Highlights:

- The Zora price has spiked to $0.088 amid the Robinhood listing.

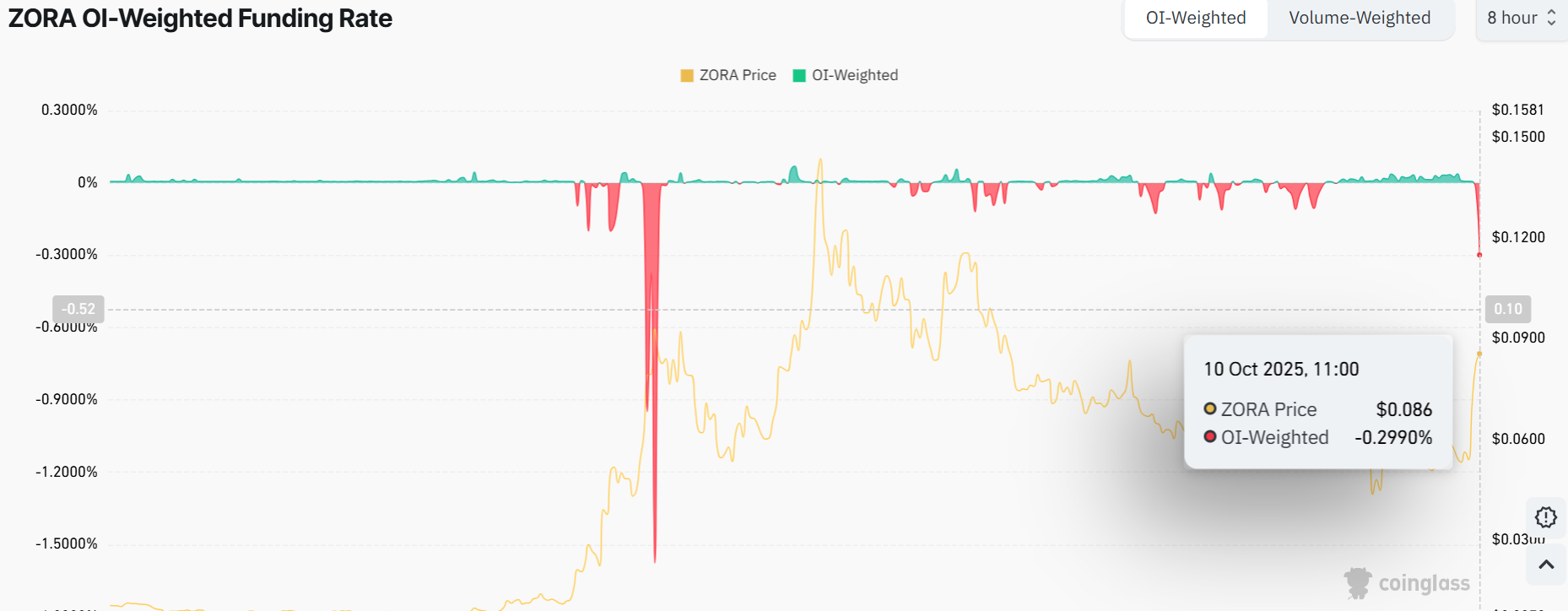

- Zora’s Weighted funding rate has flipped negative, cautioning traders not to be too greedy.

- The technical outlook signals a potential rally to $0.13 if the bulls and volume remain strong.

The Zora price is waking up, soaring 68% to $0.088, as its daily trading volume rises 701% to $499 million. This rise indicates heightened market activity as investor confidence bolsters. The recent rally followed Zora obtaining a Robinhood listing.

Robinhood is considered one of the more accessible crypto trading exchanges, offering extreme leverage in the community marketplace. Therefore, $ZORA can now be purchased and sold through the site, which is a step toward greater visibility and prospects for market investment gains.

$ZORA is now on Robinhood pic.twitter.com/bBPVH9R15p

— $zora (@zora) October 9, 2025

Market Data and Technical Indicators for Zora

A quick look at the Zora open interest (OI) weighted funding rate graph signifies relative negative territory, although not enough to avoid potential price corrections. The price variation between $0.06 and $0.12 indicates high volatility. The OI chart suggests significant movement in either direction based on speculation, particularly around July 21-27, when quick OI movements indicated that people were buying in and trying to capture trades faster.

