing any tokens. Whether you predict the market will rise or fall, you have the opportunity to profit from your forecast by entering buy or sell orders.

Capital.com’s browser-based terminal offers a user-friendly experience with a custom-built software program that is both aesthetically pleasing and intuitive to navigate. With over 75 technical indicators and extensive drawing tools available, traders have ample resources for analysis and decision-making.

Why Choose Capital.com?

There are compelling reasons for both beginners and experienced traders to choose this platform. Beginners will appreciate the range of tools available, including guides, blogs, and a native mobile app packed with mini-courses to aid in their learning journey. On the other hand, seasoned traders will find value in the platform’s support for MetaTrader 4.

To start trading cryptocurrency CFDs on Capital.com, you’ll first need to register an account and deposit a minimum of $20 using a debit/credit card or e-wallet. A minimum deposit of $250 is required if you prefer bank wire transfers. Notably, no fees are charged on AUD deposits or withdrawals. Additionally, downloading the Capital.com iOS or Android app provides convenient access to your main account.

- Access to more than 470 crypto markets

- Licensed CFD platform

- 0% commission and tight spreads

- No deposit or withdrawal fees

- Minimum debit card deposit is just $20

- Leverage of 1:2 offered on crypto CFDs

- CFDs are complex instruments. Therefore, investors should consider the enhanced risk of loss

- Market range is limited to FX and CFDs

5. Coinbase – Best Beginner Friendly Crypto Exchange

Last but not least, our guide on how to invest in cryptocurrency Australia is Coinbase. Established in 2012, it stands as a reliable and trusted cryptocurrency exchange. Renowned for its high levels of trading volume, liquidity, and traffic, Coinbase is fully licensed and regulated in Australia.

The platform prioritises user-friendliness, boasting a clean interface that is easy to navigate. With prominently displayed Buy/Sell buttons, even newcomers to the world of crypto can easily initiate transactions on the platform.

Unique Features of Coinbase

Coinbase prioritises safety and security, making it one of the most reliable options. Notably, the platform is listed on the NASDAQ exchange and licensed by the SEC, ensuring robust regulatory oversight. Additionally, a staggering 98% of all digital currencies owned by Coinbase clients are stored offline in cold storage, enhancing security measures.

Coinbase requires account holders to set up two-factor authentication, which is enforced for every login and withdrawal attempt to bolster security further.

However, one drawback of using Coinbase is the relatively high fees Australian investors incur. Debit and credit card payments, for instance, attract fees of almost 4% upon deposit. Standard trading commissions stand at 1.49%, with even higher fees applicable for investments under $200. Withdrawal fees also add to the cost, although these vary depending on the chosen payment method.

Platform Overview

| Number of cryptos available | 50+ |

| Minimum Deposit | $50 |

| Debit card fee | 3.99% |

| Trading commission | 1.49% per slide |

Why Choose Coinbase?

For those who are new to cryptocurrency investing and prioritize simplicity and security over fees, Coinbase presents a compelling option. The platform is commonly embraced by beginners seeking exposure to digital assets without prior experience in the crypto space.

Core features of Coinbase include real-time pricing and portfolio tracking services. Additionally, users can access the Coinbase wallet via iOS and Android apps for convenient mobile management. While Coinbase does not offer crypto savings accounts, investors can earn yields through staking.

With a custodial web and mobile app, Coinbase ensures secure storage of Bitcoin holdings. Moreover, the platform provides a non-custodial wallet for those seeking greater control, empowering users to manage their private keys independently.

- Great security features

- Regulated in the US and listed on the NASDAQ

- An ideal choice for beginners

- Supports over 50+ coins

- Accepts debit/credit cards, PayID, and bank transfers

- It has limited trading tools and features

- Charges high payment and commission fees

The Basics of Cryptocurrency Investment

After setting up an account with your preferred broker or exchange, the next step in your learning journey involves grasping the fundamentals of cryptocurrency investment. Cryptocurrency investment strategies vary widely, encompassing activities such as direct cryptocurrency purchases, investing in crypto funds, and supporting crypto-related businesses.

Let’s take a quick glimpse at how to invest in cryptocurrency in Australia.

For those entirely new to the cryptocurrency realm, it’s reassuring to know that cryptocurrency investments share similarities with traditional stocks and shares, particularly in terms of profit generation. The primary goal remains consistent: purchasing a cryptocurrency such as Bitcoin, with the intention of selling the tokens at a higher price. Successfully executing this strategy results in profit.

Let’s go through a detailed example to understand this.

For instance, consider a scenario where you invest $1,000 into Bitcoin when the cryptocurrency is valued at $38,000 per token. After holding onto your Bitcoin investment for 12 months, the price of Bitcoin rises to over $65,000 per token. This indicates a significant increase in value of 71% compared to the original cost price of $38,000 per token. Consequently, upon cashing out your investment, you receive $1,710, representing the profit earned on your original stake of $1,000.

As illustrated above, the profitability of a cryptocurrency investment hinges on two main factors: the initial investment amount and the percentage increase in the token’s value. However, it’s important to note that investing in cryptocurrency carries inherent risks, and there are no guarantees of making a profit. Conversely, if the value of the chosen cryptocurrency decreases and you opt to sell, you may incur a loss.

Is Cryptocurrency a Good Investment Option?

Since its inception in 2009, Bitcoin, the first-ever cryptocurrency, has witnessed exponential value growth. Over time, thousands of other digital currencies, known as altcoins, have emerged alongside Bitcoin.

Determining whether cryptocurrency is a suitable investment option for you involves considering several key factors. Notably, investing in this market entails heightened volatility, a factor that is a boon and bane for investors. However, this attracts many investors due to its potential for significant gains. Therefore, before committing to any cryptocurrency investment, thorough research is essential.

The basis for understanding how to invest in cryptocurrency is to know that Bitcoin and other cryptocurrencies often experience synchronized movements, encompassing both bullish and bearish cycles. As a prospective investor in cryptocurrency in Australia, it’s imperative to be comfortable with the fluctuations in your portfolio’s value that may occur.

Advantages of Investing in Cryptocurrency

Cryptocurrencies have established a significant track record spanning over a decade, indicating their resilience beyond mere trend status. The first step to understanding how to invest in cryptocurrency in Australia is to know the advantages of crypto investments.

Due to technological advancements and increasing industrialisation, digital currencies are gaining prominence compared to traditional alternatives despite their inherent volatility and associated risk factors.

Protection Against Inflation

One of the key benefits of investing in cryptocurrency in Australia or in general is its power to act as a hedge against inflation. Inflation threatens the value of numerous currencies, causing them to depreciate over time. Cryptocurrency is often perceived as a hedge against inflation. Bitcoin, for instance, has a fixed limit on the total number of coins that will ever be created. Consequently, as the growth rate of the money supply surpasses that of Bitcoin, its price is anticipated to rise. Similarly, many other cryptocurrencies employ similar mechanisms to limit supply, potentially safeguarding against inflation.

Cryptocurrencies have a Tremendous Increase in Value

The significant surge in value experienced by the best-performing cryptocurrencies is a primary driving factor behind many Australians’ decision to invest in this asset class. Over time, numerous digital assets have witnessed astronomical growth, appreciating by thousands or even millions of percent since their inception.

To name a few instances. At its inception in 2009, Bitcoin held little to no value. In a notable event in 2010, 10,000 Bitcoin tokens were exchanged for a pizza order valued at $40. Subsequently, Bitcoin surged to highs exceeding $68,000 per token. Thus, the 10,000 Bitcoin tokens used for the $40 pizza, valued at $68,000 per token, would have amounted to over $680 million. Hence, applying these calculations, an initial Bitcoin investment of only $100 in 2010, at its peak in 2021, would have accrued a value exceeding $1 billion.

Likewise, BNB, supported by the aforementioned Binance exchange, made its debut in 2017.

At the time of its launch, BNB was initially trading at a mere $0.11 per token, as per CoinMarketCap data. Subsequently, BNB surged to an all-time high of nearly $700.

This remarkable growth represents an increase of over 636,000%.

Hence, an investment of just $100 at the launch of BNB in 2017 would have amounted to over $636,000 at its peak.

However, It’s crucial to bear in mind that while cryptocurrency prices have exhibited exponential growth in the past, there is no guarantee that this trend will persist in the future.

The Booming Era of Blockchain Technology

Cryptocurrency represents the Internet of the 1990s, ushering in a new era of digital innovation and potential. With the emergence of technologies like blockchain, smart contracts, and the Metaverse, investing in cryptocurrencies now could present an opportune moment.

Investing in cryptocurrencies at a time when the broader market is growing and potentially undervalued, investors may capitalise on future growth opportunities.

Diversification remains key in cryptocurrency investing, as it helps mitigate risks and avoid overexposure to any single asset. Additionally, investors should only risk what they can afford to lose.