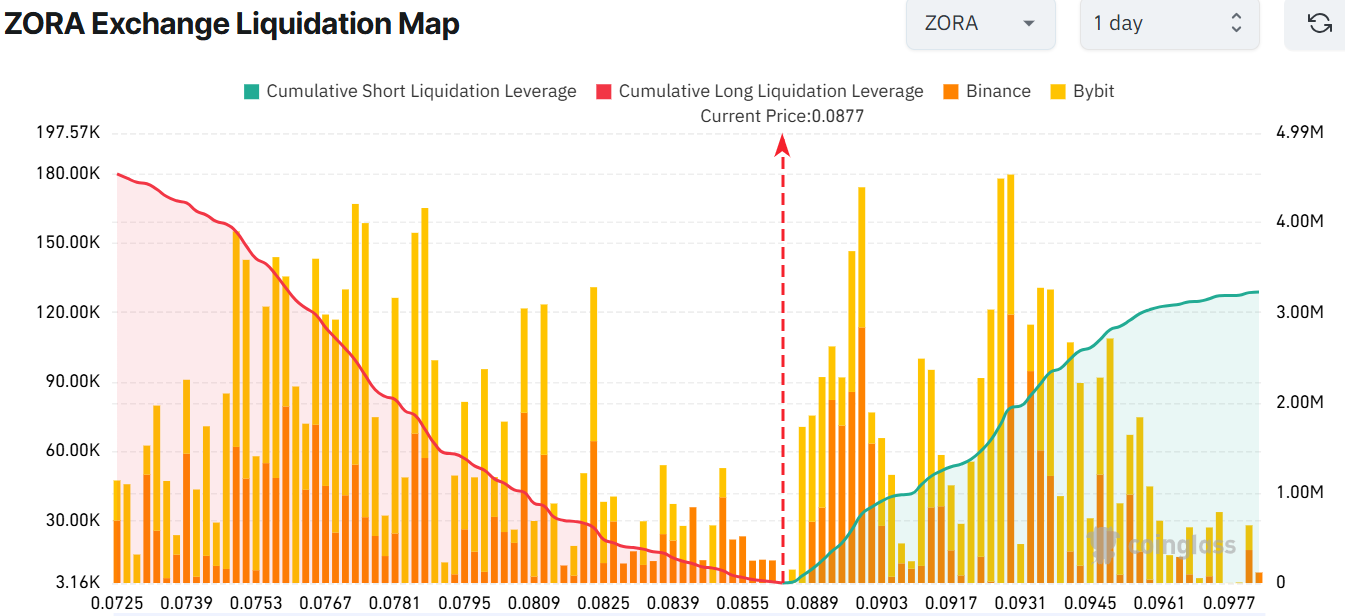

Furthermore, the exchange liquidation map is useful. Although leverage markers show substantial short and long position leverage in line with one another, cumulative long liquidation leverage ($4.70M) far exceeds short liquidation leverage ($3.33M). If the price continues to surge following the recent Robinhood listing, the long liquidation levels could continue surging and vice versa.

Zora Price Breaks Out of a Falling Channel

The ZORA/USD daily chart shows the price at $0.088, representing a solid 66% climb from its lower levels at $0.055. The chart shows that the Zora price could move to $0.11-$0.13, marking a 44% gain from its current level. If the momentum keeps up, it could even test the $0.15 mark in the next few days.

The 50-day Simple Moving Averages (SMA) hover around $0.070, and the Zora price has broken out of the falling channel. Zora’s volume has also soared, hitting $499 million, proof that the hype is real and not just some pump-and-dump sketchiness. The Relative Strength Index (RSI) at 68.06 is indicating intense buying pressure, which may soon move the token to the overbought territory.

However, a potential rejection around the $0.10-$0.11 resistance level could see a dip. If support at $0.070 (the 50-day Simple Moving Average) holds, it’s a green light to buy the dip. If it breaks, though, we might slide to $0.055 safety net.

The Moving Average Convergence Divergence (MACD) is also crossing bullish, with the signal line trending upward, indicating further upside potential. This shows that the bulls are in full control of the market, calling for investors to rally behind the ZORA token.

However, in crypto, there are risks. If the RSI jumps to the overbought, traders should be cautious not to be too greedy. This could signal a reversal and dying hype in the Zora market. For now, the Zora price is bullish, but play smart. Investors may target $0.11 in the short term and $0.13 if the bulls remain strong.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.