Furthermore, investing in newly launched cryptocurrencies, often referred to as Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs), can provide unique investment opportunities. These early-stage projects may offer significant upside potential, especially compared to established cryptocurrencies like Bitcoin and Ethereum.

Cryptocurrency is a Multi-Trillion Dollar Space if Invested Carefully

Since now you know how to invest in cryptocurrency in Australia, the more important question is, why invest? One of the most compelling answers to this is that the market has evolved into a multi-trillion-dollar trading space, presenting compelling opportunities for investors in Australia and beyond.

This significant growth in market size is noteworthy, particularly for first-time investors who may have reservations about the liquidity and accessibility of digital assets.

However, concerns about cashing out investments back into Australian dollars are valid, as it’s essential to have a seamless process for converting cryptocurrencies into fiat currency. Fortunately, investing in cryptocurrency in Australia alleviates such concerns, especially when dealing with large-cap tokens like Bitcoin, Ethereum, or Ripple. These established digital currencies boast market capitalizations in the billions, with Bitcoin recently surpassing the $1 trillion milestone.

Moreover, the cryptocurrency market operates 24/7, allowing investors to trade and liquidate their holdings at any time. This accessibility ensures that investors can convert their digital assets into cash and withdraw funds to their bank accounts without hassle.

Helps to Build a Varied Cryptocurrency Portfolio on a Limited Budget

In traditional stock trading, seasoned investors often diversify their portfolios by investing in various sectors and industries such as technology, retail, oil and gas, mining, aviation, banking, and more.

Similarly, diversifying a cryptocurrency portfolio in Australia is feasible due to the abundance of digital currencies available for trading online. With over 18,000 cryptocurrencies in existence and new tokens emerging regularly, there are numerous opportunities for diversification.

While many of these cryptocurrency projects may lack unique or proprietary features, there are still plenty of tokens worth considering for investment.

Furthermore, with platforms like eToro providing affordable options for cryptocurrency investment in Australia, you can start trading with as little as $10 per transaction. Thus, with an initial investment of just $200, you can diversify your portfolio by acquiring stakes in up to 20 different cryptocurrencies.

Backed by Major Corporations

A promising indication of the longevity of emerging technologies, such as digital currency, is the increasing involvement of major corporations in the market. The participation of prominent companies not only lends credibility to the cryptocurrency industry but also signifies its potential for widespread adoption and integration into mainstream financial systems.

The involvement of major corporations often brings significant resources, expertise, and infrastructure to the cryptocurrency ecosystem, further driving innovation and development within the industry. Collaborations between established enterprises and cryptocurrency projects also facilitate the exploration of new use cases and applications, expanding the utility and relevance of digital currencies in various sectors.

Numerous crypto-focused companies, such as Coinbase and Block, are publicly traded on major exchanges like the NASDAQ. Additionally, several leading global brands, including Microsoft, Home Depot, Overstock, and Starbucks, accept cryptocurrency as a payment method, further demonstrating the growing acceptance and integration of digital currencies into mainstream commerce.

Potential Risks of Investing in Cryptocurrency in Australia

Now you are familiar with the basics of how to invest in cryptocurrency Australia. Crypto investments do offer several benefits, but it’s crucial to also understand the associated risks before diving in.

Market Volatility

Cryptocurrency markets are known for their volatility, characterized by rapid and unpredictable price changes. This volatility presents opportunities for significant gains but also introduces the risk of substantial losses. Top cryptocurrencies like Bitcoin, Cardano, etc, often go on a major bull or bear run depending upon the market conditions.

Therefore, it’s crucial for investors in Australia, or anywhere else, to be prepared for extreme fluctuations in their cryptocurrency portfolios. Despite these challenges, investors who remain resilient during market downturns and hold onto their cryptocurrency investments for the long term often see substantial rewards.

Risk of Loss Due to Scams & Fraud

Investing in cryptocurrency in Australia comes with inherent risks, including the potential for losing some or all of your investment. A cautionary tale involves instances like OneCoin and BitConnect, both of which experienced rapid value surges in 2017, reaching market capitalisation of over a billion dollars. However, both turned out to be fraudulent schemes, resulting in their tokens becoming worthless.

Furthermore, there’s the risk of investing in newly launched cryptocurrencies that could be scams, known in the crypto community as “rug pulls.”

Market Manipulation & Fluctuations

Cryptocurrency markets are susceptible to manipulation due to their relatively small size and lack of regulation. Pump-and-dump schemes, spoofing, and other forms of market manipulation can artificially inflate or deflate prices, leading to losses for unsuspecting investors.

Staying informed about market developments, regulatory changes, and security best practices is crucial for managing risk in the cryptocurrency space.

Best Cryptocurrency to Invest in Australia

In this detailed guide on how to invest in cryptocurrency Australia, we have already discussed the top brokers and their features. Now, let’s see some of the best cryptocurrencies available for Australian investors.

1. Bitcoin – The Pioneer of Cryptocurrency Revolution

Bitcoin is often hailed as a groundbreaking invention with the potential to revolutionise the world. It has gained widespread adoption for various transactions globally, from purchasing everyday items like coffee and food to larger expenses such as electronics and travel. Its unique characteristics have earned it the nickname “magical internet money,” owing to its remarkable properties and resilience against double-spending.

Transactions with Bitcoin typically boost swifter processing times and lower fees than traditional financial services, with no protracted waiting periods and generally reduced transaction costs.

However, it’s essential to note that Bitcoin’s value can be highly volatile, experiencing significant fluctuations on a monthly and even daily basis. For example, in December 2022, Bitcoin traded around $16,000 before surging to over $22,000 by March 2023.

Crypto assets are unregulated and highly speculative. Capital at risk.

2. Ethereum – Best Cryptocurrency for Dapps & Smart Contracts

If you’re venturing into cryptocurrency investment and figuring out how to invest in cryptocurrency Australia, Ethereum presents itself as a compelling addition to your portfolio. Serving as the premier platform for smart contracts, Ethereum boasts significant appeal for investors.

In the realm of market capitalisation, Ethereum stands as the second-largest cryptocurrency, trailing only Bitcoin. Launched in 2015, Ethereum facilitates the creation of smart contracts and the deployment of decentralised applications (DApps), rendering it a favoured investment option.

Ether, Ethereum’s native currency, is progressively gaining recognition as a safe-haven asset akin to Bitcoin. Moreover, with anticipation surrounding the approval of a spot Ethereum ETF and substantial network enhancements slated for the upcoming months, some investors speculate that 2025 may mark Ethereum’s ascendance from the shadow of Bitcoin.

Through staking, holders of Ether can actively engage in the network’s operations and earn rewards, offering an additional avenue for income alongside the potential for capital gains through Ether’s price appreciation.

Crypto assets are unregulated and highly speculative. Capital at risk.

3. Uniswap – The Largest Dex in The World in Terms of Market Capitalisation

Uniswap stands as a cornerstone in advancing innovation and fostering broader adoption within the cryptocurrency market. Positioned as the leading decentralised exchange (DEX), Uniswap marks a pivotal evolution in the market landscape. DEXs present traders with a more secure alternative to large centralized exchanges that operate under custodial models.

At its core, Uniswap serves as the nucleus of decentralised exchange services. Simply put, the Uniswap platform enables users to engage in digital currency trading without reliance on centralised intermediaries. Instead, transactions are directly facilitated on a peer-to-peer basis. Uniswap achieves decentralisation through its automated market-maker system.

A notable contribution by Uniswap is the introduction of liquidity pools, which play a vital role in fostering innovation by granting new platforms access to capital. Presently, the platform hosts thousands of liquidity pools, further enhancing its ecosystem’s vibrancy.

Crypto assets are unregulated and highly speculative. Capital at risk.

4. Decentraland – Unique Cryptocurrency has Attracted the Attention of Large Institutional Investors

Decentraland represents an ambitious fusion of Virtual Reality (VR) technology with Blockchain innovation. Its goal is to establish a metaverse serving as a hub for commerce and gaming, leveraging the Ethereum network. Positioned as a virtual reality platform, Decentraland enables users not only to craft immersive experiences but also to monetise their creations and content.

MANA serves as the native digital asset within Decentraland, facilitating transactions for goods and services within the Metaverse. Operating on the Ethereum blockchain and compliant with the ERC-20 token standard, MANA plays a vital role in the ecosystem’s economy.

Significant capital inflows and sizable transactions characterise Decentraland’s platform, drawing attention from investors, particularly in Australia. With its robust features and promising trajectory, Decentraland emerges as a compelling choice for investors seeking exposure to the burgeoning metaverse cryptocurrency market.

Crypto assets are unregulated and highly speculative. Capital at risk.

5. BNB – One of The Largest Coins by Market Capitalisation

BNB, or Binance Coin, boasts multiple utility cases beyond merely covering transaction fees on the Binance Exchange. It finds application in various Binance initiatives, such as the Binance Smart Chain and Binance Academy.

Furthermore, holding BNB tokens by traders on the Binance platform results in a 25% reduction in commissions. Despite experiencing a dip in 2022, BNB remains available for purchase at a discounted rate.

Acquiring BNB on Binance presents several advantages, including lower fees compared to rival exchanges and enhanced liquidity, facilitating swift buying and selling actions to capitalize on market shifts and breaking news.

Crypto assets are unregulated and highly speculative. Capital at risk.

6. Yearn. Finance – Next-Gen DeFi Platform

Yearn. Finance (YFI) remains a prominent figure in the cryptocurrency sector, garnering attention for its decentralized ecosystem designed to address critical market challenges. Renowned for offering users the industry’s highest Annual Percentage Yield (APY) on deposited cryptocurrencies, Yearn Finance has established itself as a leading platform in the field.

Utilising a combination of cutting-edge technologies, Yearn Finance actively combats centralisation within the cryptocurrency sector, further solidifying its reputation as an innovative force in the industry.

7. Cosmos – Leading Cryptocurrency for Blockchain Interoperability

Cosmos emerges as a top contender for investment in Australia, primarily due to its specialisation in blockchain interoperability. This concept enables decentralised networks to interact and exchange data seamlessly.

Unlike the current limitations where transactions involving BNB cannot be reflected on the Cardano blockchain, utilizing the Cosmos framework facilitates such cross-chain transactions. With the proliferation of competing blockchains in the industry, the demand for Cosmos is poised for sustained growth. An essential aspect to note is that when blockchains leverage Cosmos for interoperability, fees are required to be paid using the project’s native token, ATOM.

8. ApeCoin – Trending Cryptocurrency Linked to the Ape Nft Series

APE is an ERC-20 token, a custom cryptocurrency type operating on the Ethereum blockchain. The ApeCoin project exemplifies the ongoing trend among developers towards decentralisation, even after initial success. Considering the widespread popularity and significant demand for BAYC, particularly among high-profile individuals like athletes and celebrities, it’s reasonable to anticipate growing investor interest in APE if the BAYC ecosystem continues to prosper.

The success of ApeCoin is intricately tied to its NFT collection, suggesting substantial potential upside for this digital asset. Despite being just a week old at the time of writing, ApeCoin is already available for purchase on major tier-one cryptocurrency exchanges.

9. Solana – One of The Most Popular Cryptocurrencies to Invest in Australia

Solana emerges as a highly efficient smart contract cryptocurrency with the potential to challenge Ethereum’s dominance. Renowned for its exceptional speed and minimal transaction costs, Solana achieves this through an innovative hybrid consensus model. This model combines the unique Proof-of-History (PoH) algorithm with a high-speed synchronization engine underpinned by a Proof-of-Stake (PoS) framework.

Solana aims to capitalise on the expanding NFT market, leveraging platforms like Solanart, the NFT marketplace operating on its network. The rise of NFTs presents opportunities for developers to finance projects through gaming and decentralised finance offerings, further enhancing Solana’s market presence.

Best Penny Cryptocurrency to Invest in Australia

After a detailed review of the best cryptocurrencies in Australia and how to invest in cryptocurrency Australia, let’s explore some of the cheapest cryptos available for Australian investors. Penny cryptocurrencies are digital assets trading at a few cents or below $5 per unit. While they carry significant risk, these tokens are inexpensive and have the potential for substantial future growth. Investing in penny cryptocurrencies offers the advantage of potential profitability alongside a very affordable entry point.

Here are a few options for you to choose from.

- The Graph: A penny cryptocurrency enables blockchains to index surplus data, presenting a remarkable use case, particularly given the substantial transaction volume managed by leading blockchains.

- Cronos: Crypto stands out as one of the top penny cryptocurrencies for investment, primarily because it serves as the native digital token within the Crypto.com ecosystem. This well-regarded exchange provides users with increased yields and reduced commissions for holding Cronos tokens.

- Chiliz: This initiative bridges the sporting realm with cryptocurrencies and blockchain technology. Essentially, Chiliz enables token holders to interact with their preferred sports teams through an inventive governance system. If you are looking for an interesting penny crypto, this is your choice.

However, it’s crucial to understand that a penny cryptocurrency’s low token price doesn’t necessarily equate to lower risk compared to higher-priced digital assets.

Investing in Cryptocurrency v.s Trading Cryptocurrency

Now that you are familiar with how to invest in cryptocurrency in Australia let’s explore these two different concepts within the investment sector.

When it comes to cryptocurrency, there are two main approaches: investing and trading.

Investing in cryptocurrency typically involves holding assets for the long term. This strategy aims to capitalize on the industry’s volatile cycles by weathering price fluctuations over time.

Alternatively, some Australian investors opt for short-term cryptocurrency trading. This strategy involves buying and selling assets within days or even hours. To succeed in trading, one must possess a strong understanding of technical analysis and the ability to interpret pricing charts.

For newcomers to the Australian cryptocurrency scene, it’s advisable to adopt a long-term investment approach. This eliminates the need for constant market research and technical chart analysis.

Ensuring Safe Cryptocurrency Investments

It is highly crucial to know how to manage safe investments, just as how to invest in cryptocurrency in Australia. To invest safely in cryptocurrency, it’s crucial to utilise a regulated broker. Fortunately, eToro holds licenses not only from ASIC but also from regulatory bodies in other regions, such as the FCA, CySEC, and the SEC. This multi-regulatory oversight provides investors with added assurance against potential scams, a level of security often lacking in many unlicensed exchanges.

Additionally, eToro offers an integrated wallet feature, allowing users to store their cryptocurrency investments securely. This eliminates the need for managing separate crypto wallets and reduces the risk of falling victim to hacking attempts.

How to Invest in Cryptocurrency Australia

Previously, we provided a brief overview of investing in cryptocurrency in Australia. Now, we’ll guide you through the process step-by-step, ensuring even beginners can make their first cryptocurrency investment in less than five minutes. This walkthrough will demonstrate the necessary steps using the ASIC-regulated crypto broker, eToro.

Step 1: Create a Crypto Account

To begin investing in cryptocurrency on eToro, sign up for a free account. Enter your personal details and contact information, and select a username and password. Verify your email address and mobile number to finalise the registration.

Step 2: Verify ID

Before investing in cryptocurrency in Australia, upload a verification document to ensure eToro remains compliant with ASIC regulations. Typically, eToro verifies accounts within two minutes of receiving a copy of your driver’s license or passport.

Step 3: Deposit Funds

Deposit AUD into your eToro account using a debit/credit card, local bank transfer, Neteller, Skrill, or PayPal. The AUD deposit fees are only 0.5% across all supported payment methods, with a minimum deposit of $50 for first-time clients.

Step 4: Search for Cryptos

If you know which cryptocurrency you want to buy, type it into the search bar. Alternatively, click on the ‘Discover’ button to view the full list of supported cryptocurrencies available for trading on eToro.

Step 5: Invest in Cryptocurrency Assets

Once you’ve selected your desired cryptocurrency, click on the ‘Trade’ button. Enter your total investment amount in the ‘Amount’ field. You can invest any amount from just $10, regardless of the cryptocurrency. Confirm your trade by clicking ‘Open Trade,’ and eToro will execute your cryptocurrency investment instantly.

You might also like: Best Bitcoin And Crypto Casinos In Australia

Conclusion

This guide has covered the basics of how to invest in cryptocurrency in Australia in a safe way. We’ve covered top rated exchanges for Australian investors, reason to invest in crypto assets, and the risk factors to consider.

If you want to start investing in cryptocurrency coins right now, consider doing so via eToro. It is a global excnages with low fees, high liquidity, and fully regulated in Australia.

eToro Exchange

- Free Copy Trading of Professional Traders

- Best Place to Invest in Cryptos

- Minimum Deposit only $10

- Open to AU & Worldwide

Cryptoassets are a highly volatile unregulated investment product.

FAQs

Is investing in cryptocurrency legal in Australia?

Absolutely. Australians have the legal right to invest in cryptocurrency, provided they use regulated online brokers.

How can beginners start investing in cryptocurrency in Australia?

Getting started with cryptocurrency investment in Australia is incredibly simple, even for newcomers. With platforms like eToro, you can register an account in just five minutes. From there, you can swiftly purchase your preferred cryptocurrency using a debit/credit card or e-wallet.

What taxes do I need to pay on cryptocurrency investments in Australia?

In Australia, cryptocurrency is treated as property for tax purposes. This means that capital gains tax (CGT) may apply when you sell or dispose of your cryptocurrency. It's essential to keep accurate records of your transactions for tax reporting purposes.